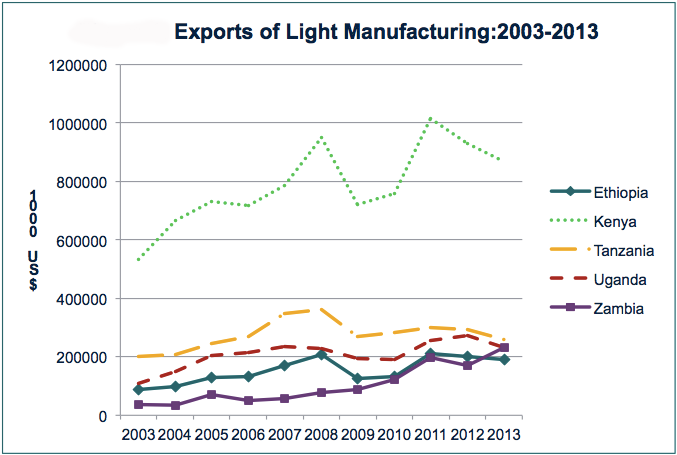

According to the World Bank Group’s 2011 report, “Light Manufacturing in Africa,” the global trading environment “favors Sub-Saharan Africa if it can overcome key constraints in the most promising subsectors.” Those subsectors include the manufacture of food products and beverages; apparel and the dressing and dyeing of fur; wood and wood products; luggage and the tanning and dressing of leather; and fabricated metal products. Sub-Saharan Africa enjoys low labor costs and abundant resources, as well as preferential trade access to US and EU markets for light manufactures. Despite these advantages, the competitiveness of Africa’s light manufacturing industry continues to be undermined by the costs of importing and exporting intermediate inputs of both goods and services.

Challenges of Linking to Global Manufacturing Value Chains

Over the past two decades, technological advancements and falling transport costs have led to the splitting up of production activities; different stages of the production process are now located across different countries and involve a range of suppliers who provide inputs and add value to a given product destined for domestic and/or overseas markets. With the prevalence of “global value chains” (GVCs), trade logistics inefficiencies and related costs are amplified along the supply chain.

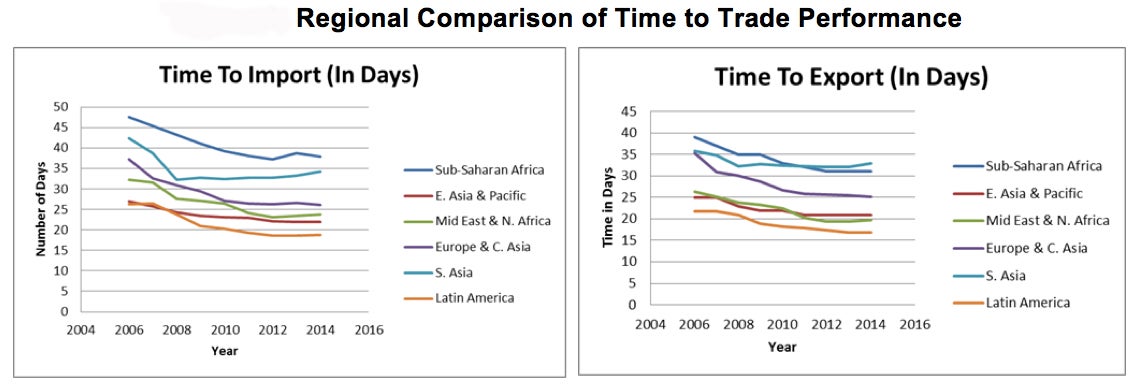

Realizing how important trade logistics performance is to participation in GVCs and the development of light manufacturing exports, many African economies are starting to seriously tackle efficiency reforms. They are streamlining procedures, reducing documents, implementing automation, adopting risk management systems for border inspections, and establishing one-stop border posts. In fact, as a result of these reforms, Sub-Saharan Africa has made some of the biggest reductions in time to trade as measured by the World Bank Group’s Doing Business Trading Across Borders indicator between 2009-2013.

Recommendations for Improving Africa’s Trade Logistics Environment

Nonetheless, Africa still has some catching up to do when compared with other regions. Reform efforts should not only focus on removing barriers for trade in goods, but also for trade in services. Access to competitively produced services – including banking, insurance, communication, IT, engineering, auditing and legal services – is crucial to the development of manufacturing exports. Recent studies - such as the Bank Group report Defragmenting Africa: Deepening Regional Trade Integration in Goods and Services - have shown that poor business services for trade function as barriers to the enhanced integration of both goods and services.

In the case of Africa, the movement of manufacturing cargo is hurt by the quality of professional logistics services providers. This is both a regulatory and commercial performance problem. It is related to market entry and qualification requirements, licensing, competition, taxation, and restrictions on foreign ownership, as well as regulations for foreign suppliers and lack of professionalization and training opportunities for logistics-providers. Tackling these issues is critical for reducing restrictions on cross-border trade in services and promoting the overall economic competitiveness of Africa’s light manufacturing industry.

All in all, the successful implementation of these reforms requires a holistic approach that not only addresses Africa’s infrastructure weaknesses, but also burdensome policies, procedures and regulations that limit the movement of people, goods and services. Throughout the entire reform process, it is critical to engage with all private sector stakeholders. They will serve as the main drivers of change and ensure that the benefits of improved trade logistics are actually passed on to producers and consumers of Africa’s light manufactures.

Join the Conversation