Photo: © Maksim_Gusev/Shutterstock

Photo: © Maksim_Gusev/Shutterstock

The economic effects of suspending a large proportion of global activity have immediately impacted the world’s commodity markets. The COVID-19 pandemic has unleashed a unique combination of shocks to both supply and demand. Sharply reduced transport has crushed the need for oil and other transport-related commodities. Shutdowns have disrupted supply chains and production. These shocks – which appear to be initiating a global recession -- are also causing weaker demand, particularly for energy and metals. Prices for almost all commodities have tumbled since the start of the year, and continued falling in April—with the exception of gold, a traditional safe haven.

The current pandemic, with its double whammy of plunging demand and disrupted supply, has few precedents. However, past episodes of major economic recessions, disruptions, and other pandemics can provide valuable insights into how commodity markets are affected by major shocks. The terrorist attacks on the United States on September 11, 2001, which led to widespread travel disruptions and reduced demand for oil, is one such precedent. Past global recessions, which have been accompanied by sharp declines in both the price of and demand for industrial commodities, are others.

Prices: oil down, gold up, agriculture mixed

In past episodes of disruption or recession, oil prices typically fell sharply , with the largest decline occurring during the 2008-09 global financial crisis. The current pandemic has led to a larger drop than any of these previous episodes, with a peak-to-trough plunge of 70 percent. In contrast, other commodity prices have seen smaller falls during the current pandemic than in previous episodes. During the global financial crisis, for example, copper prices tumbled almost 60 percent, but have fallen by a relatively more modest 20 percent since January 2020. Agricultural prices, which are typically less affected by recessions or disruptions, have in general seen only small declines this year. Gold prices have also undergone broadly similar changes as in previous events, as prices have risen, reflecting investor uncertainty.

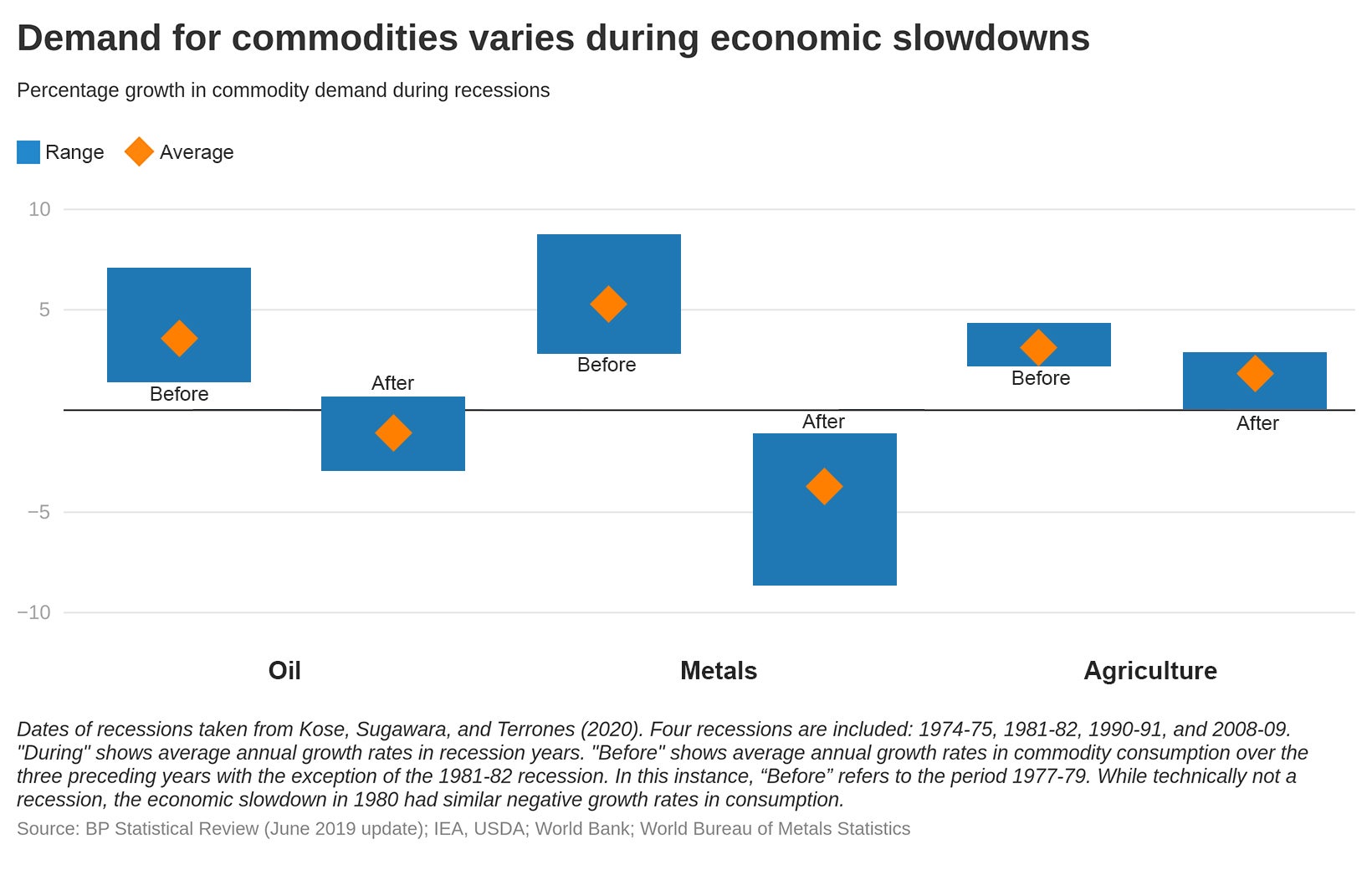

Demand: oil and metals down, agriculture little changed

Demand for oil and metals falls during global recessions, with metals, which are particularly responsive to economic activity, the most affected. However, the fall in oil demand during the current pandemic has occurred far more rapidly than in previous episodes. The International Energy Agency estimates that oil demand will slide 23 percent in 2020 Q2, and 9 percent over 2020 as a whole, more than twice as much as any previous collapse. Demand for metals is also expected to weaken in 2020 as the global recession deepens and demand from the manufacturing sector drops. In contrast, agricultural demand is typically much less affected by global recessions, reflecting its low income elasticity and declining expenditures with income.

Food security concerns

Past episodes of pandemics resulted in severe, albeit localized, disruptions to food markets. In 2014, the emergence of Ebola in West Africa resulted in second-order effects in regional food markets. Guinea, Liberia, and Sierra Leone (which were at the epicenter of the outbreak) experienced severe disruptions in food markets, with supply shortages arising from quarantine-imposed travel restrictions on sellers, while panic buying further reduced available supply. This resulted in very large local food price spikes and regional food insecurity.

While global food price movements remain muted so far, the risks to localized food price hikes remain high, particularly as the outbreak continues to spread. Further, large-scale income losses from disruptions in economic activity could exacerbate food insecurity. It is important that policy makers refrain from trade restrictions (a key contributor to the 2007-08 and 2010-11 price spikes) but instead focus on facilitating and enhancing the movement of food and necessary inputs to ensure that local food availability is maintained and that the next harvests proceed smoothly. Given the urgency of this challenge and that agricultural and food producers are a large share of the labor force and informal sector in developing economies, the functioning of the agriculture and food sectors should be prioritized in response and recovery plans.

Long-term impacts and disruption

The impact of COVID-19 on commodity markets may persist for an extended period. In the short term, continuing mitigation measures will increasingly impact supply chains, potentially threatening food security for the most vulnerable groups. Agricultural production may be affected by shortages of available inputs arising from mitigation measures. For example, movement restrictions might limit labor availability for agricultural production, especially in advanced economies, where there is a heavy reliance on migrant workers. Low availability of pesticides and other inputs are already affecting crop protection efforts and will likely reduce yields in the next season. A lack of pesticides is also hampering efforts to contain pest outbreaks, including the current locust outbreak in East Africa.

In the long term, behavioral changes may lead to changes in commodity demand, both geographically and by industry. A move toward remote working may reduce travel and hence demand for oil, while a shift to near-shoring and retrenchment of global value chains could cause a permanent restructuring of supply chains and associated commodity demand.

Commodity-dependent EMDEs, particularly oil exporters, are among the most vulnerable to COVID-19. In addition to the health and human toll and the global economic downturn, they face substantially lower export and fiscal revenue. However, policy makers can take advantage of lower oil prices by redirecting energy-related subsidies to the urgent pandemic response. These shifts need to be complemented with stronger social safety nets to protect the most vulnerable segments of society.

RELATED

The World Bank Group and COVID-19

A Shock Like No Other: Coronavirus Rattles Commodity Markets

The outlook for commodity markets, and the effects of coronavirus, in six charts

Join the Conversation