As David Francis pointed out in a recent blog, the private sector in Latin America and the Caribbean (LAC) region showed some resilience to the heavy distortions of the recent financial crisis. Latin America’s market economy is working in a way where more productive businesses are able to survive, while less productive firms are exiting the market.

But how does this fit into the larger picture of the region’s private sector?

A partial answer to this question is that the region’s private sector is adding jobs. Especially in a period where the developed world faced severe challenges on job creation, the region succeeded in creating new jobs by almost five percent in both manufacturing and service sectors. This trend is widespread: service sector firms in all countries – as we covered in a recent note on firm performance – added jobs. And in only 5 of the region’s countries did manufacturers decrease the number of employees on their books.

While the number of jobs is going up, we find private sector sales are lagging behind

So, why is the region still facing challenges in improving labor productivity levels in both the manufacturing and service sectors?

Between 2009 and 2011, the Enterprise Surveys project interviewed nearly 15,000 businesses in 31 countries in the region. These countries include 7 large economies including Argentina, Brazil, and Mexico, 13 medium-size economies as well as 11 Caribbean islands. In addition to covering many aspects of the business environment that affect firms’ operations, the surveys also collect firm-specific information that can be used to measure performance.

In a recent note (World Bank 2013), we investigated the evolution of labor productivity and employment levels in the region benchmarking them with the developing countries of other regions.

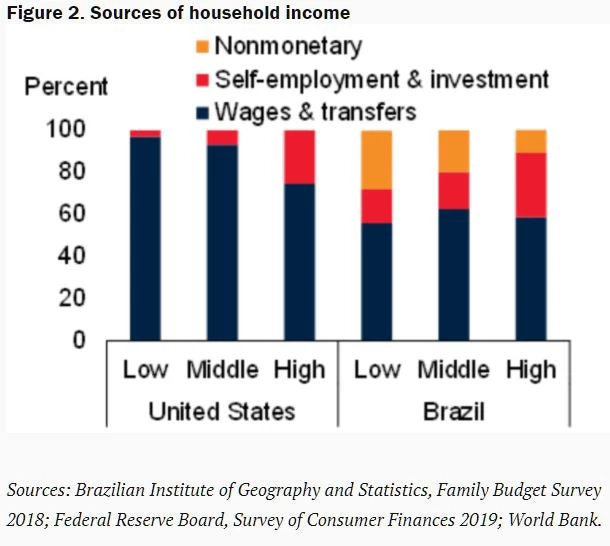

According to our analysis, while firms in LAC increased employment levels in 2010 their labor productivity declined in both manufacturing and service sectors with a stronger decline in the manufacturing sector (figure 1 and 2). This is in strong contrast with the picture seen in most of the developing countries of other regions, for example the positive labor productivity growth in both sectors in Sub-Saharan Africa.

Fig. 1

Fig. 2

The gist of this trend is that changes in sales are not keeping up with the changes in employment levels. That is, for some reason the private sector in the Latin America and the Caribbean region has not been able to translate the increase in employment levels into greater levels of production.

However, the decline in labor productivity is not consistent across the region.

In the manufacturing sector, our data show that Trinidad and Tobago, Peru, Uruguay, and Ecuador achieved both positive labor productivity and employment growth, with Peru showing an impressive employment growth rate at 11 percent annually. In some large economies, notably Brazil and Argentina, although both employment levels and sales levels increased, labor productivity declined.

All of the small Caribbean countries included in the project had positive growth in employment, but they fared worse than the rest of the region in labor productivity growth in the manufacturing sector. In the services sector the picture was not much different: only three countries (Belize, St. Lucia and St. Vincent and the Grenadines) showed positive labor productivity growth.

These trends also vary by business size.

Small firms, i.e., those with 5-20 employees, have been the most dynamic group in the region. They are the only group in the services sector that had positive labor productivity growth; both medium and large services firms exhibit negative labor productivity growth (figure 3). Similarly in the manufacturing sector labor productivity growth of small firms was positive if we exclude the small Caribbean countries. Another encouraging feature of small firms in the region as a whole is that they are the only group that had acceleration in labor productivity levels between 2006 and 2010. Although it can be expected that small firms grow faster than large firms, conditional on survival, it is surprising to see them being the only group that had positive yet mild growth rates.

Fig. 3

These results add a further dimension to the first blog post we presented, here.

Yes, larger and more productive businesses were better able to survive between the waves of the surveys in 2006 and 2010, but the evidence shows that labor productivity in more recent years is declining. Over the past few years the region has shown a dynamic labor market with many countries creating new jobs. However this dynamism was not coupled by labor productivity increases.

Altogether, the data show that while businesses are expanding employment, real factors in the region’s business environment could be holding back the region’s full economic potential. This result makes us wonder what other aspects of the private sector in the Latin American region may be hindering the private sector from fully exploiting its gains in employment, a very concerning result, which is particularly stronger in the manufacturing sector.

As the Enterprise Analysis team moves ahead with the release of additional notes on the results obtained from the recent enterprise surveys data for Latin America and the Caribbean, we plan to dig deeper into some of the business environment aspects that may be behind these results.

Join the Conversation