In just a few years since the G20’s Global Partnership for Financial Inclusion (GPFI) published its initial White Paper, the role that global financial standard-setting bodies (SSBs) have on “who gets access to what formal financial services at what cost” has been increasingly recognized.

Appreciation has also grown for the important role that digitization of financial services plays in reaching financially excluded and underserved customers, and the implications this development has had on the SSBs.

There is still far to go, but the advances are noteworthy.

The GPFI’s new White Paper, Global Standard-Setting Bodies and Financial Inclusion: The Evolving Landscape documents this progress while flagging the disruptive forces that digital financial services represent for the formal financial system, as well as the opportunities and challenges they carry for the SSBs to develop standards that countries can apply.

Considering rapid changes in the financial inclusion landscape, close cooperation among the global financial standard-setting bodies has become more important to harmonize the development and application of standards and guidance, as the paper shows.

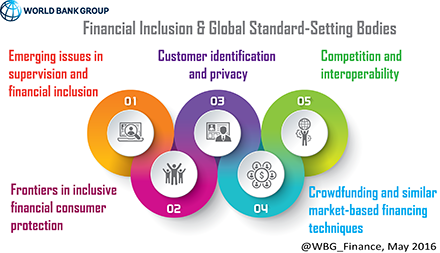

The White Paper also discusses crosscutting topics triggered by the evolution of digital financial inclusion, such as new frontiers in consumer protection and the fast-evolving space of crowdfunding and other peer-to-peer financial services, which fall within the mandates of most or all SSBs. Other crosscutting areas include:

- Competition and interoperability

- Customer identity and privacy

- De-risking and financial exclusion

- Emerging issues in supervision and financial inclusion

Which global standard-setting bodies matter most for financial inclusion?

The GPFI White Paper considers primarily the standards and guidance of the following global bodies:

- the Financial Stability Board (FSB), which exists as a coordinating body of SSBs with respect to financial stability;

- the Basel Committee for Banking Supervision (BCBS), the primary SSB for supervisors of banks and other deposit-taking institutions;

- the Committee on Payments and Market Infrastructures (CPMI), the primary SSB with respect to payment systems, including retail payment systems;

- the Financial Action Task Force (FATF), the SSB responsible for protecting the integrity of financial systems by preventing financial crimes such as money laundering and terrorist financing;

- the International Association of Deposit Insurers (IADI), the SSB for deposit insurance systems;

- the International Association of Insurance Supervisors (IAIS), the primary SSB for insurance supervision; and

- the International Organization of Securities Commissions (IOSCO), the primary SSB for the securities sector.

In addition, the paper notes that digital financial inclusion also implicates questions of core interest to technical standard setters (for example, the International Telecommunications Union, International Organization for Standardization, and industry arrangements among card networks and other payment providers), such as issues related to electronic funds transfer, telecommunications, and other technologies employed across the array of business models being used in digital delivery of financial services to excluded and underserved market segments.

In addition, the paper notes that digital financial inclusion also implicates questions of core interest to technical standard setters (for example, the International Telecommunications Union, International Organization for Standardization, and industry arrangements among card networks and other payment providers), such as issues related to electronic funds transfer, telecommunications, and other technologies employed across the array of business models being used in digital delivery of financial services to excluded and underserved market segments.

Each of these global bodies works on critical issues that contribute to achieving the World Bank Group’s goal Universal Financial Access by 2020 (UFA2020).

For example, by opening up their regulatory environment and market, countries worldwide have the opportunity to enable financial access 1.3 billion financially active, unbanked adults who currently save, remit or pay bills in cash.

The paper also provides key content for the Third GPFI Conference on Standard-Setting Bodies and Innovative Financial Inclusion, which will be hosted by the Financial Stability Institute at the Bank for International Settlements in Basel in October.

The GPFI White Paper was drafted by experts from the Implementing Partners of the GPFI – primarily the Consultative Group to Assist the Poor (CGAP) and the World Bank – with active participation of the secretariats of all the global bodies covered, demonstrating the kind of collaboration that will be needed to maximize the opportunities and minimize the challenges presented by the evolving financial inclusion landscape

Join the Conversation