Tighter focus on transparency

The PPP Decree was developed with a big-picture focus on improving transparency in project preparation in order to promote more foreign investment in infrastructure development. Equally important, Vietnam also built upon a number of specific lessons learned by investors and government alike under the previous regulations. It achieves both goals by offering a more consistent and effective regime for all PPP projects (including BOT, BTO, and BT) and providing more guidance for state authorities and investors to facilitate project preparation and implementation.

Features that that distinguish Vietnam’s new PPP Decree from preceding regulations include:

- A PPP project cycle that calls for screening and publication of projects, requirement for a feasibility study (or project proposal for smaller projects) to determine optimal contract structure, approval of State support, and competitive procurement;

- Basic eligibility requirements for PPP projects to assist agencies in the screening of projects;

- Coverage that includes a wider scope of investment sectors;

- Additional contract types based on a broad distinction between user fee type contracts and availability payment type contracts;

- No cap on level of State participation in the capital for a project as a percentage of the total investment cost (instead, there is a focus on the optimal use of State capital based on the project needs);

- Financial support made available during project selection and development through a Project Development Facility (supported by the Asian Development Bank and the French Development Agency);

- Possibility of use of State support (referred to as “State Investment Capital”) as form of viability gap funding (VGF) for PPP projects;

- Confirmation of lenders' step-in rights and right to assignment;

- Foreign governing law that is permitted for foreign invested projects; and

- Permission for foreign arbitration to be used for foreign invested projects.

Government support crucial to success

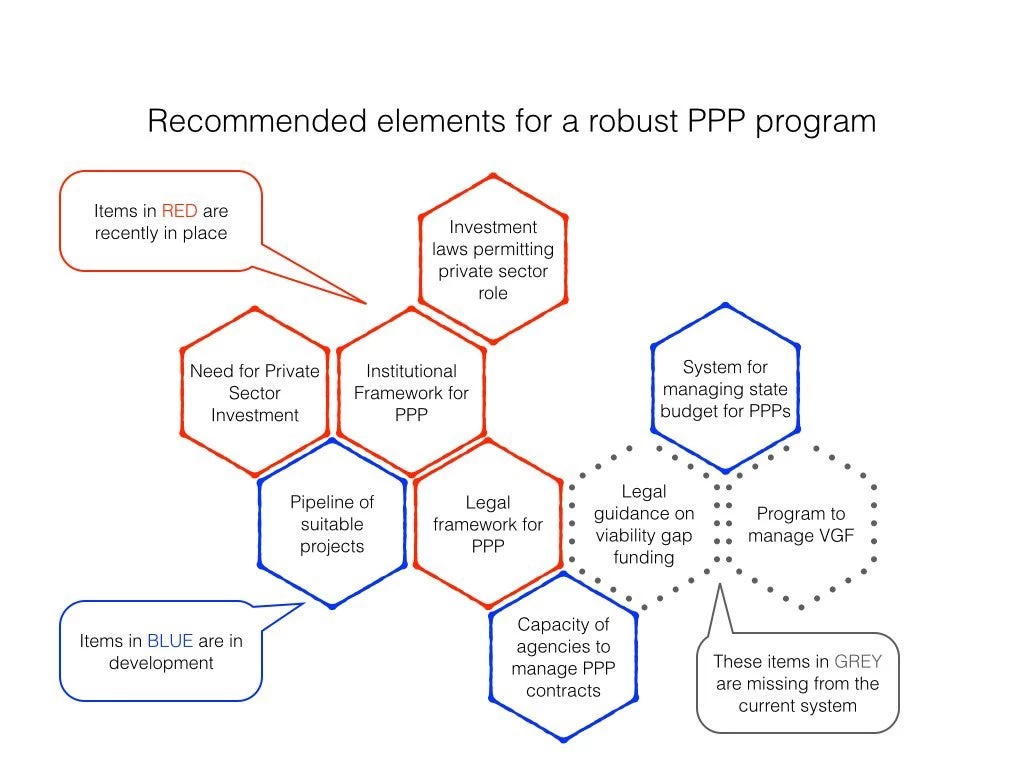

Having learned from past challenges in implementing new legislation, Vietnam’s Ministry of Planning and Investment (MPI) has launched several initiatives to support the implementation of the PPP Decree. These initiatives are designed to give the overall environment for PPPs a stronger foundation, including:

- Promotion of a common understanding among ASAs on PPP principles by way of a “PPP Foundations Course”;

- Commencement of drafting the necessary circulars and other guidance materials to implement Decree 15;

- Establishment of the project development facility (i.e. PDF);

- Preparation of standardized project documents; and

- Looking at systems for managing state support.

As this new legislation takes effect, we believe that Vietnam’s PPP program is well equipped to attract the investment needed (approximately $16+ billion per year through 2020) to keep the economy on track. With a number of development partners now active in Vietnam’s PPP space, we urge coordination among development partners to prevent duplication of work or inconsistent results. With the solid foundation of the new legislation, and close cooperation on the ground, Vietnam is well positioned to fulfill its PPP potential.

For more information, please contact Stanley Boots of Frontier Law & Advisory.

Join the Conversation