My uncle, back home in India, shared with me the challenge to finance his 60-year-old small business which he inherited from his father. He had to mortgage his home and his business premises – valued at $350,000 -- to secure a $25,000 loan, a loan to value ratio of 7%! Despite that, my uncle is one of the fortunate ones who can access formal financing at affordable interest rates because he owns real estate. Small business owners in developing economies are rarely that fortunate - without real estate, they struggle to obtain formal financing. For most MSMEs, capital and wealth are concentrated in movable assets -- in the developing world, 78% of the capital stock of businesses are inventory, equipment or receivables, and only 22% land and buildings. Conversely though, lending practices in most of the developing world, where wealth concentration in movables can be even greater, is disproportionate with concentration on immovables as the sole type of eligible collateral, most often due to inadequate legal and institutional protections available.

To find clarity and a potential solution to this challenge, I reached out to my colleague John Wilson who has extensive experience in Secured Transactions and Asset Based Lending (ABL) reforms. He immediately thought of “secured revolving line of credit (SLOC)” as the most effective credit product to address the unique needs of SMEs like my uncle’s.

ABL consists of lending products using the borrower’s tangible/intangible assets and payment instruments as collateral. SLOC is one of those products which is secured by inventory and accounts receivable.

Going back to my uncle, he has a small manufacturing company that makes chairs; and the business has cash needs at different stages of the production cycle; but the only financing that he could get was a regular installment loan with a “huge” over collateralization ratio. A SLOC would provide working capital at every stage of the business cycle using as collateral assets that “transforms” in shape and value over time.

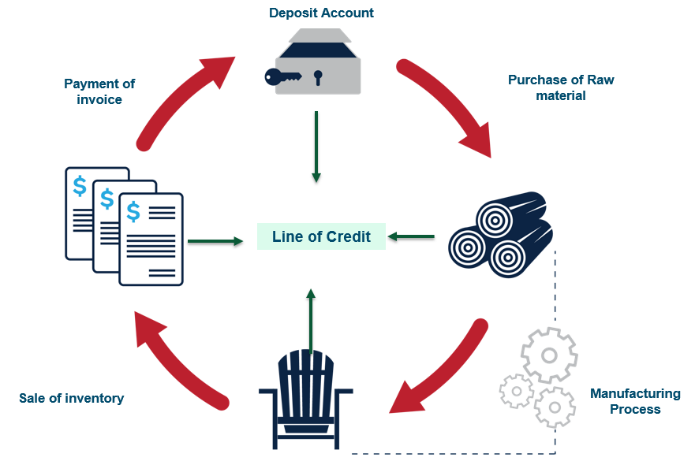

This is how "revolving line of credit" would work for my uncle:

- The first stage of his manufacturing business is to purchase the raw material (lumber in this case), thus, the line of credit would be used in first instance to buy lumber. The lumber becomes the “asset” to be used as collateral. The amount disbursed for raw materials is usually much less than in subsequent productions stages given the higher risks, including conversion, sale and collection.

- The line of credit would also finance the manufacturing process, whereby the raw materials are converted into final products (these are the chairs that my uncle makes); the process is the same, and because the risk is lesser, the loan-to-value ratio is higher.

- In the third stage, the chairs are sold, but the business still needs cash to operate while the invoices are paid. The estimated value of the collateral, which at this stage are the “invoices,” is much more accurate, and the amount disbursed is usually the highest against the value of those invoices and the fact that there are no conversion or sales risks at this stage.

- The last stage of the cycle is the repayment of the loan: the furniture stores that buy the chairs will make the payments to the bank account that is tied to the line of credit which the bank then uses to repay the outstanding amount of the line of credit.

What are the advantages?

- For my uncle (the borrower), the benefit is reliable and efficient access to long-term financing

- For the lenders, the benefit is a security interest in collateral that increases in value and decreases in risk at every stage of the production cycle.

Given that the SLOC is tied to the value of the collateral, the lender must monitor it to ensure that it doesn’t decrease in value. Ideally, the local market provides the required financial and technological infrastructure (including electronic invoicing) to allow for proper loan underwriting and collateral monitoring. In jurisdictions, where invoicing by a seller to a buyer takes place via an XML file originated by the tax authority, the XML and tax authority records provide collateral monitoring for accounts payable and receivables in real time. For those jurisdictions where these building-blocks do not exist, collateral monitoring can take place via SLOC software and field audits.

Although a simple concept, SLOC depends on technology and innovation to develop an efficient secured transactions system – one which preserves the lender’s priority throughout the borrower’s business cycle and which creates effective remedies in case of default. Other financial infrastructures that support efficient asset-based lending are credit information systems, collateral registries, active secondary markets, and favorable banking regulation.

Although the SLOC product is particularly well suited for SME financing, particularly for SMEs that have trouble financing pre-sale phases of their business cycle, these facilities can help other enterprises including profitable business which require financing for growth, businesses which face seasonal fluctuations, or that are highly leveraged. The revolving line of credit is also frequently used to finance business turnarounds, leveraged buyouts or recapitalizations.

To help local economies and economic actors in need for efficient financing options, like my uncle back in India, modern and efficient credit infrastructure systems (relevant laws/regulations, collateral registries, and credit information reporting) can play a vital role. These systems can act as foundations to a financial sector which enables and equip its lenders in developing and offering innovative financing products such as ABL and SLOC.

Join the Conversation