Blending public and private capital can make hydrogen projects bankable and commercially viable. | © Superestrella, Shutterstock

Blending public and private capital can make hydrogen projects bankable and commercially viable. | © Superestrella, Shutterstock

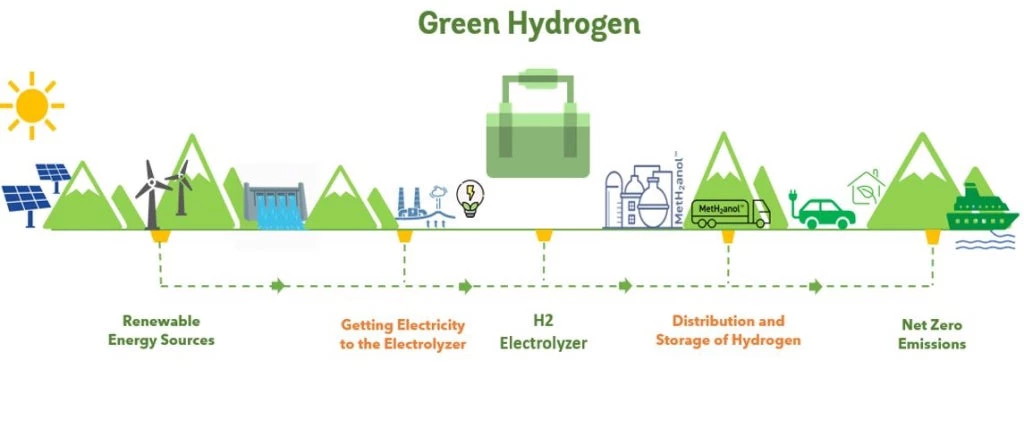

Produced by using renewably generated electricity that splits water molecules into hydrogen and oxygen, green hydrogen holds significant promise to help meet global energy demand while contributing to climate action goals.

The demand for hydrogen reached an estimated 87 million metric tons (MT) in 2020, and is expected to grow to 500–680 million MT by 2050. From 2020 to 2021, the hydrogen production market was valued at $130 billion and is estimated to grow up to 9.2% per year through 2030. But there’s a catch: over 95% of current hydrogen production is fossil-fuel based, very little of it is “green”. Today, 6% of global natural gas and 2% of global coal go into hydrogen production.

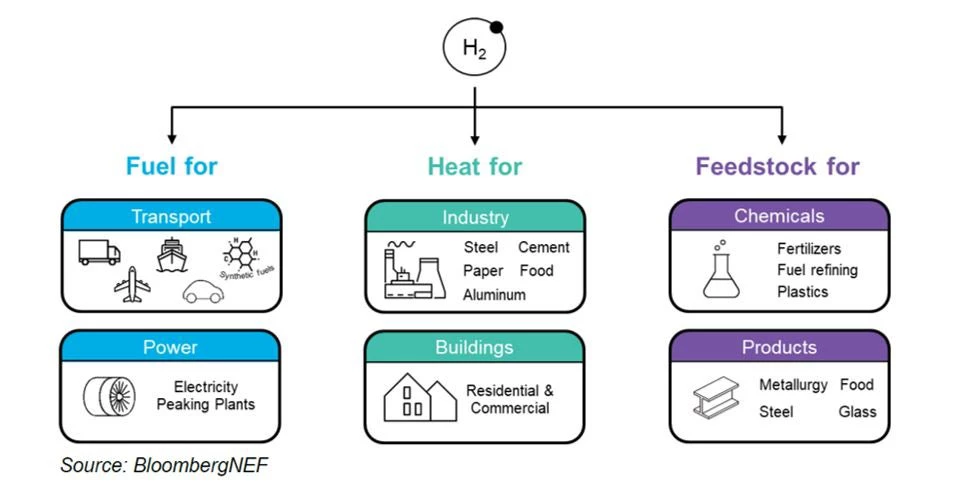

Nevertheless, green hydrogen production technologies are seeing a renewed wave of interest. This is because the possible uses for hydrogen are expanding across multiple sectors including power generation, manufacturing processes in industries such as steelmaking and cement production, fuel cells for electric vehicles, heavy transport such as shipping, green ammonia production for fertilizers, cleaning products, refrigeration, and electricity grid stabilization.

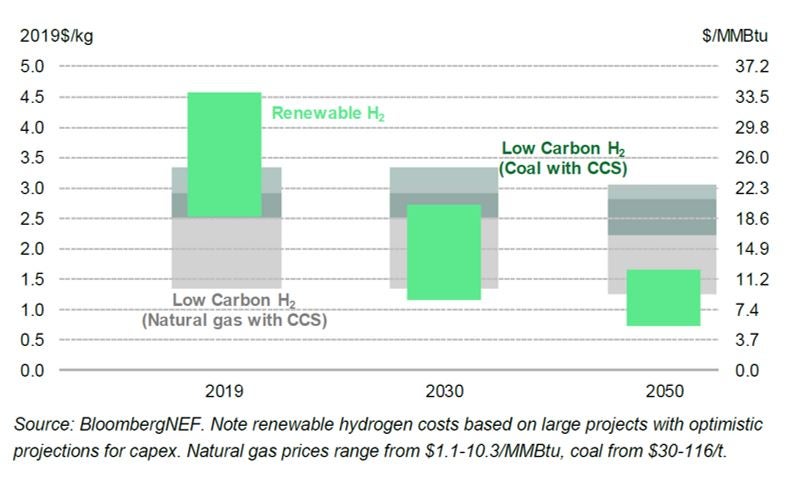

Moreover, falling renewable energy prices—coupled with the dwindling cost of electrolyzers and increased efficiency due to technology improvements—have increased the commercial viability of green hydrogen production. The figure below shows the forecast of the global range of levelized cost of hydrogen production for large projects through 2050.

According to Bloomberg New Energy Finance, if these costs continue to fall, green hydrogen could be produced for $0.70 – $1.60 per kg in most parts of the world by 2050, a price competitive with natural gas. NEL, the world’s largest producer and manufacturer of electrolyzers, believes that green hydrogen production cost parity (or even superiority) with fossil fuels could be achieved as early as 2025.

How do we structure a bankable green hydrogen project?

Given this significant growth in demand, the scale of input energy required (22,000 TWh of green electricity to produce 500 million tons of green hydrogen per year), and the parallels of the hydrogen value chain to that of the fossil fuel value chain (with upstream, midstream, and downstream elements), the green hydrogen industry should attract investments.

Yet, to date, only a few green hydrogen projects have been successfully brought to market. According to PricewaterhouseCoopers (PWC), most green hydrogen projects under construction and in operation are at the pre-commercial phase with limited electrolyzer capacity—typically less than 50 MW. While some proposed plants are of 100 MW capacity or more, they remain small compared to fossil fuel alternatives. In addition, green hydrogen projects present other peculiarities and risks that challenge traditional project finance: nescience of the technology; segmentation of energy input; production and transformation; storage; and transportation to end-users.

At the recent Global Infrastructure Facility (GIF) Advisory Council Meeting, panelists agreed that blending public and private capital can make hydrogen projects bankable and commercially viable, but certain factors need to be considered.

One way to position these projects for success is to locate renewable energy production and hydrogen production facilities together so they can be better integrated. This was the approach in Puertollano, Spain, home to both a 100 MW solar farm and Europe’s largest green hydrogen facility for industrial use.

Governments also need to create policy and regulatory frameworks that incentivize investments. Building capacity and providing technical assistance for governments, especially in emerging markets and developing economies, is key to developing these regulations and ensuring their enforcement and compliance. Further, there is need for a globally agreed definition of green hydrogen and methods to guarantee and certify the origin of the fuel. Also critical, especially in light of the Just Transition agenda, is the need to help workers develop the skills they need for this emerging industry.

How is the World Bank Group helping?

The World Bank Group is working with developing countries to accelerate green hydrogen projects from pilot stage to industrial scale. To achieve this, we provide technical assistance to foster enabling policy, regulatory, and fiscal frameworks; build innovative financing that catalyzes concessional and climate finance resources; integrate risk mitigation and credit enhancement instruments to mobilize private capital; and transfer knowledge to develop local green jobs to support a just transition.

One example of our work is the World’s Bank program in the Latin America and Caribbean region, which has the cleanest energy mix globally and abundant, low-cost renewable energy potential. In countries such as Chile, Colombia, Costa Rica, Panama, and Brazil, the World Bank Group is taking multiple actions to establish green hydrogen as a fuel and to promote the use of green hydrogen as energy storage. Specifically, we are working to design green hydrogen financing facilities, develop mechanisms to certify green hydrogen along the value chain, and establish carbon pricing through the Partnership for Market Readiness. Our program in the region is fully aligned with the countries’ visions to leverage green hydrogen as means to decarbonize their economies and facilitate a just energy transition. Ultimately, making these changes would increase competitiveness, open new markets, create local green jobs, and attract even more private sector investment—contributing to green, resilient, and inclusive growth.

Moving forward

The few pioneering projects that have reached successful commercial and financial close and have transitioned to operation have tested the financing parameters and established bankable project structures and documentation packages that can be referenced by commercial-scale projects under preparation across the globe. The GIF is uniquely positioned to provide technical assistance and transaction advisory services to support governments in EMDEs as they look to develop green hydrogen projects as part of their energy transition objectives.

Related Posts

Green Hydrogen: A solution for Chile's climate emergency and economic recovery

Mind the gap: Time to rethink infrastructure finance

Blended finance can catalyze renewable energy investments in low-income countries

Sloughing off Earth Day despair with resources to make climate-smart infrastructure a reality

GIF: making climate-smart infrastructure bankable

Join the Conversation