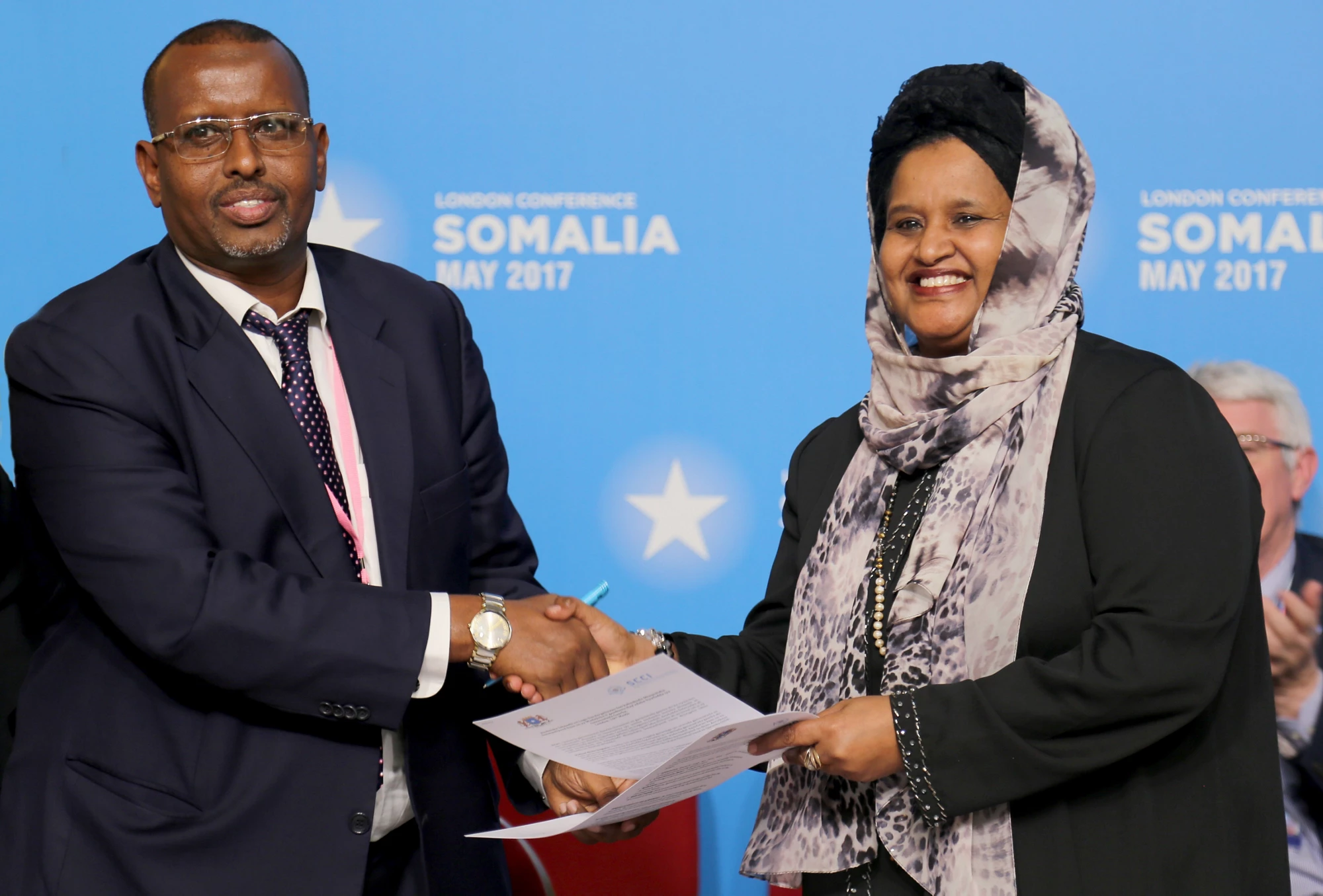

The president of the Somali Chamber of Commerce, Mohamoud Abdi Ali, joins with the country's Minister of Commerce and Industry, Khadra Ahmed Dualle, at the IFC-sponsored Public-Private Dialogue at the Somalia Conference, which was convened in London in May 2017. The need to increase revenue, growth and trust led to the creation of the Public-Private Dialogue. Photo credit: MPF.

Stabilizing countries that have long been afflicted by fragility, conflict and violence (FCV) – and helping them shape effective reforms to strengthen the investment climate – is one of the most difficult challenges in international development. The task is all the more severe when, as in Somalia, a large proportion of the population has been displaced by violence and natural disaster and when the economy is overly concentrated on a few sectors. Such factors make rebuilding investor confidence a daunting challenge for the newly elected government.

However, despite these challenges, Somalia represents a rare example of private-sector resilience. The major sectors of the economy survived the tumultuous period after the collapse of the state in 1991. Entrepreneurs in Somalia and abroad continue to innovate and adapt in a country void of regulatory frameworks or government oversight. Domestic mobile-money transfers average $1.2 billion in monthly transactions, and mobile money usage is above 70 percent.

Nonetheless, economic growth in Somalia has stagnated and has not resulted in a peace dividend for the population. Government revenue is low – around 2.5 percent of GDP – in an economy driven by consumption, as identified in the World Bank Group’s Somali Economic Update (SEU) from 2016. According to the SEU, two of the biggest obstacles to equitable growth are access to finance and lack of regulations. Moreover, investment in priority sectors is low, held back by protectionism, conflict and instability.

Somalia was the focus of an international conference in May 2017 in London that brought together some of Somalia’s top private-sector firms, development institutions and government leaders to discuss how to jump-start private-sector-led growth and achieve long-term peace and development. Among the distinguished attendees were the newly elected president of Somalia, Mohamed Abdullahi Mohamed “Farmaajo”; Prime Minister Teresa May of the United Kingdom; United Nations Secretary-General Antonio Guterres; and the European Union’s foreign-policy chief, Federica Mogherini. The World Bank Group delegation was led by Jan Walliser, the Vice President for Equitable Growth, Finance and Institutions.

The conference dedicated a special side event to economic recovery, bringing together government, private-sector leaders and development partners to discuss their common challenges. This side event achieved the signing of a landmark Public Private Dialogue (PPD) Declaration between the government and the private sector. The declaration is a potentially transformational step: The government affirmed its responsibility to develop and strengthen regulatory frameworks and policies, in consultation with the private sector, to enable economic recovery that will benefit all Somalis. In turn, the private sector committed to actively engage with the government to progressively establish a modern business environment based on the rule of law and a fair, predictable and competitive taxation system. The declaration also outlined key sectors for investment and regulation, such as Information and Communications Technology and agribusiness.

The meeting concluded that a constructive partnership between the public sector and the private sector in Somalia can help unlock revenue collection, improve regulatory compliance, strengthen investment and advance foundational reforms, like the establishment of a national identification system.

The Somali government used the occasion to underscore the priorities within its three-year National Development Plan, recognizing that the private sector’s significant strides can go further with stronger government support. Shaping a regulatory environment that is conducive to business – along with well-crafted reforms that create an economic environment based on the rule of law, that promotes competition and that enforces transparency – is a top priority for the new administration.

As in many fragile countries, Somalia’s focus is now on improving investment laws, streamlining business registration, establishing efficient tax systems, increasing access to finance, ensuring commercial justice and improving trade logistics. Such reforms can bring large payoffs in terms of economic growth and stability, encouraging businesses to make the transition from the informal to the formal sector, generating tax revenues and reducing corruption. The private sector’s contribution is critical: It already generates more than 90 percent of the country’s GDP. Moreover, remittances from overseas amount to about $1.4 billion each year.

The World Bank Group played a pivotal role in the London conference: Oumar Seydi, the International Finance Corporation (IFC)’s Regional Director for East and Southern Africa, chaired the session on economic recovery, and Bella Bird, the World Bank's Country Director for Burundi, Malawi, Somalia and Tanzania, provided opening remarks. The conference also gave international financial institutions and Somali government leaders a chance to re-engage in their discussion about the path to arrears clearance – as well as the importance of working with bilateral creditors. The government’s strong commitment to raising revenue, along with continuing investment in public financial management and institution-building, as was underscored in London, is a critical aspect of the roadmap to regain access to concessional IDA lending and IFC investment.

Since 2012, programs delivered through the Bank Group’s Trade & Competitiveness Global Practice have been making progress in strengthening investor confidence in Somalia. The FCV agenda is a critical part of the Bank Group’s work, and advanced discussions are underway for IFC to scale up its efforts in Somalia through the “IFC 3.0” effort to promote private-sector-driven investment.

The Bank Group, through the Multi-Partner Fund, supports a range of state-building initiatives in Somalia, including IFC’s work with the private sector. The Somali Core Economic Institutions and Opportunities (SCORE) Program is developing a regulatory and policy framework for Somali financial institution, to catalyze private investment and job creation across Somalia. Efforts are also underway to set up a One-Stop-Shop for business registration and to support value chains in fisheries, gums and resins. Moreover, the Multi-Partner Fund supports Public Financial Management (PFM) reform with the Ministry of Finance. In addition, the Trade & Competitiveness Global Practice has been driving the PPD effort to ensure close coordination between government officials and private-sector leaders.

The London conference was a landmark occasion in Somalia’s journey toward development – uniting such development partners as Denmark, Sweden, the European Union, the U.K.’s Department for International Development (DFID) and USAID in an ever-closer partnership with the country. As Somalia and its development partners anticipate continued collaboration, the World Bank and IFC continue to deliver on their projects commitments, refine their Monitoring and Evaluation results frameworks, and coordinate with partners to fulfill both short- and long-term objectives. With well-calibrated reforms and well-targeted investment that promote job creation and income growth, they can lay the foundations for Somalia’s stability, prosperity and peaceful development.

Join the Conversation