In order to promote women’s participation in the economy, maximizing private finance has a key role to play. This means increasing the volume of private finance available for development and increasing the impact of private finance in achieving the Sustainable Development Goals (SDGs).

One of the most coveted global private financial flows is foreign direct investment (FDI). It is stable and it is productive. In 2016, total FDI flows to developing countries reached $646 billion, out of a total of $1.8 trillion. This dwarfs the $145 billion in Official Development Assistance flows for the same year according to the OECD. It is therefore not surprising that researchers and policymakers are investigating the impact of FDI on a range of development outcomes and determinants, including on women’s economic empowerment.

What can FDI contribute towards economic equality for women?

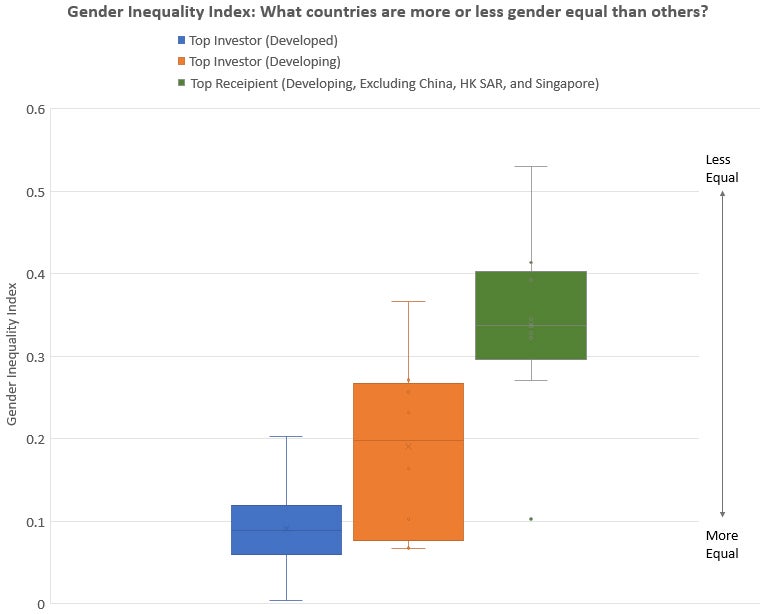

Two researchers, Heiwai Tang & Yifan Zhang, published a paper in 2017 examining the impact of multinational corporations on women's employment in the manufacturing sector in China. They found that FDI has a positive impact on women’s economic empowerment when it comes from more gender equal countries. Specifically, their research showed that foreign invested firms from countries with more equal culture, as measured by their score on the UNDP Gender Inequality Index (GII), tend to hire more women and have more women managers. They also found that local firms operating in cities or sectors that have a high concentration of foreign affiliates from countries with higher gender equality tend to hire more females. This suggests cultural spillover across firms. They concluded that the trends result directly from spontaneous cultural transfer between the home country and the host country mediated through FDI.

It is well known that outward investment from developing countries is gaining momentum and changing the landscape of FDI in developing countries, especially in smaller ones. Given Tang and Zhang’s research, we wondered: How will this newer wave of FDI, potentially from countries with less equal gender cultures, impact women?

We used Tang and Zhang’s methodology and applied it to the developed and developing countries with the highest levels of outward an inward FDI[1]. Here is what we found:

- Developed countries with the most outward FDI tend to be among the most gender equal countries in the world and are significantly more gender equal than developing countries who are receiving the bulk of these flows.

- Developing countries with the most outward FDI are on average significantly less gender equal than the traditional developed FDI source countries. They are also quite dispersed on the gender equality spectrum. Some are a lot less equal than others.

If more FDI is originating from more unequal countries, can the spontaneous positive cultural spillovers of gender norms continue to give FDI a positive gender equality story?

A lot more research is needed, yet it seems that with the changes in the landscape of FDI, relying on positive externalities to move the needle on gender norms will not be sufficient. This is a case where private finance needs a nudge to achieve the SDG on Gender Economic Equality. This nudge may come from enlightened host country policies, but may equally come from the actions of different civil society players and from consumers voting with their purse. Not taking active and targeted action to maximize the impact of FDI for women will be a waste of a $646 billion opportunity.

Join the Conversation

hola, ante todo FELICITACIONES x tratar los temas de gran interes para paises en desarrollo... la verdad que existen poca personas profesionales expertos en URBANISMO o que les apasione los temas del diseño urbano planificado....es muy importante ya que la mayoria de las ciudades de latinoamericas tienen una edad ya avanzadas 250 años o 450 o mas; como las ciudades primeras en la fundaciones... ,alguas y esas ciudades fueron construidas con ciertos vehiculos y perspectivas.....pero con el paso de los años en la actualidad son otros las variables que se deberian tener en cuenta para su REDISEÑO-- esto se evidencia a traves de graves congestionamientos, los embotellamientos, el rapido deterioro de las cinta asfalticas , los accidentes de trasito, la gravedad de ellos y la exponencial crecimiento, el strees de conductores manifiesto en su mal humor, etc-gracias y exitos

Read more Read lessYa existen innovadores sistemas de transporte público masivo que crecen con las ciudades, eficientes, limpios, inteligentes y altamente rentables, con vías muebles que se instalan rápidamente sobre la infraestructura urbana sin interrumpir el tráfico automotor. Son sistemas que solucionan a futuro todos los problemas de movilidad y contaminación de las grandes y medianas ciudades.