Performance-based financial instruments - which pay out based on the attainment of key performance indicators (KPIs) - have been gaining attention recently with the growth of the sustainability-linked loan and sustainability-linked bond (SLB) markets. During 2023, issuance in the corporate market for these instruments has slowed due to concerns over the robustness of their KPI frameworks. With Chile and Uruguay issuing two sovereign SLBs in 2022, how can we ensure strong frameworks are built into this nascent asset class?

In a previous blog series, we introduced KPIs based on a benchmark model, or simply benchmarked KPIs, and how they can help protect the Amazon. The key idea was that issuers should be rewarded for their efforts or performance rather than outcomes. This is because outcomes, such as deforestation, can change due to a range of factors, like exchange rates or commodity prices, that are not in the issuer's control. Why should issuers be rewarded or punished for events they cannot influence? Such benchmarked KPIs can then be used to monitor and incentivize an issuer. However, this does not address the ‘giraffe’ in the room: how do we set reachable sustainability performance targets?

A reachable target is ambitious and feasible

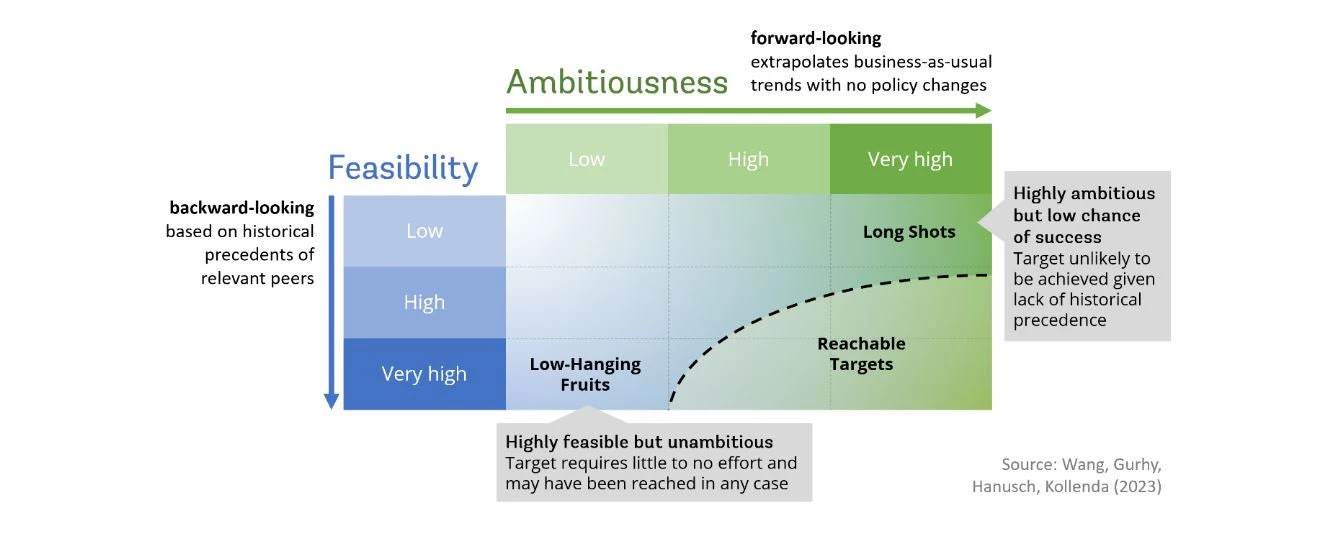

Setting a reachable target has been more art than science. Here at the World Bank, we developed the Feasibility-AmBitiousness (FAB) Matrix to give more structure to the target setting exercise. As the name implies, the FAB Matrix gauges targets along feasibility and ambitiousness dimensions. This helps issuers map out possible blind spots and avoid targets that are vulnerable to greenwashing accusations : i.e. highly ambitious targets may not be feasible (long shots), and, likewise, highly feasible targets may not be ambitious (low-hanging fruits).

What do we mean by feasibility and ambitiousness?

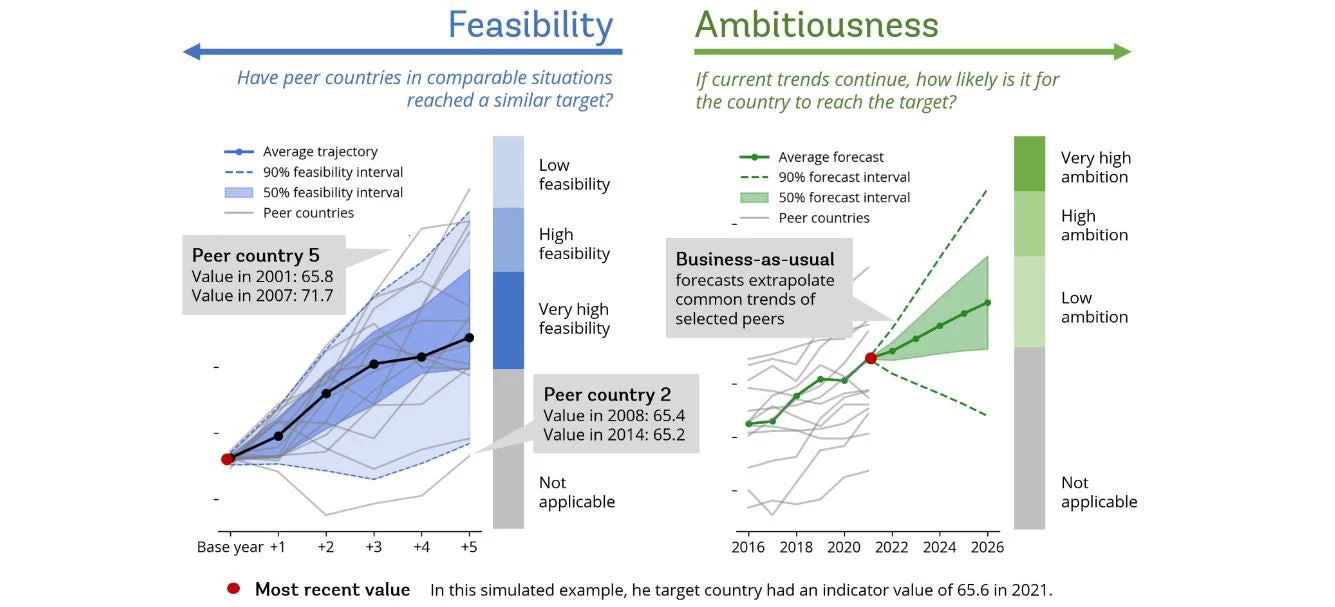

Feasibility is backward-looking in that it relies on historical precedence. We start with the question: has any other country reached the target within the given timeframe? The figure below illustrates this idea with an artificial KPI. Suppose the country issuing the SLB aims to improve a given KPI value currently at 65.5 within the next 5 years. Is a target of 70 realistic? How about 80? To determine if the target is realistic, we first find countries that, at some point in their past, had a value close to 65.5. Then, we look at how well they have performed over the next five years once they hit this point. In this example, most countries could improve on the KPI and, after five years, had achieved 67.5 on average. We can take this average trajectory and the distribution around it, the feasibility intervals, to classify targets according to how feasible they are.

Ambitiousness is forward-looking and assesses targets using business-as-usual forecasts. What outcomes can we expect if current trends continue without any policy interventions? Using statistical models, we can project the likely trajectory of a KPI into the near future. The figure below shows how this might look like for the highlighted issuer country, given its own and its peers’ historical records. The peers are countries that are similar in some important regard to our issuer country (e.g. income level or geographic region). Since we use a statistical model, we can also see how likely alternative trajectories are. The 50% and 95% confidence intervals can then serve as foundations to assess the ambitiousness of targets.

Steer clear of low hanging fruits and long shots

Putting both concepts together yields the FAB Matrix, shown below. It lays out all possible feasibility and ambitiousness combinations, meaning that every target is positioned somewhere on the Matrix. With the entire spectrum in front of us, it becomes straightforward to see which targets both issuers and investors would want to avoid.

Low hanging fruits. Highly feasible but unambitious targets are vulnerable to greenwashing allegations. If little to no effort is necessary to reach the target, then such targets would have probably been reached anyway. Why would investors incentivize or reward issuers for such a target? And why should the issuer set an ambitious target next time? Responsible or impact investors who at the end of the day need to report their impact, may find SLBs with such targets unattractive.

Long shots. Greenwashing allegations cannot be ruled out simply by setting targets excessively high. If the targets are so ambitious that they are unattainable, then the promised additionality will only exist on paper. Such empty promises have a potential reputational risk for both the issuer and the asset class as a whole.

… instead, aim for reachable targets

The FAB Matrix not only shows what targets to avoid, but also which ones to aim for – just like giraffes stretching for the sweetest leaves just within their reach. The ideal target would be both highly feasible and highly ambitious. Performance-linked financing tied to these goals stand a very high chance of delivering additionality, thereby sending a strong signal to issuers and investors alike.

Setting such targets is not easy in practice. Issuers will face a trade-off between ambitiousness and feasibility and ideally choose a target within the area of reachable targets (shown by the dashed line in the FAB Matrix figure). The main purpose of the FAB Matrix is to give context to this decision making.

At the World Bank, we aim to integrate the FAB Matrix into our Sovereign ESG Data Portal – a source for the data needed for FAB assessments. Our goal is to make the FAB Matrix an open-access tool for as many ESG indicators as possible. This will allow potential issuers and investors to explore which targets would be relevant for respective countries and – sticking our own necks out – we believe this will help to build confidence that targets are in tune with their sustainable development goals.

Visit esgdata.worldbank.org/tools/fab and subscribe to our newsletter to stay posted about our latest developments.

Join the Conversation