Top view of one of the busiest signals in Dhaka traffic. Photo: © Asif Himel/Shutterstock

Top view of one of the busiest signals in Dhaka traffic. Photo: © Asif Himel/Shutterstock

As the world emerges from one of the deepest recessions of the past 150 years, it is tempting to look back to the 1918 Spanish flu and hope for a decade of rapid global growth reminiscent of the “Roaring Twenties” of that era. A century on, are we on the verge of a surprise boom in the 2020s? Or are we on the cusp of a decade of global growth disappointments?

The roaring 1920s

Building on technological breakthroughs in earlier decades, North America and Europe enjoyed rapid modernization and strong economic growth in the 1920s. Automobiles replaced horse-drawn transportation and became ubiquitous as improvements in assembly lines cut costs. Newly built electrical grids paved the way for rapid industrial and household electrification. The economies of the United States, Japan and some European countries became more productive. Global growth that averaged 3.6 percent in the 1920s was double that of the preceding two decades.

Before the pandemic: weaker growth expected in the 2020s

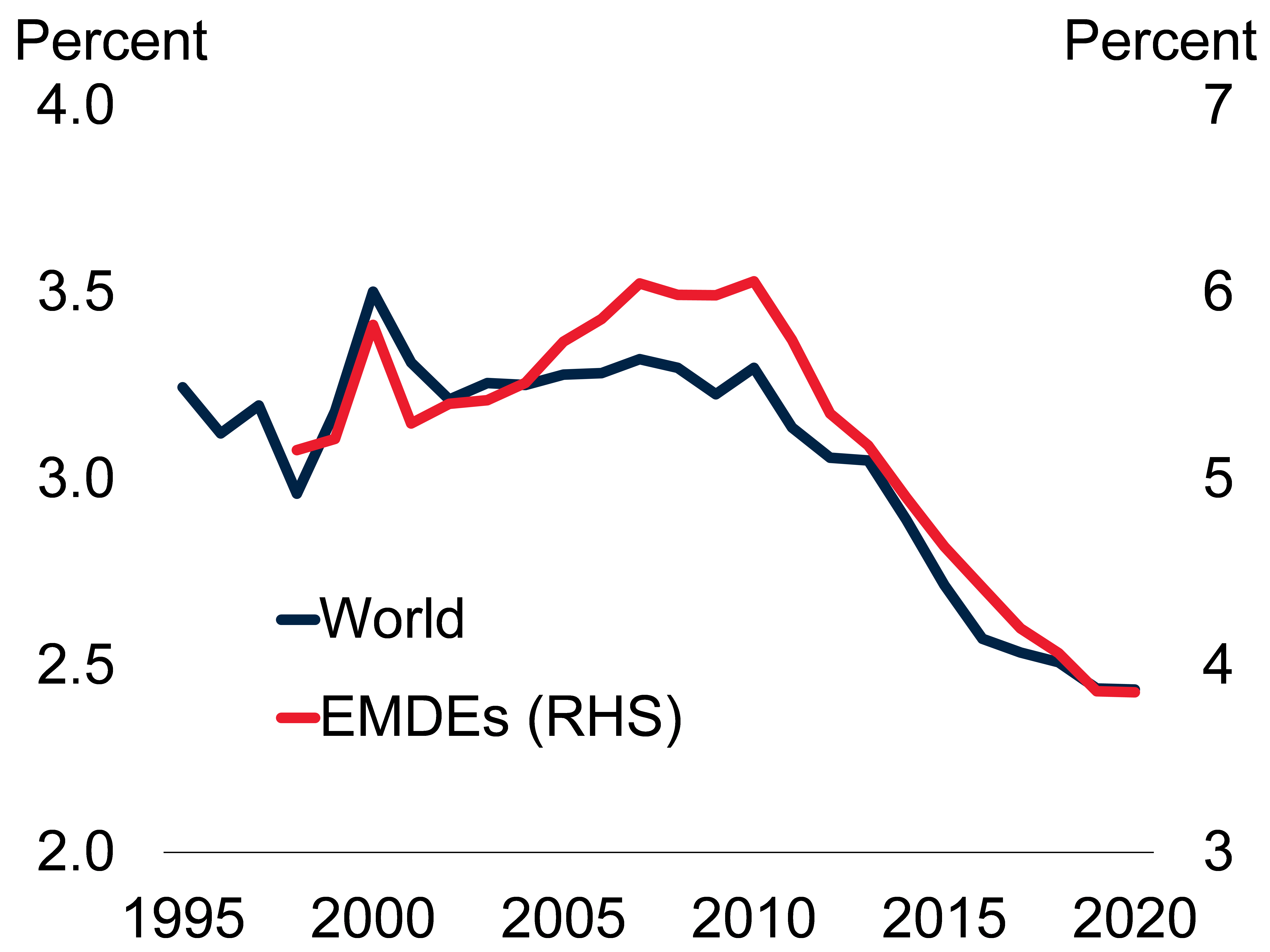

However, in contrast to the decade that preceded the roaring 1920s, all fundamental drivers of growth weakened in the 2010s. Growth in investment, productivity, and working age populations, as well as improvements in education and health all slowed over the 2010s compared with the previous decade. Even prior to the unexpected blow of a global pandemic, those trends had been expected to weigh on the global economic outlook in the 2020s. Potential growth—the growth rate that can be sustained when an economy is operating at full employment and full capacity—among global and emerging market and developing economies (EMDEs) was expected to slow between the 2010s and the 2020s, by 0.4 of a percentage point globally and by 1 percentage point among EMDEs (to 2.1 percent and 4 percent, respectively, Figure 1).

Figure 1. EMDE potential growth

Note: Columns show decade averages. Sample includes 82 economies (including 30 advanced economies and 52 EMDEs, of which 12 are low-income countries) for 1995-2029. These countries accounted for 95 percent of global GDP over the past five years. Potential growth is calculated

After the pandemic: a darker outlook for the 2020s

Since the onset of the pandemic, there has been a collapse in investment and severe disruptions to labor markets and education systems. Investment in EMDEs other than China collapsed by almost 11 percent in 2020, and is expected to remain below pre-pandemic levels until 2022. Global unemployment increased by about 2 percentage points in the first half of 2020 alone. The longer unemployment rates remain high, the greater will be the associated human capital losses. In addition, the pandemic has interrupted education for 90 percent of the world’s children. In quality-adjusted terms, COVID-19 could lower average years of schooling by 0.6 years.

As a result of these disruptions, the slowdown in potential growth over the 2020s is now likely to be another 0.3 of a percentage point steeper globally and 0.6 of a percentage point worse in EMDEs. Countries with sharper declines in investment, such as energy exporters or those that experienced particularly severe COVID-19 outbreaks, are expected to see the largest downgrades to potential growth. Given the importance of growth for poverty reduction, these downgrades are likely to further set back progress toward development goals.

Disappointments expected

Such a decline in growth prospects over the following decade is indeed what typically happens after severe recessions, whether global or country specific. For example, after the 2009 global recession, over the subsequent decade, long-term (10-year-ahead) forecasts for global growth were downgraded by a cumulative 0.9 of a percentage point, to 2.4 percent in 2019, and those for EMDE growth were downgraded by a cumulative 2.2 percentage points, to 3.9 percent in 2019 (Figure 2). In part, this reflected repeated instances when actual growth fell short of expectations. At the country level as well, deep recessions were often followed by significant and lasting downgrades in long-term growth expectations.

Policymakers have responded to the pandemic recession with unprecedented policy support, which has mitigated short-term disruptions. However, a rebound fueled by policy stimulus and pent-up demand will likely be short-lived, as happened following the 2009 recession. Moreover, the surge in public and private sector debt, following a decade of the fastest and most broad-based wave of debt accumulation on record, makes the global economy vulnerable to sudden disruptions in financial markets as stimulus is unwound.

Figure 2. Long-term growth expectations

Can a lost decade be avoided?

Still, a lost decade can be avoided provided there is a renewed push for reforms that boost longer-term growth. Such efforts could go a long way toward stemming the expected potential growth decline over the 2020s. For example, if each EMDE is able to repeat its strongest ten-year investment growth track record, its own best performance in improving secondary schooling outcomes, and can raise its female labor force participation as much as the best performers among its peers, EMDE potential growth in the 2020s could rise to 4.3 percent. While potential growth would still be slowing from the previous decade, the decline would be more modest than currently anticipated.

To accomplish these admittedly ambitious goals, policymakers—many of whom face limited fiscal space—need to focus on reforms that can catalyze private sector growth and improve the efficiency of government service delivery. This implies improving business climates and public governance, getting a better handle on corruption, and strengthening legal systems. These reforms can pay large growth dividends. In addition to the direct benefits they can deliver, countries that undertake lasting governance reforms typically enjoy several years of upgraded long-term growth expectations.

Policymakers may be hoping that the recovery from the pandemic unleashes a productivity boost that delivers a decade of stronger growth ahead. However, without a reform push, the reality of weakening fundamental drivers of growth, especially after the damage wrought by the pandemic, will eventually exact its toll. The 2020s are more likely to be “disappointing” than “roaring” unless policymakers get serious about implementing comprehensive reform.

RELATED

The World Bank Group’s Response to the COVID-19 (coronavirus) Pandemic

Join the Conversation