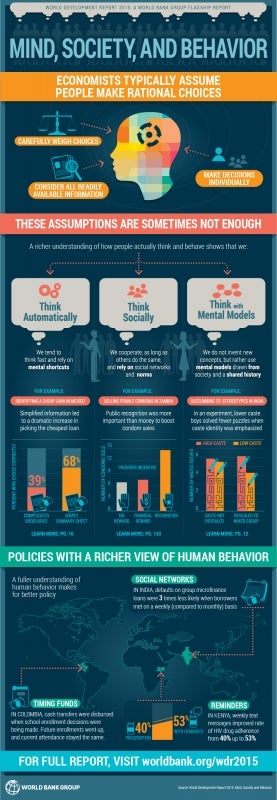

Like many World Bankers, I took some time recently to look through the newly released 2015 World Development Report “Mind, Society, and Behavior.” From my perspective, in the Finance and Markets Global Practice, one thing jumped out immediately: The report is packed with insights that are directly relevant to our work on financial inclusion.

In the Overview alone, the reader is met with an abundance of findings related to consumer protection, financial capability, savings and other key topics involving financial inclusion (grouped together under the theme of “household finance,” which is fully explored in Chapter 6). We’re told of how changes to the framing of payday-loan terms dramatically altered borrowing behavior in the Unitedc States; how embedding financial messages in an engaging television soap opera in South Africa improved the financial choices of viewers; and how SMS reminders increased saving rates in Bolivia, Peru and the Philippines.

Of course, this is not the first body of work to summarize key behavioral lessons learned from decades of careful research on financial inclusion: See, for example, Chapters 6-9 of Banerjee and Duflo’s Poor Economics or the Bank’s 2014 GFDR on Financial Inclusion.) But these examples do help drive home the key message of the report: Paying attention to how people think, and to how history and context shape their thinking, can improve the design and implementation of development policies and interventions that target human behavior.

The report highlights that psychological impulses such as present bias, loss aversion and cognitive overload can lead to poor financial decision-making. For those in or on the edge of poverty, the ramifications of these poor decisions – low savings, chronic over-indebtedness, investment shortsightedness – can be devastating. We are reminded that most adults in developing economies do not benefit from the sophisticated financial tools such as automatic salary deposits, mandatory retirement contributions, or default insurance programs that help mitigate the effects of automatic thinking.

Yet, as outlined in Chapter 6, there are a range of interventions that have been shown to help address behavioral constraints on financial decisions in a developing-country context. Many of those interventions take advantage of what we know about the natural processes of the mind, using techniques such as framing, default settings and emotion persuasion to nudge people toward better financial decisions.

It would probably be a stretch to conclude that the lessons of the report are more relevant for financial inclusion than for other areas like health, education or child development. Rather, I think the key takeaway is that, given what we now know about how automatic, social and mental model-based thinking affects people’s financial behavior, those of us who are working in the area of financial inclusion have no excuse not to draw from and contribute to this knowledge base when designing or financing financial inclusion programs or policies.

What does this mean in practice?

First, we should be proactive in our individual and project-team efforts to reflect key behavioral research in Bank engagements. Having worked previously in DEC, I’m very aware of the gap between research and operations in the Bank – a gap that has perhaps shrunk recently due to a range of efforts (see Research Academy, IE vs. OPS Smackdown, etc.) but that persists nonetheless. Devoting some time to reading up on what behavioral design elements have worked (or not worked) for previous, related projects – and perhaps even crossing the demarcated line to talk to some of the folks who have designed and implemented the research – should be expected and encouraged.

Second, as the report so nicely puts it in an excellent chapter on development professionals, “Development practice requires an iterative process of discovery and learning.” Because, for all we already do know, it’s a microcosm of what we could know – and it’s incumbent on all of us to leverage our own work to contribute to the collective knowledge base. The Bank has set its sights high when it comes to financial inclusion, aiming for nothing short of Universal Financial Access by 2020. Supporting our clients in achieving this goal and fulfilling their own ambitious financial inclusion priorities will require consistent and meaningful support for behaviorally conscious program design, experimentation and evaluation.

We’ve tried to incorporate this principle in the Financial Inclusion Support Framework (FISF) programs in Rwanda, Indonesia, Mozambique, Zambia and elsewhere. (FISF country support programs are multi-year World Bank technical assistance programs aimed at helping countries achieve their financial inclusion priorities and targets.) Each of these programs has dedicated significant funds to evaluating strategically important financial inclusion initiatives, whether they’re directly supported by the programs or pre-existing / independent initiatives.

The goal is to better understand which interventions and policies can meaningfully improve how adults manage their day-to-day finances and how to plan for the future in each individual country context.

So, where to begin? Reading the report (or at least the Overview) – and keeping it handy for rereading during your next project – would be a good start.

Join the Conversation