Economic growth and global economic integration go hand-in-hand for Lao PDR. As a small, land-locked, and commodity-dependent country in a fast-expanding region, Lao PDR’s growth prospects are directly linked to its ability to integrate with the global economy. This is why the government has been prioritizing economic integration with both the Southeast Asia region and the multilateral rules-based trading system. In 2010, Lao PDR became signatory to the ASEAN Trade in Goods Agreement (ATIGA), acceded to the World Trade Organization (WTO) in 2013, and ratified the Trade Facilitation Agreement in 2015.

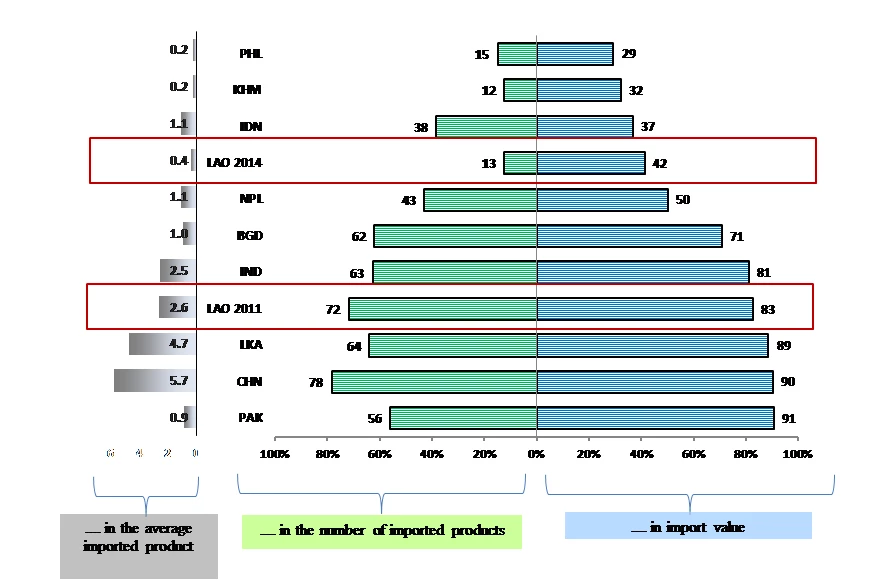

However, efforts to modernize Lao PDR’s regulatory framework governing trade and the overall investment climate have not been matched with welfare improvements. In a recent study, we provide a comparative overview of the landscape of Non-Tariff Measures (NTMs) affecting imports in Lao PDR, and identify lingering regulatory hurdles that hamper its ability to reap the gains of deeper integration with the global economy. Our findings reveal that while the existing NTM framework is broadly in line with regional practices (figure 1), the current import licensing scheme in Lao PDR and the associated array of fees linked to it raises the time and cost to bring products to market. Ultimately, the system of quantitative controls applied by Lao PDR is equivalent to an ad-valorem tariff of 5.4%, which is well above regional and world averages.

There are three main problems associated with the procedures for obtaining import licenses in Lao PDR:

- A Vientiane-based system for granting licenses. Such a highly centralized set-up discourages rural traders who are forced to spend more time and resources to obtain required certificates. Recently, the Government has taken measures that empower provincial authorities with the ability to grant licenses for select products such as pesticides and chemical substances. Further decentralization may prove important to reducing the cost of trading.

- A lack of coordination between central authorities in charge of granting licenses and border agencies in charge of enforcing the licenses. This leaves room for provincial authorities to exercise their own discretion and delay the process.

- The central government’s internal procedures and timelines for granting licenses are often poorly communicated to the trading community. This leaves room for unnecessary delays and may encourage traders to make informal payments to expedite the process.

As it stands, the existing licensing structure in Lao PDR can have an adverse impact on the health, safety and welfare of its population. Apart from increasing the time and cost required to import products, Lao PDR’s current licensing structure may negatively affect households, especially the poor. Since traders typically pass part of the extra costs incurred from obtaining licenses onto consumers, existing policies impact the final (higher) prices paid by consumers and ultimately their welfare. The report finds that the costs associated with existing licensing measures are higher in sectors that form an important component of the local staple diet: vegetable oil, processed foods, and vegetables. As a result, the segment of the population that is most affected by this are the poor, since they see the largest relative decrease in their disposable income. A complex import regime also encourages traders to resort to informal channels for bringing their products to market, putting the health and safety of consumers at risk.

Going forward, the report suggests that a regulatory impact assessment of import licenses and their associated fees should be a priority for Lao PDR. This regulatory impact assessment can be done in two stages:

- 1st stage: Review the manner and frequency with which fees are collected to reduce the administrative burden associated with applying for and obtaining import licenses for the trading community.

- 2nd stage: Conduct a comprehensive review of licenses for products that, while important in the daily consumption of the Laotian population, do not generate important fiscal revenues for line agencies. These products include bicycles, food preparation items, stoves, baby strollers, and motorcycles.

Follow Jose-Daniel Reyes (@jdanielreyes1) and Sohaib Shahid (@Sshahid_WB) on Twitter.

Join the Conversation