Istanbul Financial Center (IFC) in Atasehir, Istanbul, Turkey. Global financial services hub. Modern business center skyscrapers in Istanbul.

Istanbul Financial Center (IFC) in Atasehir, Istanbul, Turkey. Global financial services hub. Modern business center skyscrapers in Istanbul.

Insolvency systems play a crucial role in managing financial distress for individuals and businesses. They mainly facilitate the rescue of distressed but viable firms and reallocate resources to more productive uses. However, in times of crisis, a sudden wave of insolvencies can overwhelm the system and courts may find it challenging to process the sudden increase in their workloads. When this happens, it is essential to implement measures that complement the formal system , such as special out-of-court procedures, to optimally restructure debt and prevent economic damage and job losses. Financial institutions particularly benefit from these measures—a restructuring reached at an early stage allows them to retain their customer base and prevent losses.

In Türkiye, out-of-court procedures were in the spotlight during the summer of 2018, which was the beginning of a convulsive period for the country’s economy. The years that followed (2018-23) were marked by significant challenges that included exchange rate volatility, depreciation of the Turkish lira (TL) and persistently high inflation. Adding to these were the effects of the COVID-19 pandemic, the energy crisis, and the devastating Kahramanmaras earthquakes.

Urgent Solutions Were Needed

Many Turkish firms were brought to the brink of default during this challenging period. When the first currency crisis hit in August 2018, the corporate sector already needed urgent solutions to prevent liquidation of distressed but viable firms, which were experiencing mounting debt levels and declining local-currency-denominated revenues. The natural option would have been to restructure as set out in the Insolvency Law (‘Konkordato’). Unfortunately, the formal insolvency regime in Türkiye has traditionally been perceived as sub-optimal due to its long durations and uncertain outcomes, especially for financial institutions.

In response, the Framework Agreements (FAs) were crafted to encourage financial institutions to avoid relying only on the court system, so that distressed but viable firms could stay in business and preserve jobs. At their core, the FAs involved a multi-creditor agreement that set out the steps and conditions that financial institutions agreed to follow when a distressed firm requested a restructuring. It was a system based on principles of cooperation and mutual trust—the key idea was that a restructuring achieved through concessions made by creditors is a better outcome than the liquidation of a viable borrower. Among other features, the FAs involved a meeting of creditors to vote on the restructuring proposal, which was passed and imposed on all creditors if endorsed by creditors representing two-thirds of total outstanding debt. A recent WBG publication explains the key features of the FAs in more detail.

The FAs were introduced in September 2018 and designed only as a temporary tool. They were expected to be in place for two years but were extended twice due to the persistent challenging economic environment. The FAs expired in July 2023, at the end of their second extension. However, in light of their impact and results achieved, the FAs have been reintroduced in December 2023 as a complementary measure to the government’s recent efforts to safeguard financial stability.

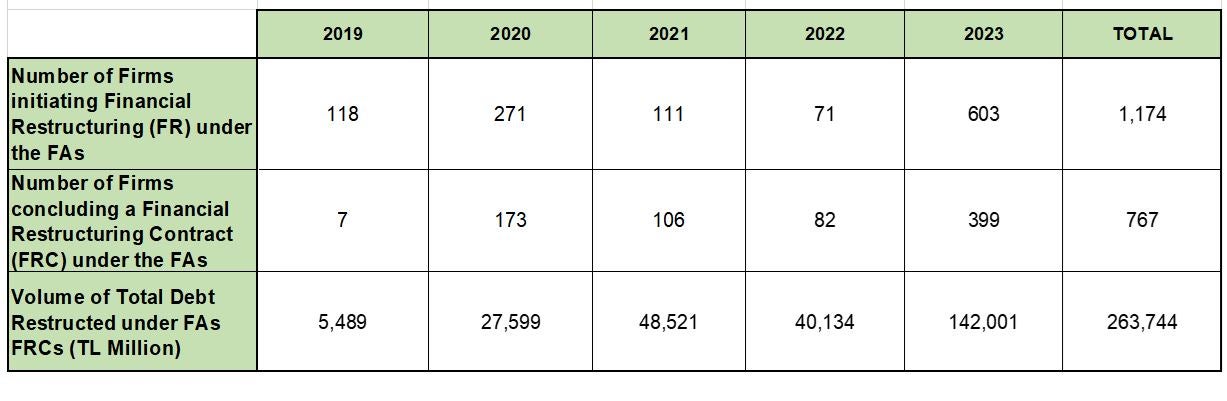

The evidence available supports the reintroduction of the FAs. An analysis of data made public by the Banks Association of Türkiye suggests that the FAs have been very successful at restructuring troubled borrowers, both in the volume of debt and the number of firms restructured. Since their introduction in 2018 and until July 2023, the FAs have enabled financial institutions to restructure loans of TL263,744 billion ($18.4 billion). They have also supported the restructuring of 767 distressed borrowers, mostly large corporations. The FAs have thus helped keep these companies in business and preserved jobs. Combined with other policy measures, the FAs also helped avoid a nonperforming loan surge, which could have had negative implications for the health of the banking sector.

The Impact of the Framework Agreements (2018 - 2023) (*)

A Global Model

The FAs are one of the most successful out-of-court workout models introduced worldwide since the Global Financial Crisis, even though questions remain around the sustainability of FAs’ restructurings, as they rely heavily on generous grace periods and long debt rescheduling. Going forward, the FAs can continue to represent a useful tool for banks to navigate the challenges that could arise during a period marked by the new approach to monetary policy. More importantly, the FAs illustrate how enhanced workout models can support the restructuring of the corporate sector in a crisis context, especially when the in-court restructuring system cannot achieve similar results. With insolvencies rising globally and climate change threatening to exacerbate that surge even further, the workout model followed by Türkiye can certainly inspire reforms in other countries.

Join the Conversation