Amid the chronic chasm between the world’s wealthy and its excluded, almost half of the adult population worldwide – an estimated 2.5 billion people – lack access to basic financial services. The global economic crisis has intensified the plight of the financially excluded, preventing even more of the world’s poor from gaining a foothold on an important ladder out of poverty.

Amid the chronic chasm between the world’s wealthy and its excluded, almost half of the adult population worldwide – an estimated 2.5 billion people – lack access to basic financial services. The global economic crisis has intensified the plight of the financially excluded, preventing even more of the world’s poor from gaining a foothold on an important ladder out of poverty.

As the G20 nations gather this week in Los Cabos, Mexico, for their annual summit, broadening financial inclusion has moved toward the top of the international economic agenda. The world’s leading economies are poised to announce specific new country-by-country commitments and timelines for ensuring broader access to finance to those who have, for too long, been under-served by the marketplace.

The new emphasis on financial inclusion is a tribute to the vision of this year’s Mexican Presidency of the G20, which has exhorted policymakers to consider practical ways to expand access to financial services, strengthen regulatory frameworks, and promote ethical practices that meet the long-range needs of the poor. The Mexican Presidency has brought developing countries’ perspective to the G20 agenda, helping shape an action-plan on the chronic exclusion that afflicts the developing world.

The scale of the challenge is daunting. In Sub-Saharan Africa, for example, about 80 percent of the population has no contact with the formal financial sector. Even in the increasingly prosperous East Asia region, almost 60 percent of adults – an estimated 875 million people – still have no accounts in formal financial institutions.

Lacking access to reliable financial services, the excluded are cut off from opportunities to survive hard times, improve their economic well-being, smoothly manage their family finances and, over time, escape poverty. Exclusion also stunts overall economic growth: Micro, small and medium-sized enterprises are prevented from gaining ready access to capital to expand their business and create jobs.

This issue is especially important for women, who are disproportionately deprived, worldwide, of access to financial services. Only 37 percent of women in developing countries have bank accounts. The problem tends to be most severe in regions that are already struggling to revive their stagnant economies. In the Middle East and North Africa, for example, recent World Bank Group studies have found that, while 75 percent of women business-owners in Tunisia had sought bank credit, only 47 percent received it. Similarly, in Lebanon, 51 percent of women business-owners had sought bank credit and just 17 percent received it.

In studying options for greater inclusion, the G20 has learned how governments can play a significant role by making their payments – such as salaries, benefits and pensions – through bank accounts rather than by check or in cash.

Technology helps speed the flow of money while cutting costs: Governments can save as much as 1 percent of GDP in administrative costs when they make regular payments into poor people’s bank accounts through electronic payment systems – while also enrolling new recipients in the formal financial sector.

Both wealthy and poor countries have a great deal to learn from success stories in developing nations. Brazil’s “Bolsa Familia” program, for example, delivers cash transfers to more than 12 million recipients through electronic benefit cards. Modernization pays off: Since merging four different cash-transfer initiatives into a single system, the program has lowered administrative costs by more than three-quarters (from almost 15 percent to less than 3 percent of the value of the grants disbursed). Kenya has extended payment services to more than 40 percent of its adult population through its mobile payments system: The Mpesa (“mobile money”) system allows customers to transfer funds directly through their mobile phones – and it easily enables employers to pay salaries and companies to collect bill payments.

The World Bank Group is active in more than 60 countries and has a $3 billion portfolio of projects to help catalyze broader financial services, while providing technical assistance to regulators and policymakers. Through the Bank Group’s private sector arm, the International Finance Corporation’s clients have an outstanding portfolio of nearly 8 million microloans, worth nearly $12.6 billion.

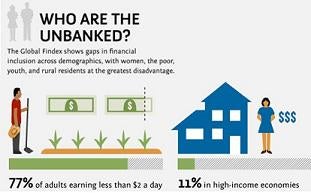

Working with the Mexican Presidency in advance of the G20 summit, and drawing on our experience as the principal global financial institution that consults with finance ministries and regulators, the Bank Group recently launched a new Global Financial Inclusion database that includes the results of interviews conducted with 150,000 people in 148 countries through the Gallup World Poll survey. The Findex provides the most comprehensive picture yet of financial behavior around the world, tracking how people save, borrow and make payments.

The Findex gives policymakers and industry leaders new data to help them develop the appropriate financial infrastructure and an effective regulatory environment – including stronger rules for microfinance; strong consumer safeguards; efficient retail payment systems; stronger information-sharing systems, like credit bureaus and collateral registries; and efficient data collection.

There is no silver-bullet solution to the challenge of empowering the excluded, and achieving the ideal of broader financial inclusion will surely require governments’ sustained attention. But through the steps that the G20 is poised to take this week, many of the world’s policymakers seem ready to underscore the urgency of giving the financially excluded a way to participate, at last, in the wealth-building opportunities of the formal economy.

Join the Conversation