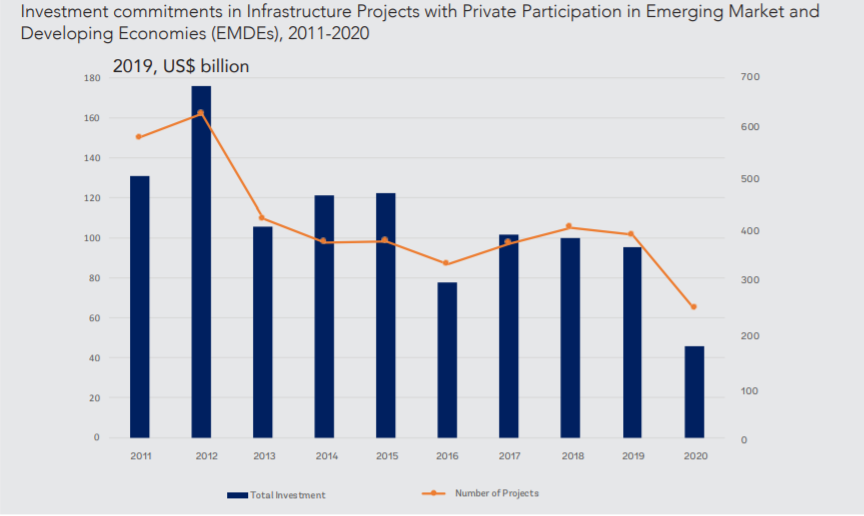

Recently released data on private participation in infrastructure shows a significant reduction in investment numbers as a consequence of the extraordinary circumstances created by COVID-19 — such as lockdowns, border closings, and disruption of economic and social activities. Unsurprisingly, this had led to loss in demand affecting ongoing and prospective PPPs. At the same time, loss of revenues for governments and competing demands for spending on health and social well-being of citizens has further constrained their capacity to finance infrastructure, which is critical for economic recovery.

We also see much more recognition of the need for action on preexisting trends and challenges (like population growth, urbanization, and in particular climate change) that requires a green, resilient, and inclusive infrastructure development model to fully respond to the vulnerabilities that the COVID-19 pandemic has made patent. Consequently, private participation in infrastructure and public-private partnerships (PPPs) in particular are again on many minds to help bridge the financing gap while delivering sustainable infrastructure in emerging and developing economies — stimulating economic recovery while government resources can mainly focus on other needs such as health, education, and social safety nets.

But how can PPPs be the “right tool” to support sustainable and resilient infrastructure development? Here are some key ideas:

- Mainstreaming a lifecycle approach to infrastructure project management is key. First and foremost, governments must follow good investment planning processes that prioritize projects based on development needs, socio-economic return, and targeted to ensure inclusivity. There must be thorough understanding of associated commercial, technical, environmental, social and financial risks and their implications. Here, we need clear, practical guidance for decision-makers focused on real, lifelong affordability and value for money. All these conditions fit the PPP model well since lifecycle costing, risk-sharing, and value for money are intrinsic to it.

- Integrating the potential impact of climate change in infrastructure project design and structure in a manner that enhances long-term affordability and value for money is also critical. The main challenge to climate change adaptation and mitigation of its potential impact on infrastructure is its integration into the project design and structure in a manner that enhances long-term affordability and value for money. This means looking at the long-term benefits of sustainability given the inherent uncertainties that could affect these assets over time. Here too, the very nature of PPPs makes them a strong tool to meet these challenges. A PPP is intrinsically a performance-based instrument, accustomed to the concept of long-term value for money and focusing on continued quality service rather than simply the underlying assets. With clear, contractually bound key performance indicators, PPPs are well-placed to incentivize adaptation and mitigation to climate change and resilience in project design and service delivery based on private sector skills, technology, and innovation.

And so, what does it mean then for PPPs to be “rightly done?”

PPPs could respond even better to current trends and challenges by introducing more flexibility in terms of models and contractual provisions, while including fiscally sustainable government support mechanisms to address resilience and affordability issues:

- Even with innovative private-sector approaches, climate change resilience and other future shocks will still require backing from the public sector to manage all the risks and uncertainties associated with long-term infrastructure projects. Government support mechanisms will facilitate reaching the most adequate risk allocation among parties that maximizes value for money, ensuring both resilience and affordability. Instead of a principal-agent relationship, PPPs should create a framework and process for the joint discovery of innovative solutions for infrastructure delivery.

- Proper understanding of the fiscal implications of PPPs and their adequate integration in the overall public investment strategy prevent misconceptions that perceive PPPs as “free” infrastructure. This will help the above-mentioned government support mechanisms to be seen, not as an additional cost, but rather as tools to create the optimal structure to deliver quality infrastructure services.

- In the context of long-term PPP contracts, we need adjustments that add a certain degree of flexibility. Governments and practitioners need to embrace a more diverse pool of PPP models, including the better understood contractual PPPs, but also additional forms of institutional PPPs —for example, joint venture-type schemes. The challenge is to be aware of different options and wisely apply the best fit for the purpose. Since fully complete contracts that predict all potentialities are unattainable, contracts should instead put in place processes that foster satisfactory resolution of unforeseeable circumstances while increasing flexibility.

Related Posts

A blueprint for action to attract private investment in climate adaptation for infrastructure

Leveraging PPPs to tackle climate change – A new resource

The developing world is crying out for greater private investment in sustainable infrastructure

Bouncing back is not enough. Let’s bounce forward to infrastructure resilience

This blog is managed by the Infrastructure Finance, PPPs & Guarantees Group of the World Bank. Learn more about our work here.

Join the Conversation