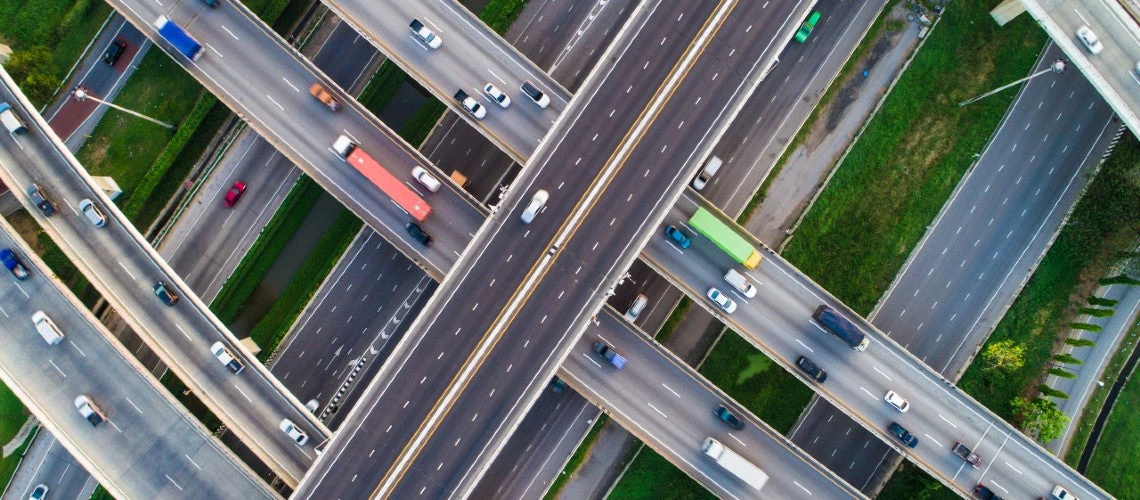

Transport junction traffic road with vehicle movement aerial view by drone

Transport junction traffic road with vehicle movement aerial view by drone

What if governments were able to leverage existing, aging infrastructure to raise funds for new development? Many countries are realizing that this is in fact possible through an approach called “asset recycling.” To see this approach in action, let’s look to India, which is on its way to creating a $5 trillion dollar economy by 2025.

To meet this ambitious target, the government of India is seeking large-scale infrastructure investment, with asset recycling—or monetization of existing infrastructure assets—as a key pillar of sustainable infrastructure financing. The government’s National Monetization Pipeline (NMP), backed by a comprehensive framework developed by the Ministry of Finance, NITI Aayog (a government policy think-tank), and other relevant ministries, aims to generate $72.8 billion by leasing out public infrastructure assets between 2022 and 2025. The proceeds from the asset recycling initiative will be invested in new infrastructure assets, thus supporting the government's large-scale infrastructure investment plan of close to $1.4 billion, the National Infrastructure Pipeline (NIP).

Asset recycling allows governments to concession out or lease existing, brownfield infrastructure assets, such as toll roads, airports, ports, rail, and electricity transmission assets that have the potential for private sector efficiencies in their operations and maintenance. Governments, in turn, can invest the realized proceeds into building new, sustainable greenfield infrastructure assets. This creates a virtuous cycle whereby the public accesses improved services provided by the private sector (operating existing assets) and benefits from additional services delivered by investment in new infrastructure assets.

As seen in the case of India, there are four key reasons for implementing asset recycling :

- Meet infrastructure investment needs and gaps

The development of new infrastructure—a critical need in emerging and developing economies (EMDEs)—is estimated to require between 2-8% of a country’s annual gross domestic product (GDP) until 2030 to achieve infrastructure-related SDGs. An average annual investment of 4.5% of GDP is needed to enable EMDEs to limit climate change to below 2°C.

In addition, resources are required for the operation and maintenance of existing infrastructure to ensure the quality of services provided by the infrastructure asset. This is estimated to cost EMDEs an additional 2.7% of GDP each year.

The rehabilitation of infrastructure assets and capital improvements to ensure climate resilience require an additional upfront capital investment of 3% of GDP.

- Alleviate constraints in raising financing and funding

In EMDEs, government debt as a percentage of GDP has increased substantially over the last decade, resulting in a rising proportion of tax revenue used to service debt. This has impacted the ability of the government to spend on other critical public services. The median government debt service to tax revenue ratio of EMDEs has increased from approximately 33% in 2013 to 42% in 2021 (see Figure 1.16). Debt service is taking up an increasing proportion of tax revenue and preventing spending on measures that support socioeconomic benefits.

With public budgets constrained by this factor, as well as by intertwined global crises and growing populations, governments in EMDEs are struggling to meet demand for infrastructure spending. This is a key reason why countries need to seek out alternative options—including asset recycling—to finance infrastructure needs.

- Leverage private sector efficiencies for better service delivery of existing infrastructure assets

Private sector participation in public infrastructure can help introduce efficiencies by leveraging the private sector’s technical expertise and innovation. Supported by contractual obligations that impose service delivery quality, under an asset recycling scheme there can be long-term gains in efficiency and effectiveness in the management and operations of assets. Open and competitive tendering processes can also help governments realize cost efficiencies while maintaining service level and quality.

- Promote infrastructure as an asset class for domestic and foreign institutional investors

An investment pipeline of brownfield infrastructure with a demonstrated history of operations can attract and mobilize private capital from foreign and domestic investors as well as institutional capital.

When a country's financial institutions, such as pension funds or sovereign wealth funds, invest, they can effectively curb capital outflows; and at the same time, facilitate diversification of their portfolios and support the development of domestic infrastructure projects.

Guidelines for implementing asset recycling

Clearly much can potentially be achieved from pursuing asset recycling.

But this is a relatively new approach, and countries need guidance to implement it effectively. With that in mind, the World Bank, with the assistance of KPMG, has developed a set of Asset Recycling Guidelines to support governments in selecting, preparing, and delivering asset recycling transactions using long-term concession and lease models.

The asset recycling guidelines offer a structured approach to asset recycling transactions. Specifically, sections 3-8 of the guidelines outline the necessary steps that governments should follow to execute asset recycling transactions successfully—set out as follows:

- Section 3: Asset Selection Process undertaken by the government in selecting an asset that is appropriate for asset recycling. These include conducting operational checks, financial/commercial checks, legal and environmental checks, and social and environmental checks.

- Section 4: Project Preparation Process, including the due diligence process, project structuring, and market sounding activities.

- Section 5: Tendering Process for the asset recycling transaction, from development of the request for proposal (RFP) to bid award and contract finalization.

- Section 6: Financing options and instruments available for asset recycling transactions.

- Section 7: Contract Management process post-contract award; this includes guidelines for developing the contract management plan, monitoring and reporting, and dispute resolution mechanism.

- Section 8: Mechanisms for the use of proceeds realized from an asset recycling transaction based on international best practices.

Asset recycling can be applied across many infrastructure sectors. Accordingly, the guidelines also provide sector-specific examples of due diligence requirements, a risk allocation matrix, and terms of reference for the selection of transaction advisors.

The guidelines are also supplemented with information to support asset recycling transactions. These include:

- Template for a term sheet for concession/ lease model

- Range of bid parameters for a typical concession/ lease model

- Bundling and unbundling criteria for assets considered for asset recycling transaction

- Details of climate finance and Islamic finance as a financing option for asset recycling transactions.

You can find the Guidelines for Implementing Asset Recycling Transactions online at the Public-Private Partnership Legal Resource Center (PPPLRC), or download the PDF version here.

Disclaimer: The content of this blog does not necessarily reflect the views of the World Bank, its Board of Executive Directors, staff, or the governments it represents. The World Bank does not guarantee the accuracy of the data, findings, or analysis in this post.

Related Posts

Asset recycling in EMDE infrastructure development can be a win-win-win

Join the Conversation