The evidence is strong that technology is transforming the trade landscape, and creating new opportunities to participate in trade, including for poor people in developing countries.

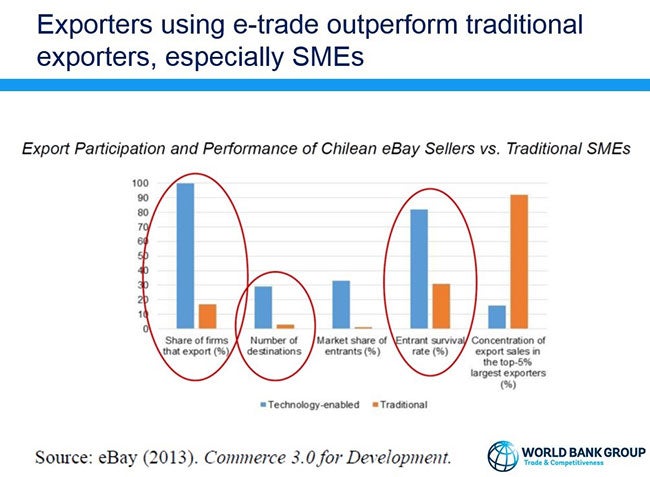

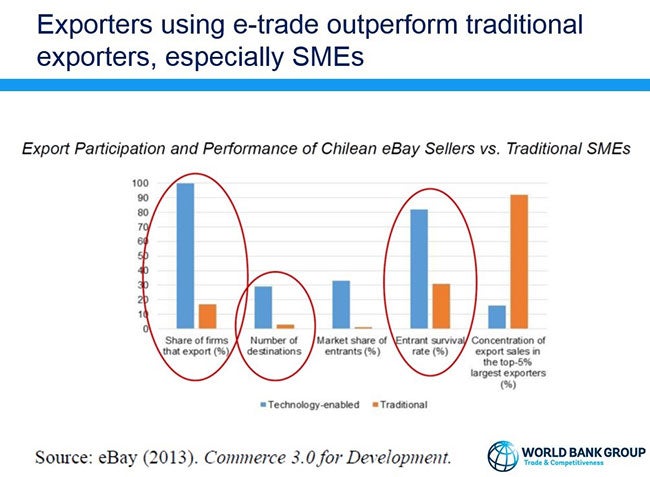

For instance, we know that exporters –especially SMEs - using e-trade and digital platforms outperform traditional exporters. We also know that there is much more opportunity ahead. Even with the massive amounts of online transactions happening every day, only 22% of the world’s people have ever bought something online. As another example, from a gross revenue of about USD 2 billion in 2013, the online outsourcing industry is expected to grow to close to USD 6 billion in 2016, and between USD 15 and 20 billion by 2020.

However, it’s important to go beyond the excitement about the positive impacts (as well as the risks) of the digital economy on trade. We need to think through the implications for trade policy and development assistance in a more systematic way.

However, it’s important to go beyond the excitement about the positive impacts (as well as the risks) of the digital economy on trade. We need to think through the implications for trade policy and development assistance in a more systematic way.

Amid all the excitement and energy – within the G20, B20, WTO, World Bank Group, and elsewhere - how can policymakers and international organizations respond? What trade-related policies and regulations are most relevant for the digital economy – and where are the financing and capacity gaps most relevant?

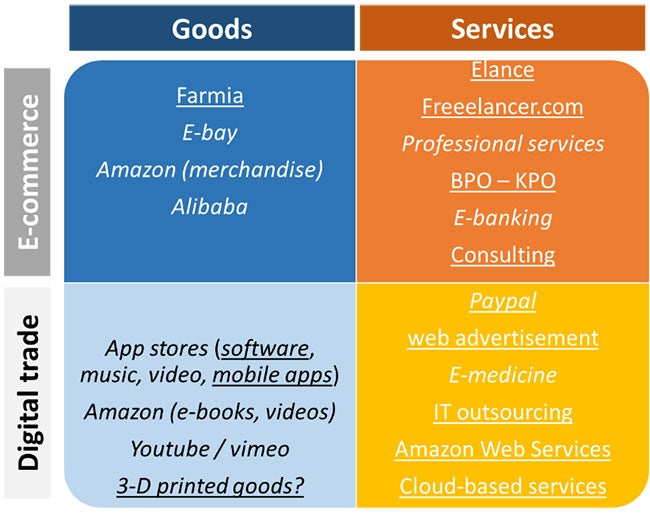

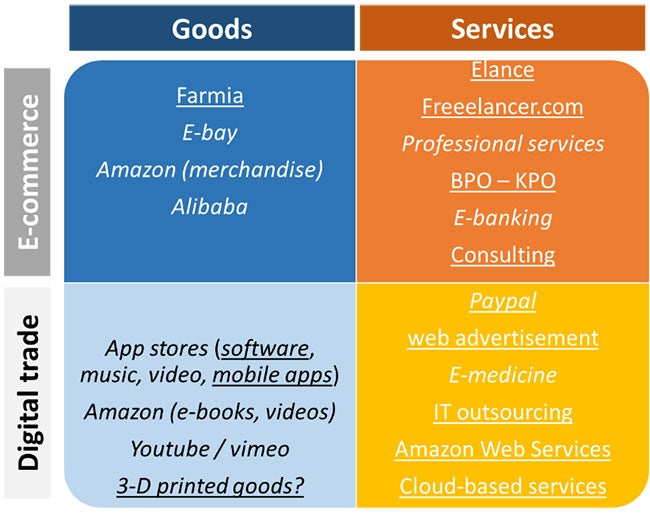

Based on our experience in this area, and following two significant conferences in the past year ( #DigitalTradeConf and Harnessing Digital Trade for Competitiveness and Development, we have come up with two simple frameworks to help think through the issues. Although global flows of data have grown dramatically – up to 45-fold since 2005 by one estimate – the traditional production of goods and services hasn’t disappeared. Rather, the digital economy is enabling “traditional” trade in goods and services, as well as creating opportunities for new “digital-only” trade. The chart below tries to break this down, with a few examples of companies included.

Types of e-trade

The top two quadrants show areas where the digital economy has enabled trade in goods and services that are still being produced in essentially the same way, but where trade costs have fallen through the use of the Internet. For example, in these cases the Internet acts as a low-cost platform for advertising, exchanging information between buyers and sellers, and enabling a more efficient allocation of tasks among actors like individual contractors. This can be termed “e-commerce”. The bottom two quadrants show areas where the trade itself is happening through digital channels, and where the goods and services concerned are “embodied” in digital form. This can be thought of as “digital trade”.

One of the benefits of breaking down the issues in this way is that it helps us move to a more nuanced consideration of what policy and regulatory issues are more relevant to different aspects of the e-trade agenda. We’ll talk about this more in Part 2 of this blog series.

E-Trade Environment

We can build on this by breaking down the different elements of the “e-trade environment” – the various drivers that affect the capacity of firms in different countries to engage competitively in e-trade. This has been done in different ways by different people, but at the Bank we have been thinking along the lines set out in the chart below.

This aims to capture the different levels of the e-trade environment – from the essential infrastructure that allows people and firms to connect to the Internet; to the different enabling conditions; and to the data management tools and skills that drive firm growth and competitiveness in the digital economy. At each level, different policies and regulations are relevant, as are financing and technical needs facilitated by development organizations like the World Bank Group.

This aims to capture the different levels of the e-trade environment – from the essential infrastructure that allows people and firms to connect to the Internet; to the different enabling conditions; and to the data management tools and skills that drive firm growth and competitiveness in the digital economy. At each level, different policies and regulations are relevant, as are financing and technical needs facilitated by development organizations like the World Bank Group.

In Part 2 of this post we’ll explore these policy and regulatory issues in more detail, using the frameworks introduced above. We’ll also share some thoughts on what this means for trade policy-makers at the national and international levels, as well as for the work of the World Bank Group.

Read part 2 of this series: E-trade: national and international policy implications

For instance, we know that exporters –especially SMEs - using e-trade and digital platforms outperform traditional exporters. We also know that there is much more opportunity ahead. Even with the massive amounts of online transactions happening every day, only 22% of the world’s people have ever bought something online. As another example, from a gross revenue of about USD 2 billion in 2013, the online outsourcing industry is expected to grow to close to USD 6 billion in 2016, and between USD 15 and 20 billion by 2020.

Amid all the excitement and energy – within the G20, B20, WTO, World Bank Group, and elsewhere - how can policymakers and international organizations respond? What trade-related policies and regulations are most relevant for the digital economy – and where are the financing and capacity gaps most relevant?

Based on our experience in this area, and following two significant conferences in the past year ( #DigitalTradeConf and Harnessing Digital Trade for Competitiveness and Development, we have come up with two simple frameworks to help think through the issues. Although global flows of data have grown dramatically – up to 45-fold since 2005 by one estimate – the traditional production of goods and services hasn’t disappeared. Rather, the digital economy is enabling “traditional” trade in goods and services, as well as creating opportunities for new “digital-only” trade. The chart below tries to break this down, with a few examples of companies included.

Types of e-trade

The top two quadrants show areas where the digital economy has enabled trade in goods and services that are still being produced in essentially the same way, but where trade costs have fallen through the use of the Internet. For example, in these cases the Internet acts as a low-cost platform for advertising, exchanging information between buyers and sellers, and enabling a more efficient allocation of tasks among actors like individual contractors. This can be termed “e-commerce”. The bottom two quadrants show areas where the trade itself is happening through digital channels, and where the goods and services concerned are “embodied” in digital form. This can be thought of as “digital trade”.

One of the benefits of breaking down the issues in this way is that it helps us move to a more nuanced consideration of what policy and regulatory issues are more relevant to different aspects of the e-trade agenda. We’ll talk about this more in Part 2 of this blog series.

E-Trade Environment

We can build on this by breaking down the different elements of the “e-trade environment” – the various drivers that affect the capacity of firms in different countries to engage competitively in e-trade. This has been done in different ways by different people, but at the Bank we have been thinking along the lines set out in the chart below.

In Part 2 of this post we’ll explore these policy and regulatory issues in more detail, using the frameworks introduced above. We’ll also share some thoughts on what this means for trade policy-makers at the national and international levels, as well as for the work of the World Bank Group.

Read part 2 of this series: E-trade: national and international policy implications

Join the Conversation