Fifty six percent of the respondents to a recent poll of over 300 asset managers said they would invest in thematic or sustainable bonds in emerging and frontier markets in the next year (see graph below). This is very good news for many emerging and frontier countries at a time when their balance sheets are stretched to the limit, and a clear signal that investors remain more committed than ever to a greener, fairer and more durable recovery from the pandemic. The poll was conducted in the ‘Sustainability Digital; A Planet in Trouble’ event organized by Top1000funds.com, where asset managers representing more than $14 trillion in fiduciary capital from 40 countries participated, all seeking to find ways to accelerate sustainable bond market development.

Source: Sustainability Digital; A Planet in Trouble.

While many emerging markets rely on financing from multilateral development banks like the World Bank, the international capital markets are an important source of capital for many , especially those with large financing needs and shallow domestic debt markets. Thematic bonds, which include green, social, and sustainability-linked bonds, offer an opportunity for these issuers to attract international investors by meeting their interest in transparency and environmental, social, and governance (ESG) issues.

Despite the COVID-19 outbreak this market segment continues to grow. Green bonds in particular have soared, surpassing USD $1 trillion cumulative issuance since 2008 when the World Bank issued the first labelled green bond in the world.

Interest from sovereign issuers is expanding, for example, a number of new sovereign issuers including Guatemala, Sweden, Thailand, Germany, Egypt and Mexico entered the thematic bond market in 2020— all with impressive subscription rates from investors. Furthermore, the pandemic diversified the market by accelerating the growth of new categories of thematic bonds such as social and sustainability-linked bonds. Social Bonds fund social expenditures such as health, education, and financial inclusion. Sustainability-linked bonds are results-based. The issuer commits to achieving predefined sustainability-linked targets and the financial characteristics of the bond change depending on whether the target is achieved or not.

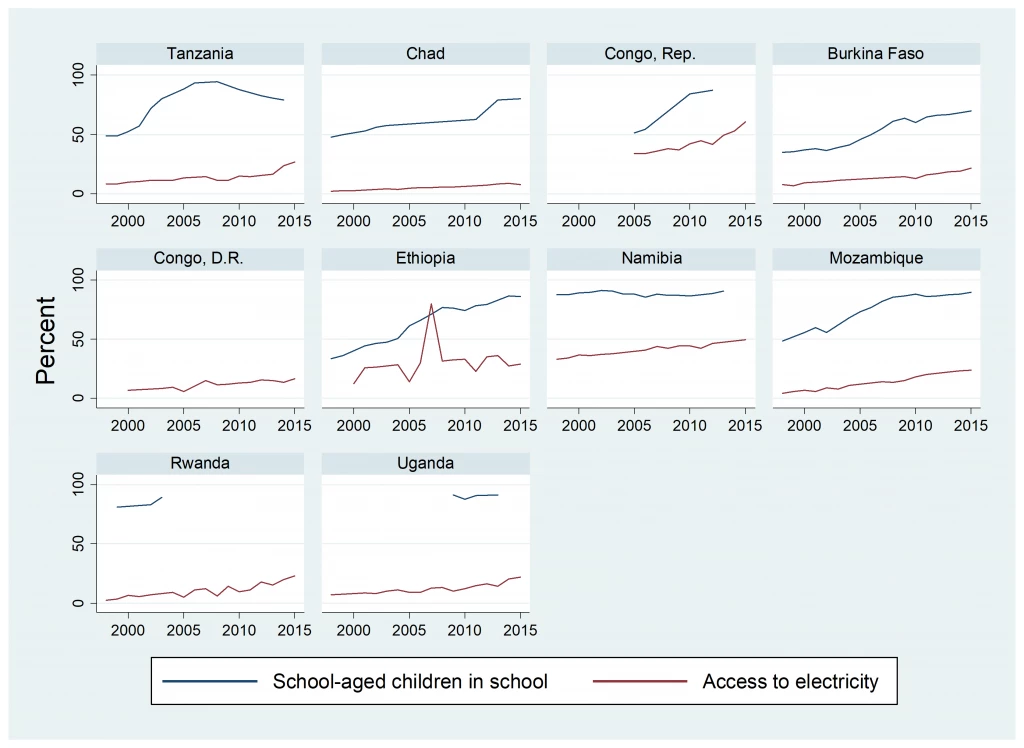

Despite the remarkable growth of the thematic bond market, emerging market issuances, particularly at the sovereign level, still account for a fraction of the total thematic bond issuance (see graph below).

Source: Bloomberg, As of January 2021, Market classification based on internal criteria.

The situation is set to change as investors increasingly use ESG information to assess sovereign issuers, whether for credit risk assessment, security selection, asset allocation, or impact investment. Speaking at the event organized by Top1000funds.com, Farah Imrana Hussain, Senior Financial Officer and sustainable finance specialist at the World Bank Treasury said, “There will be a number of ground-breaking transactions from emerging market sovereigns this year. We are very confident about this asset class.”

How can issuers capitalize on the increasing interest in emerging market thematic debt? In another poll on what it would take to go into emerging and frontier markets, asset managers voted for clarity in the use of proceeds, benchmark size issuance, and technical assistance from multilateral development banks such as the World Bank to lend credibility to transactions.

The World Bank is working with emerging market regulators to build an ecosystem that attracts ESG investors by helping them develop policies, regulations, incentives and green taxonomies. At the same time, the Bank is working with emerging market sovereign debt issuers to facilitate innovative transactions, encourage ESG integration in funding strategies, promote better engagement with investors, and standardize reporting, and transparency.

Thematic bonds also offer investors an opportunity to engage with sovereign issuers as part of their responsible investment strategy. Mary-Thérèse Barton, head of emerging debt at Pictet Asset Management, said at the Sustainability event that sovereign debt investors are now focusing more intentionally on ESG issues and increasingly promoting sustainable economic, societal and environmental outcomes during conversations with issuers at conferences and roadshows.

This is also corroborated by a recent J.P. Morgan survey of emerging market investors which found that the majority of investors believe ESG funding should support sovereigns in their development journeys.

Thematic bonds offer an investment opportunity for emerging markets issuers and investors to generate much-needed impact in countries that need it the most to rebuild out of the current pandemic in a more sustainable and resilient way.

Join the Conversation