In just four days in February, 200 avalanches hit the mountain regions of Tajikistan, sweeping away houses, rendering critical roads impassable, and killing 19 people.

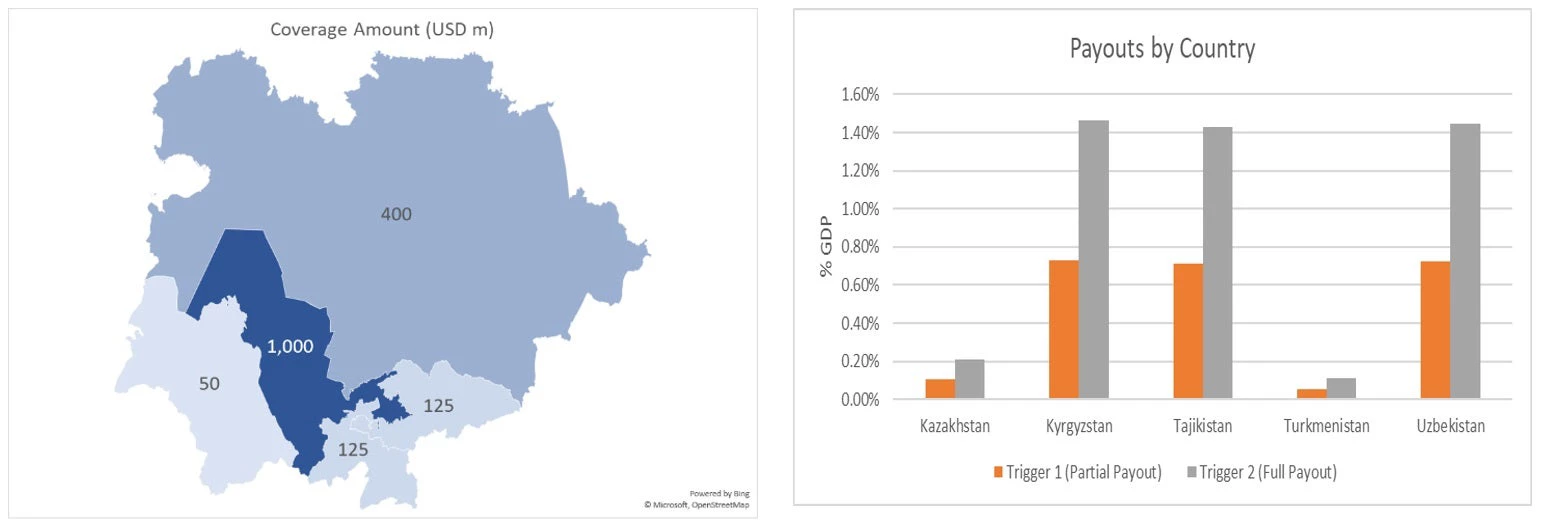

These kinds of disasters are nothing new to Central Asia. Over the past two decades, the region lost over $1.5 billion to natural disasters, affecting over 2.5 million people. A major flood—say, one with a one percent probability of occurring annually—could cause devastating losses: from $220 million in the Kyrgyz Republic to $2.3 billion in Kazakhstan. A major earthquake can cause financial losses from over $360 million in Turkmenistan to over $10 billion in Uzbekistan. With climate change, natural disasters are becoming more frequent and severe than probabilities might suggest.

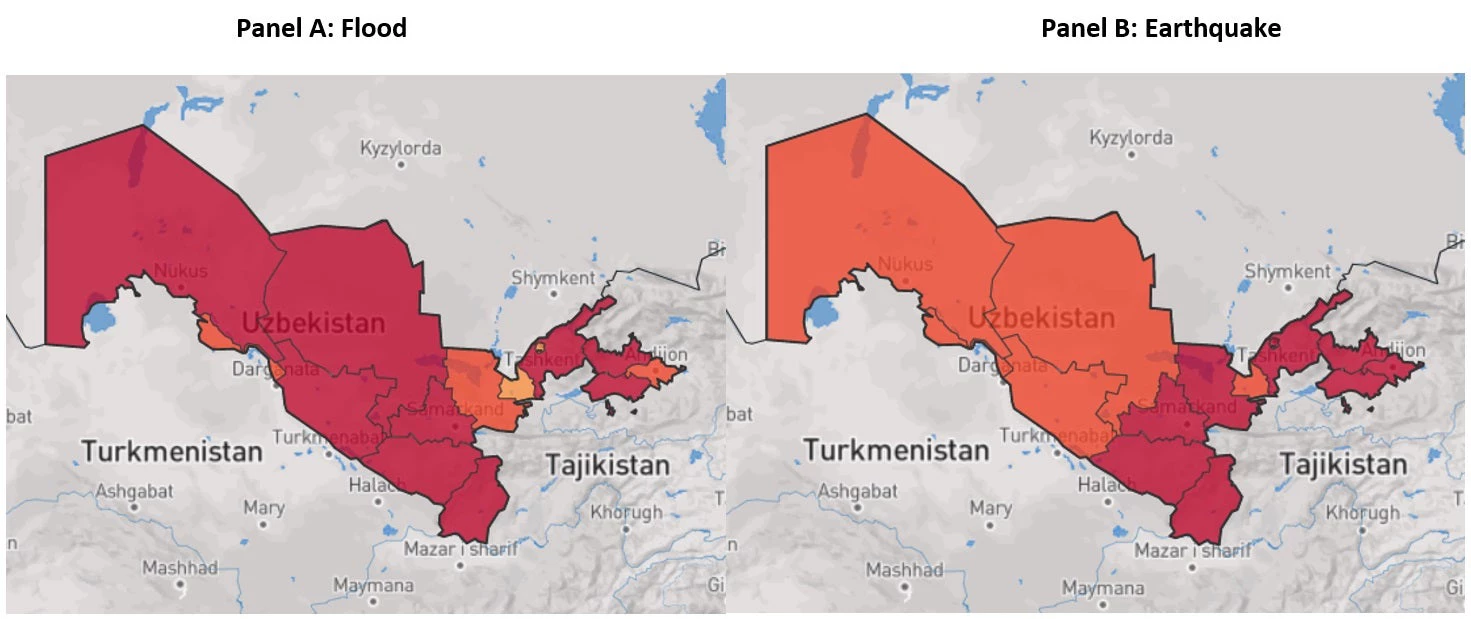

Map 1: Flood and Earthquake Hazard Profiles for Uzbekistan

Financial preparedness of Central Asian countries for disasters is limited and largely ad hoc. Most governments primarily rely on generic contingency funds, budget reallocations, borrowing, or international support. In a recent blog, we have explained the fundamentals of a well-diversified disaster risk layering strategy. Such a strategy can protect the state against the financial impact of disasters and help recover faster by efficiently financing the rebuilding of state infrastructure, upholding livelihoods, and restarting businesses, among others.

Public money alone is not enough to cover all post-disaster costs. Private capital is needed for greater and targeted funding that is deployed fast. One way to access private capital is to develop domestic private insurance and credit markets. There is also an opportunity to transfer the risk of budget losses due to extreme disasters to international markets. A catastrophe bond, also known as cat bond, is an instrument that allows states to do this.

How does a typical sovereign cat bond for developing countries work?

The World Bank issues cat bonds that provide member Governments with catastrophe insurance, and to date has transferred $3.3 billion of risk to capital markets investors through 19 Cat bonds.

When the World Bank issues a cat bond sponsored by a government, it stands between governments and the market. The government enters into an insurance agreement with the World Bank and will receive pay-outs from the World Bank if pre-agreed disaster events occur. In exchange, the government pays an insurance premium to the World Bank.

Simultaneously, the World Bank issues a cat bond to investors with terms that mirror those of the insurance agreement. The cat bond provides a hedge to the World Bank for its obligations under the insurance agreement. If the World Bank makes a pay-out to a government under the insurance agreement, it will deduct the same amount from the principal amount of the bond. The World Bank uses the insurance premium it receives from the government to pay a portion of the bond coupon. At maturity, any outstanding bond principal is returned to the bond investors by the World Bank.

In times when public resources are scarce, a cat bond offers an appealing feature—it mobilizes private capital without adding to the national debt. This is because the sovereign is not the issuer of the debt, it simply enters into an insurance agreement. A cat bond can allow governments to access a large pool of capital and typically for longer coverage periods, compared with conventional insurance. There is credit risk exposure in conventional insurance; it’s possible the insurer won’t have the funds to pay out. Because cat bonds are fully funded, they eliminate any counterparty credit risk concerns for countries. Cat bonds are also viewed positively by rating agencies in sovereign credit rating assessments.

Why would investors be interested in cat bonds covering risks from Central Asia? Primarily, cat bonds provide investors with returns uncorrelated with other asset classes, bringing diversification to investment portfolios and providing robust performance in good and bad times. The cat bond market, has grown to nearly US$ 40 billion, and is predominantly exposed to hurricane and earthquake risk in the U.S. and Japan. Therefore, other risks such as those from Central Asia can provide diversifying benefits to cat bond investors. In addition, World Bank issued cat bonds help investors meet sustainable development and ESG targets because the proceeds are used to finance World Bank sustainable development projects globally , and any payouts support post-disaster recovery in the insured country.

What could a cat bond for a Central Asian country look like?

To offer longer protection, a cat bond could provide coverage for several years (three or five years, for instance). It would offer coverage to participating countries for coverage of earthquakes or floods, according to their objectives and risk profile. The governments would decide what losses they want to cover. For example, the entire cat bond can disburse after a disaster that has a 1 percent chance to happen and partially after a disaster that has a 2 percent chance to occur.

For each peril, triggers could be based on the physical parameters of an event or based on modelled losses for an event. For example, for earthquakes, payouts could be triggered based on the location and magnitude of an earthquake. For floods, payout triggers could be based on absolute water levels, precipitation levels, or river flow rates.

Figure 1: Example coverage and pricing of CAT bonds for Central Asian countries

Central Asia countries can start exploring potential Cat bond solutions

Cat bonds are a sophisticated disaster risk transfer instrument. The World Bank can support Central Asian countries in understanding and exploring potential cat bond solutions and in taking catastrophe risk to international capital markets. This support could include knowledge sharing, building local technical capacity, and coordination of an entire transaction from design to execution.

Join the Conversation