The volatility that’s now shaking the global financial system seems likely to have some of its most profound effects on the world’s emerging markets and developing economies (EMDEs). As policymakers seek to ride out the late-summer storm, it’s more vital than ever for economists and investors to understand how and why those economies got into today’s predicament.

In the wake of the global financial crisis that began in 2007, the extraordinary monetary policies (EMPs) pursued by the world’s developed economies – its wealthier nations – triggered a buying spree in emerging and developing economies (EMDEs). Those countries experienced an unparalleled surge in total gross capital inflows from an annual average of $0.5 trillion from 2000 to 2007 to $1.1 trillion from 2010 to 2013. EMDE external bond issuance, which had been increasing steadily before the crisis, accelerated rapidly post-crisis and has now reached unprecedented levels.

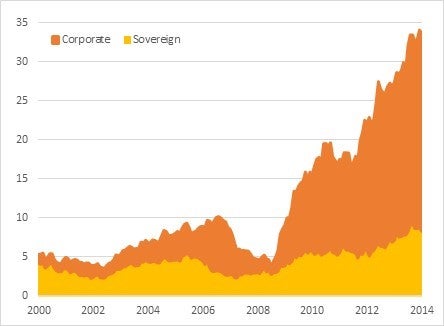

From 2009 to 2014, EMDE corporates and sovereigns cumulatively issued $1.5 trillion in external bonds – almost a tripling from $520 billion in the period from 2002 to 2007. The recent surge in issuance is driven by corporates, which issued a total of about $300 billion in 2014 compared to $14 billion in 2000 (Figure 1). Most of that issuance is denominated in foreign currencies (Figure 2). Cumulative post-crisis issuance of bonds relative to the size of the economy has risen to unprecedented levels – a phenomenon that is widespread and not driven by a single country or region (Figure 3).

Figure 1: External issuance: Corporate vs. sovereign (billions USD)

Figure 2: External issuance: Foreign vs. local currencies (billions USD)

Figure 3: Outstanding external bond stock (Country median % of GDP)

Note: EAP: East Asia & Pacific, ECA: Europe & Central Asia, LCR: Latin America & Caribbean, MNA: Middle East & North Africa, SAR: South Asia, and AFR: Sub-Saharan Africa

A recent paper (published by the Social Science Research Network at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2630379 and curated by the World Bank at http://documents.worldbank.org/curated/en/2015/07/24775841/global-liquidity-external-bond-issuance-emerging-markets-developing-economies) – co-authored by Swati Ghosh, Katie Kibuuka, Subika Farazi and myself, all of whom are members of the World Bank Group’s Finance and Markets Global Practice – looks at the impact of looks at the impact of global liquidity factors on the external issuance of bonds by EMDE corporates and sovereigns. As we discussed in greater detail in an analysis for Vox EU, the research portal of the Centre for Economics and Policy Research, our research aims to shed light on the impact of global financial conditions on the propensity of countries to issue external bonds; on the impact of global factors on the yield and maturity of bonds at the time of issuance; and on the existence of the risk-taking channel through exchange-rate appreciation for external bond issuance by EMDEs.

Propensity to issue bonds by EMDEs

Our findings support the notion that external issuance across EMDEs is highly synchronized with the global financial cycle. Increased expectations of financial volatility, which typically makes investors more risk-averse, and higher perception of risks in credit markets act to decrease primary market bond flows to EMDEs. Meanwhile, an increase in the size of the U.S. Federal Reserve System’s balance sheet, associated with the implementation of EMP, has served to increase bond flows. When it comes to “country pull” factors, we find that GDP per capita, an economy’s growth rate and its current-account balance are most important.

Yields and maturities of external bonds at time of issuance

We also find that favorable global conditions reduce bond yields across EMDEs in a synchronized manner and increase investor willingness to lengthen maturities. The size of the bond does not explain bond [CWC1] spreads significantly, but larger bonds are typically associated with longer maturities. Domestic pull factors do not play a very important role for bond spreads and maturities, suggesting that global factors are more significant.

The risk-taking channel of exchange-rate appreciation

Research by Bruno and Shin (2015 a, 2015 b) show that, in the case of international banks, whose leverage and lending capacity is determined by risk limits such as Value at Risk (VaR), looser monetary and financial conditions in the United States, and the concomitant depreciation of the U.S, dollar vis-a-vis local currencies, reduces banks’ VaR as local borrowers’ balance sheets look stronger. This induces banks to lend more, leading to greater cross-border banking flows. Our analysis shows that the propensity of EMDEs to issue bonds is also significantly higher when the U.S. dollar depreciates in real terms. Therefore, local currency appreciation can be expected to affect their behavior in a manner similar to that of banks highlighted by Bruno and Shin, leading to higher international bond flows.

So what are the policy implications?

Our findings provide strong support for the idea that the surge in bond issuance by EMDEs is strongly driven by global factors. EMDEs have been able to take advantage of ample international liquidity by reducing their borrowing costs and extending maturities. Such steps can improve those economies’ risk profiles.

However, the massive and widespread external issuance of bonds in EMDEs raises important questions regarding the impact of pro-cyclical investor behavior once the global cycle winds down, or if global shocks occur. While issuance at lower cost and extensions of maturities can help reduce individual borrowers’ risk profiles, having large foreign-currency exposures raises risks, particularly for unhedged issuers. The recent trend of a rapidly strengthening U.S. dollar against most EMDE currencies further heightens currency risks.

In this context, the inevitable winding down of EMPs in large developed economies will tighten international funding conditions. That factor could be disruptive for EMDEs. In addition, fragility in EMDEs can be further compounded by their shallow local financial markets and by a lack of strong institutions, supervisory and surveillance capacity, technical experience, and (macro) prudential tools.

These realities all point to a continued need to strengthen financial-sector policies in EMDEs, including:

- creating vibrant local currency (corporate) bond markets and an active, diverse domestic investor base;

- building comprehensive macroprudential tools and monitoring financial markets closely; and

- strengthening the banking sector to safeguard against potential spillovers.

References

Bruno, V. and Shin, H.S. (2015a). “Cross-Border Banking and Global Liquidity”. Review of Economic Studies 82, pp. 535-564.

Bruno, V and Shin, H.S. (2015b). “Capital Flows and the Risk Taking Channel of Monetary Policy”. Journal of Monetary Economics 71, pp. 119-132.

Feyen, E., Ghosh, S., Kibuuka, K., and Farazi, S. (2015). “Global Liquidity and External Bond Issuance in Emerging Markets and Developing Economies” World Bank Policy Research Working Paper 7363 . The paper is also available on Social Science Research Network

Join the Conversation