LNG vessel crossing suez canal

LNG vessel crossing suez canal

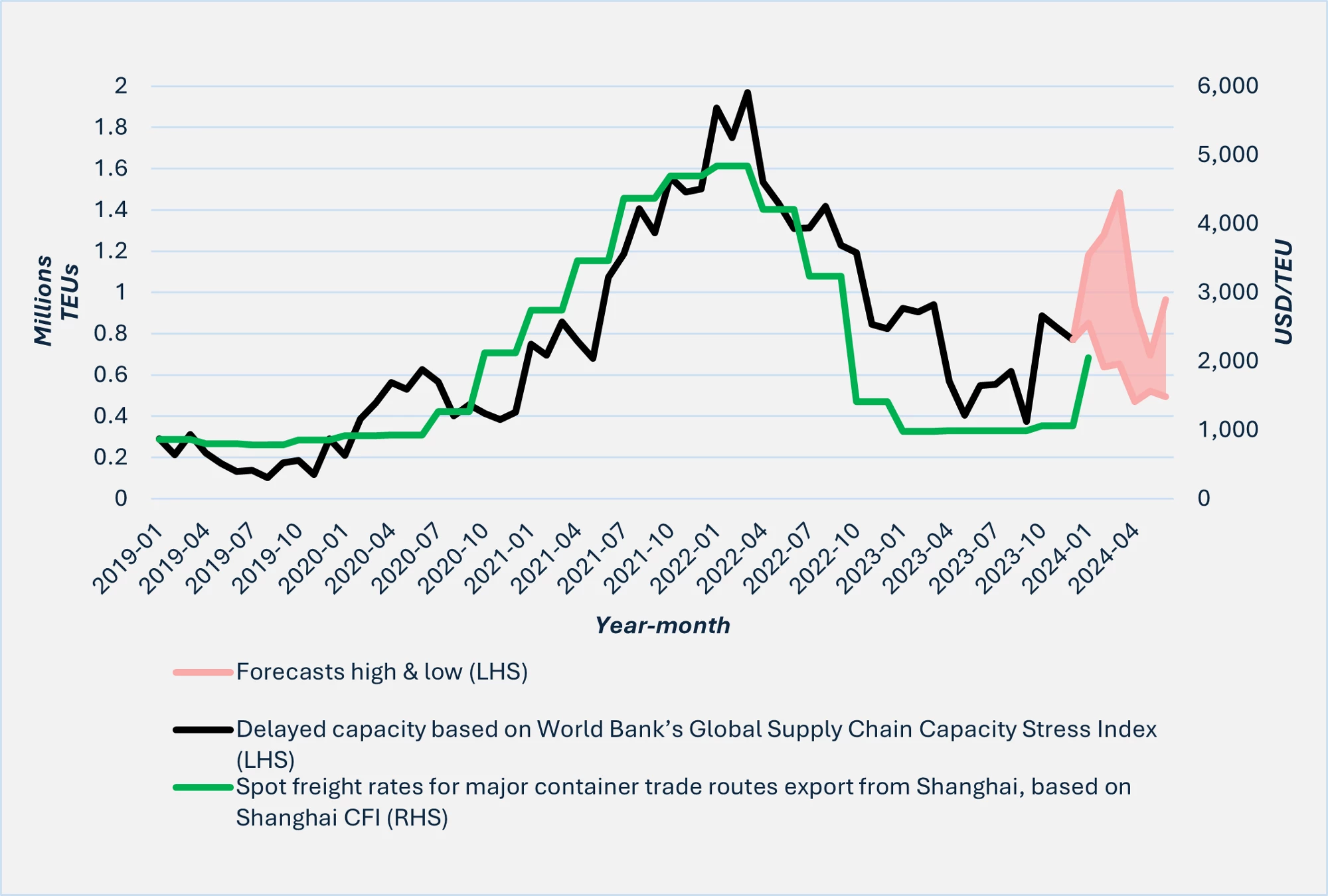

In the near term, the global container shipping industry will likely absorb the shock to capacity caused by attacks on vessels in the Red Sea because demand is generally soft in January and February. However, should the attacks persist into March and April, when global trade experiences a seasonal rebound, capacity constraints could trigger a supply-chain crisis like the one that occurred in 2021-22.

That crisis happened when container shipping proved unable to support the rebound of international trade starting in late 2020. COVID-19-related closures and staff shortages at ports kept ships waiting days or weeks to unload their cargo, with the result that fewer ships were available to move goods. Competition for slots on ships sent on-the-spot shipping rates soaring; the increase was eightfold on routes in between Asia and Europe or North America compared with 2019.

The source of supply-chain stress is different today, but the outcome could be similar. Major freight carriers, including Maersk and Hapag-Lloyd, have suspended operations through the Suez Canal to avoid the Red Sea and are rerouting vessels around the Cape of Good Hope , adding 3,000 to 3,500 nautical miles (5,500 to 6,500 km) and seven to 10 days to a typical trip between Europe and Asia. The extra distance could absorb from 700,000 to 1.9 million standard containers (twenty-foot equivalent units, or TEUs) of shipping capacity, depending on the estimate.

The higher figure is comparable to the stalled capacity of 2021 at the peak of the COVID-related crisis, as measured by the World Bank’s Global Supply Chain Stress Index (figure 1). The index is an estimate of capacity tied up when excessive delays are observed over historical port-to-port lead times (black line). The index is highly correlated with freight rates, which are sensitive to short-term changes in supply and demand. The pink area in figure 1 shows the forecast for January 2024 to May 2024.

Figure 1: The World Bank’s Global Supply Chain Stress Index jumped at the height of the COVID-19 supply-chain crisis and is forecast to rise again if Red Sea violence persists.

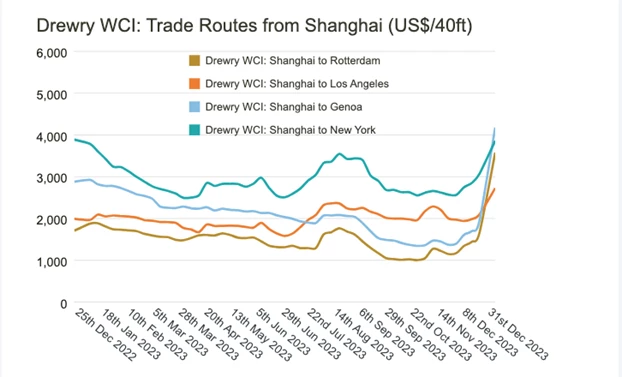

The additional costs of the trip around the Cape of Good Hope—which include up to US$1 million in fuel for every round trip—are being reflected in higher shipping rates. Maersk is adding a “transit disruption surcharge” of US$200 per TEU to books (both contractual and spot) for trips between East Asia, Northern Europe, the Mediterranean Sea, and the US East Coast. That’s on top of a “peak season surcharge” of US$300 and US$1,000 per TEU. MSC, another global container shipping company, said it will impose a “contingency adjustment charge” of US$500 per TEU on shipments from Europe to Asia and the Middle East.

Spot rates have risen even more (Figure 2). The rate for a journey from Asia to Europe has jumped to over US$3,000 per 40-foot container, a threefold increase over the lowest rate in 2023 (about US$1,000). This could mean that exporters in Asia are again competing for shipping slots in anticipation of major supply-chain disruptions. Fortunately, January and February are seasonally quiet months for shipping, so existing capacity probably suffices to handle the longer route in the weeks to come. But naval attacks lasting into March could again have a significant impact on global trade and GVCs.

Figure 2: Spot rates from Asia started to rise sharply at the end of 2023.

Join the Conversation