Kazakhstan capital city Astana illuminated at night

Kazakhstan capital city Astana illuminated at night

Kazakhstani banks aren’t moving decisively enough to greener lending—lending that supports environmentally friendly activities. In an earlier blog, we highlighted a two-pronged approach to greening bank lending in Kazakhstan. Here we dig more deeply into bank exposures to transition risks—the risk associated with industries that rely on fossil fuels as the world transitions to greener economic activity. We look at the carbon intensity of credit and priority actions for Kazakhstan’s banking regulators.

Exposure to transition risk is rising for Kazakhstani banks

In 2022, bank lending exposed to transition risk in Kazakhstan amounted to 70 percent of bank capital. That reflects an analysis of bank lending based on the updated Climate Policy Relevant Sectors classification, which rates the exposure of bank credit to transition risk. The data scores economic sectors based on their propensity to produce greenhouse gases (GHGs) and rates the credit financing them as more or less risky. Figure 1 shows Kazakhstan banks’ lending exposure to risky sectors relative to bank capitalization. We find a declining trend in the transition risk exposure from 2015 to 2019 and then stagnation. Credit to energy-intensive sectors dominates bank lending with high transition risk. Exposure to the risky transport sector grew noticeably in 2022.

Figure 1: Exposure of Kazakhstani Banks to Transition Risks

The carbon intensity of credit in Kazakhstan

The classification of Climate Policy Relevant Sectors is useful for benchmarking across countries, but is not as precise as looking at the actual level of carbon (or GHG) emissions associated with bank lending in Kazakhstan. We compute the actual carbon intensity of credit across sectors for which GHG data are available and relate them to bank lending. This can give us a better idea of where the problem is concentrated and where to focus.

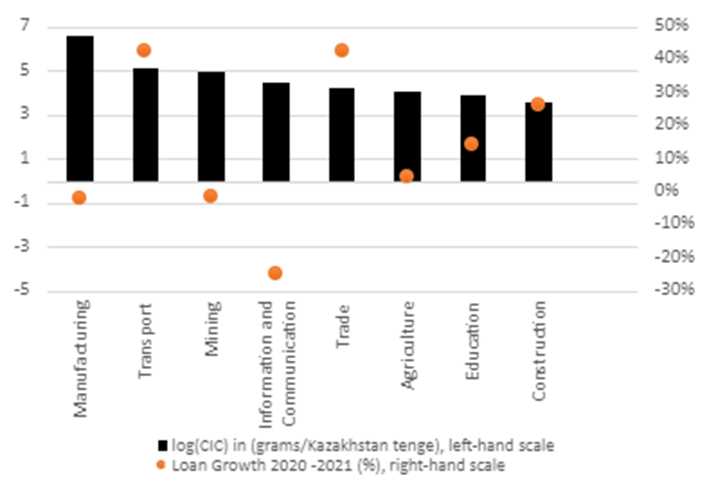

In Figure 2, the black bars show that bank lending to manufacturing was the most intensive in supporting GHG emissions in 2022. Within manufacturing, ferrous metals, chemicals, and textiles are the most GHG-emitting industries. Lending to the relatively carbon-intense transport, mining, and information and communications technology (ICT) sectors ranks next. In Kazakhstan, data reporting for sectoral GHG emissions do not match the way data for bank sectoral lending is reported. Better data alignment would enable better monitoring of green lending and transition risk exposure, especially for sectors such as energy or water, where data is particularly hard to compare.

The orange dots in Figure 2 show that the highly carbon-intensive transport sector received the greatest increase in bank lending over 2021–22, along with the less carbon-intensive trade sector. This may suggest an increase in the banking system’s exposure to transition risk — unless the transport loans are for greening projects. At the same time, lower-emitting sectors such as agriculture appear to be starved for credit.

Figure 2. Carbon Intensity of Credit (CIC) and Sectoral Loan Dynamics

Financial regulators can encourage greener lending and reduce transition risk

Kazakhstan’s Agency for Financial Regulation and Development (AFR) should require banks to prepare carbon transition plans. Banks could define short-, medium-, and long-term decarbonization targets that are at least as ambitious as Kazakhstan’s national determined contributions under the 2015 Paris Climate Accords. The plans should focus on reducing total emissions—the carbon footprints of the bank itself and up and down it value chain, notably the carbon intensity of bank lending and investment portfolios—known as scope 3 emissions.

To set reliable decarbonization targets, banks need to invest in substantial data-gathering capabilities and demand credible carbon footprint data from borrowers. The carbon transition plans would be submitted annually to the AFR, which would ensure that banks are reducing their exposure to transition risks. Supervisors and banks should be realistic in implementation because transition plans are an iterative process. The agency can benchmark banks’ plans, identify emerging best practices, and reflect them in requirements for transition risk management.

No banking supervisor in a developing country has yet implemented bank carbon transition plans. Kazakhstan could be a global leader, given its economy’s heavy reliance on fossil fuels. An early rollout of such a policy could accelerate the transition to zero or at least put it on a firm footing. The World Bank stands ready to assist the AFR in implementing the requirements for bank transition plans—either within the ESG risk management guidelines or risk management regulation.

This blog is part-two of our series on Kazakhstan: Banking the transition to net zero. You can read part one - How Kazakhstan can leverage green finance to reduce emissions here.

Join the Conversation