The market for sustainability-linked bonds – debt which sets interest rates according to whether the borrower meets pre-determined performance goals on sustainability – has been experiencing choppy waters over the last year. According to Climate Bonds Initiative, borrowers issued $21.4 billion of new sustainability-linked bonds , which was a huge rebound of 46% compared to Q4 2022 but a 17% decline on Q1 2022, with total SLB volumes of USD226.6bn recorded at the close of Q1 2023.

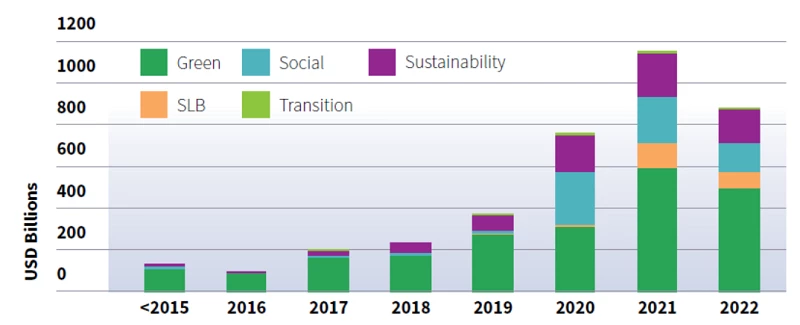

GSS+ volumes reached USD858.5bn in 2022

These instruments have faced mounting criticism recently - stemming from the credibility of issuers, to the weakness of targets, and the gaming of incentive structures to avoid the higher interest charged as a penalty for missing the sustainability targets. IFC research has also pointed out loopholes related to late target dates and callable options embedded into many of these bonds.

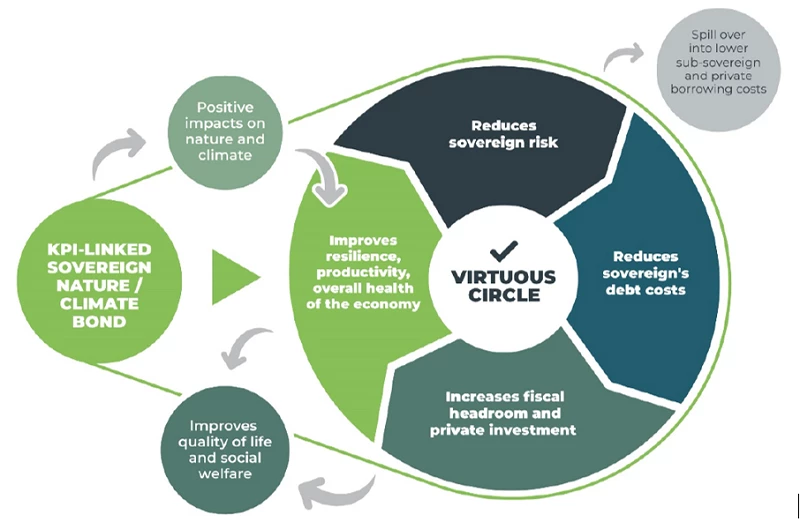

However, while we believe that corrections are needed, it is too early to write off the market as a whole and that these instruments – including the developing sovereign market - have merit and the potential to drive changes in the real economy by realigning the financial sector focus from inputs to outcomes.

Virtuous Circle of Sovereign SLBs

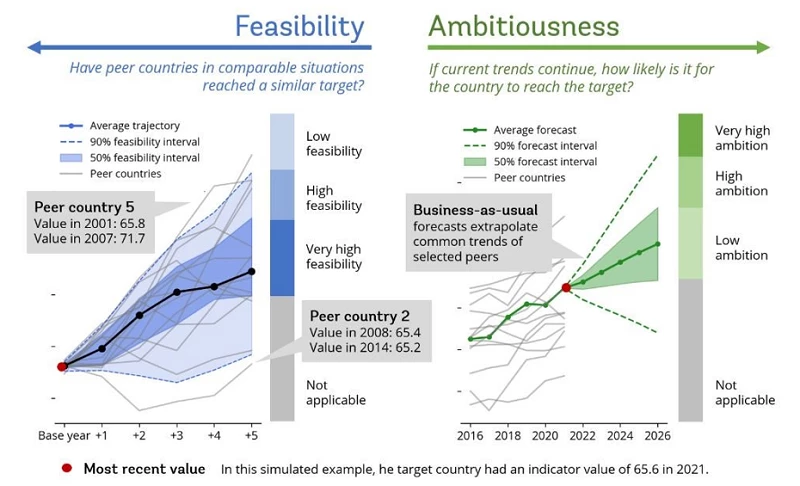

How then can the SLB market be revived? First, we need to be more rigorous on target setting. For our research on sovereign SLBs, we have developed the Feasibility-AmBitiousness (FAB) Matrix to give more structure to the target setting exercise. As the name implies, the FAB Matrix gauges targets along feasibility and ambitiousness dimensions. This helps issuers map out possible blind spots and avoid targets that are vulnerable to greenwashing.

Regulatory guidance and support to drive transparency and better practice in the market will also benefit the market. For example, to address greenwashing risks, the Financial Conduct Authority in the UK is advising that key performance indicators (KPIs) and related sustainability performance targets (SPTs) are aligned with borrowers climate transition plans where a company has adopted one. The regulator may also recommend that bond issuers disclose what makes SPTs ambitious and meaningful. The Loan Market Association, Loan Syndications and Trading Association and the Asia Pacific Loan Market Association updated their guidance on the instruments earlier this year, including releasing model provisions.

Rigorous targets alone are insufficient to incentivize a change in issuer behavior; corresponding financial incentives need to be material as well. Robust bond structures can ensure that issuers are held accountable if they miss targets, which is critical for SLBs to be impactful. This includes appropriate setting of penalty size and target dates, ideally calibrating financial incentives that are proportional to the ambition of the targets. It also entails avoiding features like call options and fallback clauses that allow issuers to evade financial responsibility post-issuance in case of missed targets.

On this front, industry standards, such as those of the International Capital Market Association, need to be updated to include frameworks on the materiality of financial incentives. Market participants, such as sustainability coordinators or Second Opinion Providers, can also play a role by expanding their scope to cover assessment of bond structures. Policymakers can assist by increasing market awareness of structural issues, encouraging investors to update pricing models to discount weak structures, thereby prompting a move towards stronger financial incentives in SLBs.

The SLB market has only existed for a few years; it continues to adapt and grow. Economic theory suggests that this evolution will accelerate with increased market activity as market participants update their expectations and preferences due to availability of more information. Such information aggregation can lend to learning by issuers and investors, potentially improving the quality of the market over time.

Some evidence is already starting to point in this direction: issuers have moved away from using third-party ESG ratings, which tend to be based on self-reported information by issuers, as a sustainability indicator over time to more precise and relevant metrics. Additionally, our research shows that financial incentives are moving in the right direction. Hiked interest rates for missing targets, known as step-up penalties, are gradually increasingly over time, breaking away from the arbitrary market norm of 25 basis points. Furthermore, market participants are also beginning to adopt rewards for outperformance, or step down structures - which we believe are more effective for impact, particularly in the sovereign SLB market.

These trends are encouraging and underscore the need to avoid throwing the proverbial baby out with the bathwater – hence our call to ‘save’ our SLB markets.

Join the Conversation