Sovereign Wealth Funds (SWFs) currently have a very limited role in climate finance and green investment – reportedly, below the average for institutional investors. According to the Asset Owners Disclosure Project (AODP), which evaluates institutional investors on the basis of their low-carbon performance, five of the 10 lowest-rated large investment funds were SWFs.

However, the more progressive SWFs are currently divesting from assets with large climate-related risks, and some countries are pondering whether their SWF should take a more pro-active role in green finance. What lies ahead for SWFs in this rapidly changing landscape?

SWFs could have an impact on climate finance

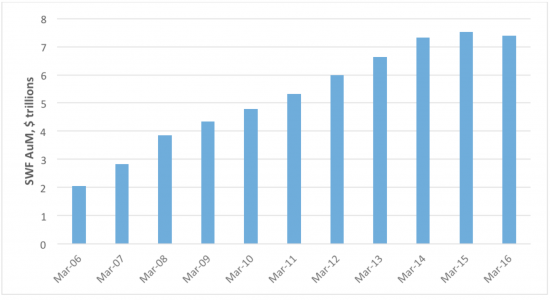

The sheer amount of capital managed by SWFs means that their impact on green finance, while marginal historically, has the potential to become significant. According to the Sovereign Wealth Fund Institute (SWFI), SWFs hold assets worth approximately $7.4 trillion, and the total capital of SWFs has more than tripled over the last decade.

But SWFs’ mandate does not typically include green finance. To the extent that they have been active in this area, it has been to reduce climate-related risk to their portfolios – including exposure to fossil fuels. For example, last October the $22.6 billion New Zealand Superannuation Fund (NZSF) announced a strategy to address climate-change risks that represent a “material” issue for long-term investors, and to “intensify its efforts” in areas including alternative energy, energy efficiency and “transformational” infrastructure. Norway’s giant Government Pension Fund Global ($873 billion) has adopted similar policies to reduce climate-related risk.

Aggregate SWF assets under management (in trillions of US$), 2006–2016

Source: Sovereign Wealth Fund Institute

How green are SWFs now?

Current reporting on SWFs’ investments does not allow for a precise analysis of these funds’ role in green finance, but some preliminary numbers can be established.

According to preliminary estimates contributed by the World Bank Group to a recent report by the Organization for Economic Cooperation and Development (OECD), between 2006 and 2016 green investments represented 0.7 percent of the value of all reported SWF deals, or 3.6 percent of infrastructure, energy, and utility investments. The share for 2016 may be higher, at 3.5 percent – equivalent to 13.4 percent of infrastructure, energy and utility investments. However, this recent uptick is driven by a small number of large deals, and it could be just a temporary blip. Overall, SWFs’ involvement in green finance remains very low.

Green investments by SWFs (as a percentage of total investment)

Source: Sovereign Wealth Fund Institute Transaction Database; internal World Bank Group analysis.

* Preliminary estimate.

Stronger classification and reporting systems needed

Although some of the more progressive SWFs have recently shown a greater willingness to take climate change into account, a broader engagement is likely to require the strengthening of SWFs’ classification and reporting systems for green investments. Several international standards and classification systems are used to assess investor performance in green finance, including the Climate Strategies and Metrics; the Climate Change Investment Solutions; as well as the AODP Global Climate Index, which provides a standard for assessing how large global investors conduct climate-risk management.

However, existing standards allow only for an approximation of SWFs’ impact. None of them is comprehensive, and most focus on policy and management rather than transaction-level criteria for green investment. A unified global standard would allow for the aggregate reporting, assessment and analysis of SWFs’ involvement in green finance. It would also promote market efficiency through improved transparency.

The successful implementation of a robust classification system depends on the disclosure and thorough reporting of participating SWFs. Ideally, green finance reporting standards for SWFs would build on existing frameworks and guides. The Low Carbon Investment Registry (LCIR) – a database compiled by the Global Investor Coalition on Climate Change – relies on self-reporting by institutional investors. It could become a useful tool for SWFs. However, as of now, SWFs have minimal presence in this database.

The results of the work that is now being conducted by the Financial Stability Board’s Task Force on Climate-related Financial Disclosures could be of great relevance to SWFs. The task force, chaired by former Mayor Michael Bloomberg of New York, aims to develop “voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers and other stakeholders.”

The road ahead for SWFs

Is the role of SWFs as commercial, return-optimizing investment vehicles compatible with a more pro-active stance on green finance? Some think so, although that idea is the subject of debate.

According to a recent paper, “Hedging Climate Risk” by Mats Andersson, Patrick Bolton and Frédéric Samama (in Financial Analyst’s Journal, Vol. 72, Number 3), long-term passive investors such as SWFs may hedge climate risk without sacrificing financial returns. That can be done by investing in a decarbonized index based on a standard benchmark, such as the Standard & Poor’s 500 index, while minimizing the tracking error with respect to the underlying benchmark. The authors note that decarbonized indices have so far matched or even outperformed benchmark indices, because financial markets still tend to underprice carbon risk.

SWFs differ widely in terms of investment strategy, transparency and disclosure of information. As the global green investment agenda gains further traction, and as pressure builds on investors to “green” their portfolios, the more transparent and climate-conscious funds could help build initial momentum. Over time, traditionally less transparent SWFs might find it in their interest to join them.

This blog is based on the authors’ contribution, on behalf of the World Bank Group, to the recent OECD “Progress Report on Approaches to Mobilizing Institutional Investment for Green Infrastructure.” Interested readers can find the details on methodology and estimation within that report.

Join the Conversation