For decades, various governments around the world have used trade-distorting policies (tariff and non-tariff barriers) to support the development of local automotive industries that would not have otherwise been economically viable. However, to what extent are these policies, which once helped attract market-seeking automakers (or Original Equipment Manufacturers: OEMs), still serving the interests of these countries is uncertain.

In fact, for India and Pakistan, two of the biggest South Asian automotive producers, a recent World Bank Group report highlights that such polices might be reducing competitiveness and slowing down the spread of world-class good practices in the value chain. These effects need to considered carefully. A process of reform via gradual reduction of import tariffs and convergence with international environmental and safety standards is recommended to enhance competitiveness of this sector.

In the automotive sector, India is the world’s sixth-largest auto producer by volume, but it owns less than 1 percent of global export markets compared with more than 3 percent for China, 4.5 percent for Korea and 7 percent for Mexico. The average auto firm in India exported only 5 percent of its total sales, compared to 16 percent in China. Productivity levels in India are one-third the levels in China, and this gap persists for OEMs that are sub-scale, with below-average investment in innovation and skills, and with low participation in global value chains (GVCs). All these factors were discussed in a previous Private Sector Development blog post. The situation is worse in Pakistan, with lower levels of exports and productivity, and with similar factors driving it.

Trade policies, through tariff and non-tariff barriers, play an important role in shaping the external environment, which in turn influences a firm’s incentive to become more productive (or not). Firms facing greater competition in their product markets are inclined to raise the minimum productivity threshold to operate profitably and reduce inefficiencies. They do this both through investing in productivity-enhancing activities and through reducing costs, which in turn helps them capture greater market shares. Competition also helps reallocate resources from the less-productive to the more-productive firms, increasing the incentives for all firms to invest in the within-firm productivity levers such as innovation and skills.

One such important channel of competition in the product market is missing for local OEMs in India and Pakistan. Both countries have high import tariffs on completely built units (CBUs) of passenger cars (high levels of 60 percent in India and 80 percent in Pakistan), which make imports in all categories of cars (except commercial vehicles for India) prohibitively expensive and which have encouraged local OEMs to focus on the domestic market at the expense of exports. The level of tariffs on auto parts remains at similar high levels in Pakistan.

Once viewed as important to attract market-seeking OEMs, such policies today are discouraging innovation and moving up the value chain in serious ways, which in a context of increasing centralization and subcontracting of design activities to “single-stop” suppliers, makes for a tricky future in global markets. It also explains, to a great extent, the curious combination of growing production levels and a low share in global exports by both countries, despite excess capacity in plants (by 30 to 40 percent) and no explicit barriers to exporting.

An oft-heard argument is that reducing import tariffs on CBUs on cars would lead to an influx of cheap imported cars from overseas and would destroy local manufacturing in these countries. That does not sit well for three reasons:

- The nature of the auto sector: To reduce transport costs and damage during transit, most automakers prefer to manufacture their products close to the market of sale and to encourage suppliers to co-locate. Where countries cannot promise local economies of scale, high volumes of mass-market cars get imported. This is not the case for India: Maruti and Hyundai are both operating at scale, for instance. In fact, India is particularly good in making certain types of cars that could not be made as competitively in the second-best location regionally. OEMs are likely to respond to lower tariffs in India by a global rebalancing of their sourcing strategies: They might consider making India a preferred production base, boosting activities in some product categories such as small passenger vehicles, for domestic and export markets, while serving another vehicle segment more via regional imports.

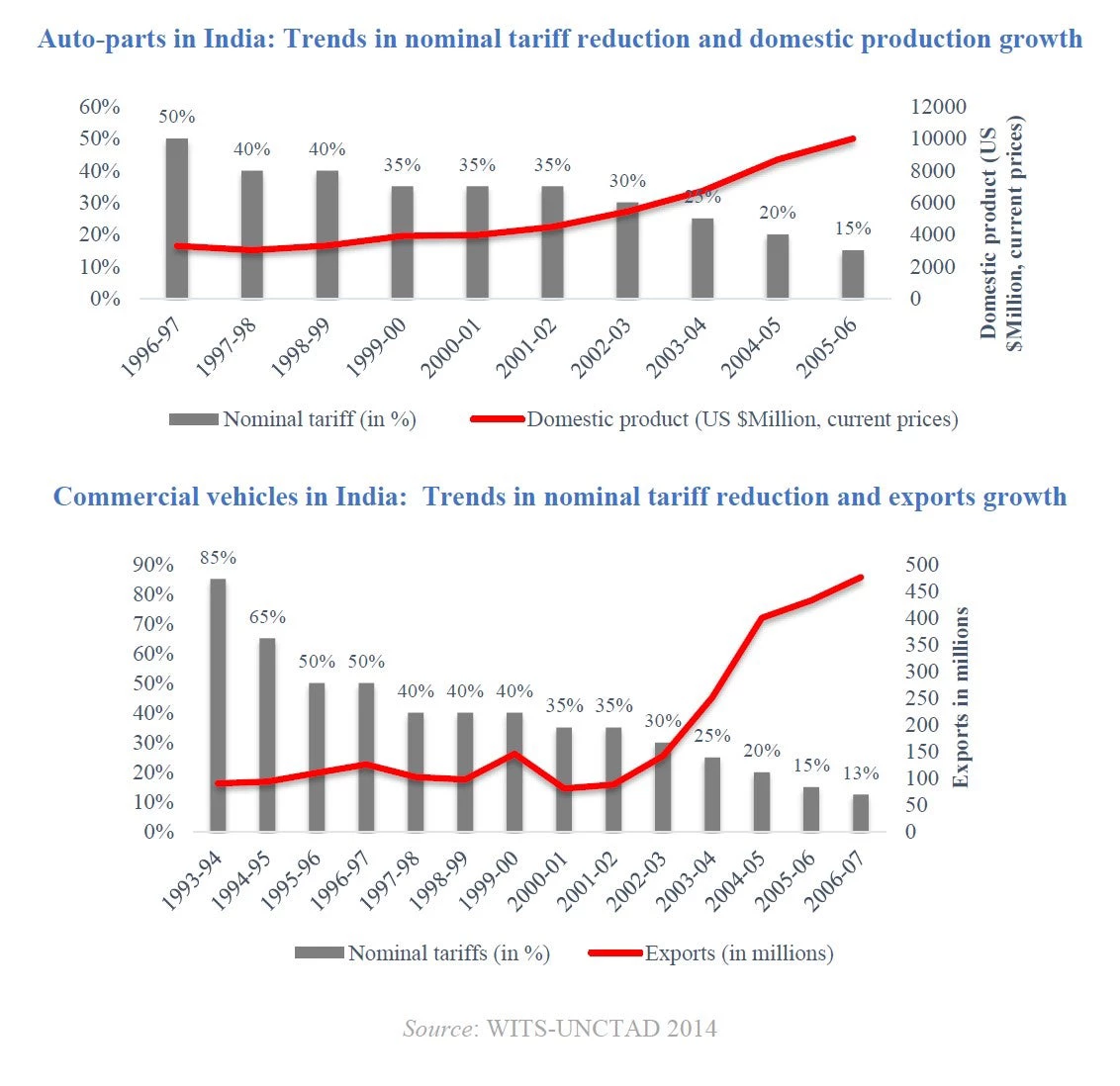

- The case of auto parts: The experience of the Indian auto-parts sector shows that a gradual reduction of import tariffs, far from leading to the debilitation of an industry, has been a powerful catalyst to its global success. Tariffs on auto parts in India have fallen sharply since the 1990s (from 60 percent to an average of 12.5 percent), with increased production and exports. Exports now comprise more than 40 percent of production, imports have grown, and firms are able to trade with mature end-markets in GVCs. Local jobs were created.

- The case of commercial vehicles: Like the auto-parts segment, the decline in import duties on commercial vehicles was associated with increases in production and employment, and the subsector currently shows a trade surplus.

For all these reasons, it is unlikely that a gradual reduction in import tariffs will harm the industry. What is likely is that gradually reducing tariffs to expose local manufacturers to more competition will have efficiency-improving effects along the value chain. The less-productive firms may have to fight to survive, but the more-productive firms will see increased production. More product-market competition is found to be linked to increasing aggregate management capability. A reduction in import tariffs should be done together with policies that bolster investments in infrastructure, unify taxes (India did that recently), along with policies that provide more support to SME suppliers and critical R&D infrastructure for automakers and parts suppliers.

On non-tariff barriers (NTBs), some good progress has been made to close the gaps in meeting international standards for environmental and safety regulations in India. More attention is needed on this issue in Pakistan. For instance, the Indian government announced a bold move to leap over Euro V, and move straight to Euro VI regulations by 2020 (a decision that makes sense in light of India’s record on high pollution levels in cities). Converging toward international environmental and safety standards, as the Indian government is planning to do, would further encourage automotive firms in South Asia to adopt (and contribute to) international good practices.

For NTBs, in particular, three areas of reforms are mentioned in the report on the automotive sector in South Asia :

- Greater predictability of rules on environmental and safety standards would enable firms in India and Pakistan to improve their planning.

- Changes in pollution and crash-test regulations would need to include provisions for India and Pakistan’s large existing fleet of cars.

- Safety norms for workers, especially in supplier factories in both India and Pakistan, would need to be upheld.

This blog post is the second part of a two-part analysis of competitiveness of the automotive sector in India. The first blog post can be found here . The full report on automotive-sector competitiveness for South Asia can be downloaded here . The full volume on South Asia’s competitiveness can be downloaded here .

Join the Conversation