ESG

ESG

The World Bank Treasury just released a guide for sovereign debt managers on why and how they should engage proactively and systematically with investors on environmental, social and governance (ESG) issues. Titled “Engaging with Investors on Environmental, Social and Governance (ESG) Issues,” the guide leverages the World Bank Treasury’s experience in developing sustainable capital markets, a series of roundtable discussions, and surveys of debt managers and investors to outline practical steps sovereign issuers can take to engage with investors.

ESG information is important for sovereign debt investors

For investment practitioners and market participants, ESG is a term that articulates the role of environmental, social, and/or governance factors in investment decisions. While analysis of governance criteria has always played an important role in investment decisions, many investors are increasingly recognizing that environmental and social risks also affect the risk-return characteristics of their investments. The global pandemic has further reinforced the importance of assessing these risks. As of March 2020, 3000 institutions have signed up to the United Nations Principles for Responsible Investment (UN PRI) and committed to incorporating ESG issues into investment analysis. These investors collectively manage approximately $100 trillion of assets.

Yet another group of investors use ESG information to identify investment opportunities that can generate positive, measurable social and environmental impact. The Global Impact Investing Network (GIIN) estimates the size of the impact investing market to be $715 billion.

The World Bank Treasury’s survey of investors confirmed that sovereign debt investors are also using ESG information in security selection (65 percent of respondents), asset allocation (40 percent), and thematic investing (35 percent), and the interest is growing.

Figure 1: ESG Investment Approaches

ESG issues impact the sovereign issuer’s capacity and willingness to meet financial commitments

Credit rating agencies are considering ESG factors in ratings and assessments. Twenty-three credit rating agencies, including Fitch, Moody’s and S&P Global Ratings have signed on to the UN PRI Statement on ESG in Credit Risk and Ratings, which recognizes that ESG factors can affect borrowers’ cash flows and the likelihood that they will default on their debt obligations. Weakening fiscal positions and increase in social risk during the current pandemic have led to a number of rating actions. S&P Global Ratings for instance reviewed over two-thirds of its sovereign ratings during the COVID-19 pandemic, lowering over one-fifth of ratings.

Debt managers serve as the main point of contact for the investment community but are missing the mark

Sovereign debt managers are responsible for raising the capital to finance critical public goods and services. A debt manager’s task is to ensure the government’s financing needs are met at the lowest possible combination of cost and risk. The fact that large pools of capital are affected by ESG considerations has important implications for sovereign debt managers.

Over 90 percent of debt managers in the World Bank Treasury’s survey said that investors are asking questions related to their country’s ESG issues and that these inquiries have increased in the past year. They also reported that more investors want to know about their plans for issuing thematic bonds (green, blue, sustainable or sustainability-linked bond) than other topics. And yet, the majority of debt managers have not made any changes in their funding or investor engagement strategies to capitalize on investor interests.

If debt managers do not engage with investors and credit rating agencies on ESG, they miss an opportunity to give investors relevant context, which may affect the demand for their bonds. Better engagement, on the other hand, can help sovereign issuers differentiate themselves from peers and even lower bond yield by attracting greater investor demand.

Debt managers can attract investors by issuing thematic bonds and developing ESG communications strategies

Debt managers should develop strategies to better engage with investors on the risks and opportunities presented by their national development plans and goals. They should coordinate closely with relevant line ministries to collate information and convey a consistent message to investors through investor relations offices or investor relations functions. They should include thematic bonds in their funding plans to finance priority environmental and social activities.

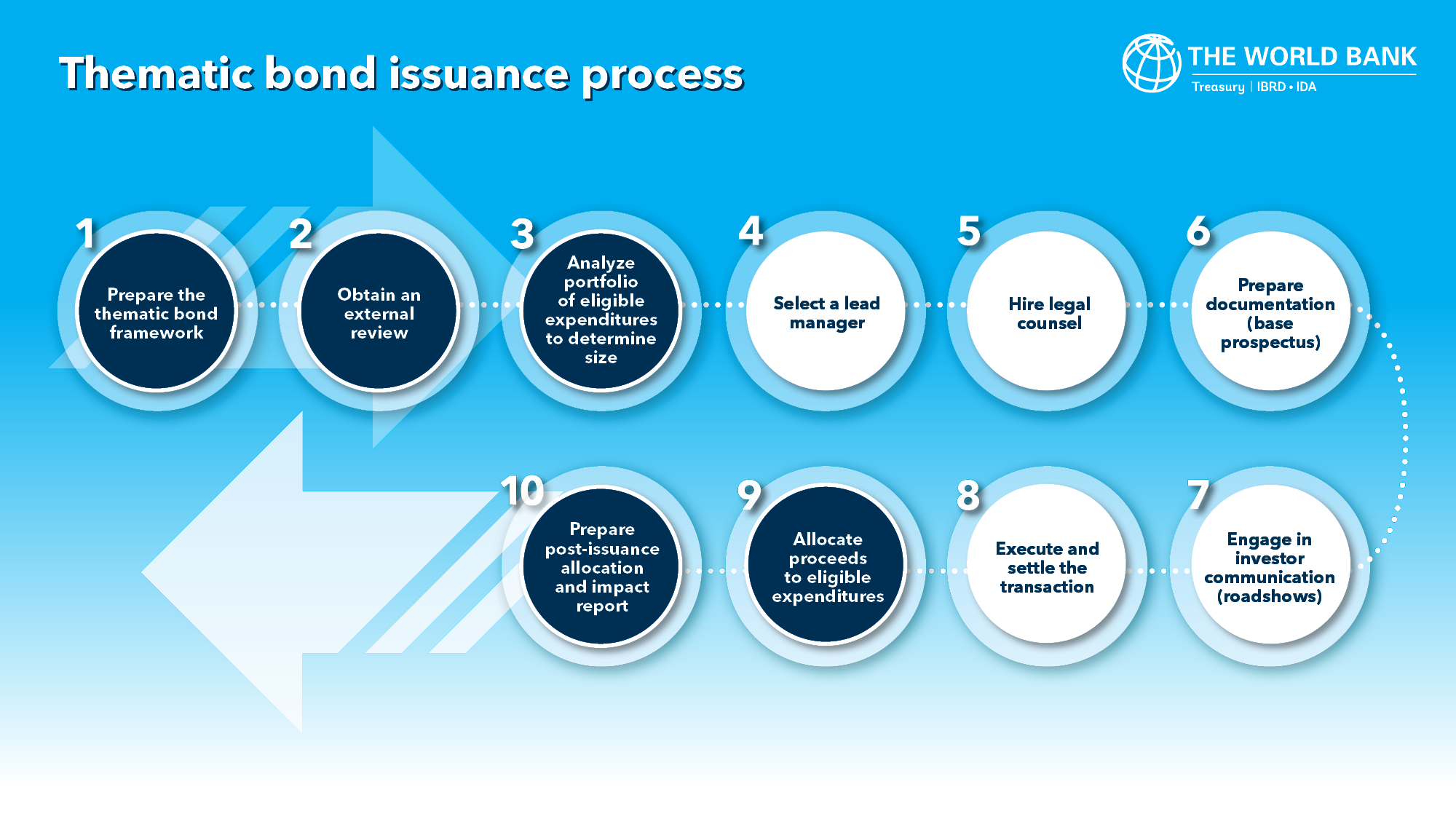

Figure 2: Process for Issuing Thematic Bonds:

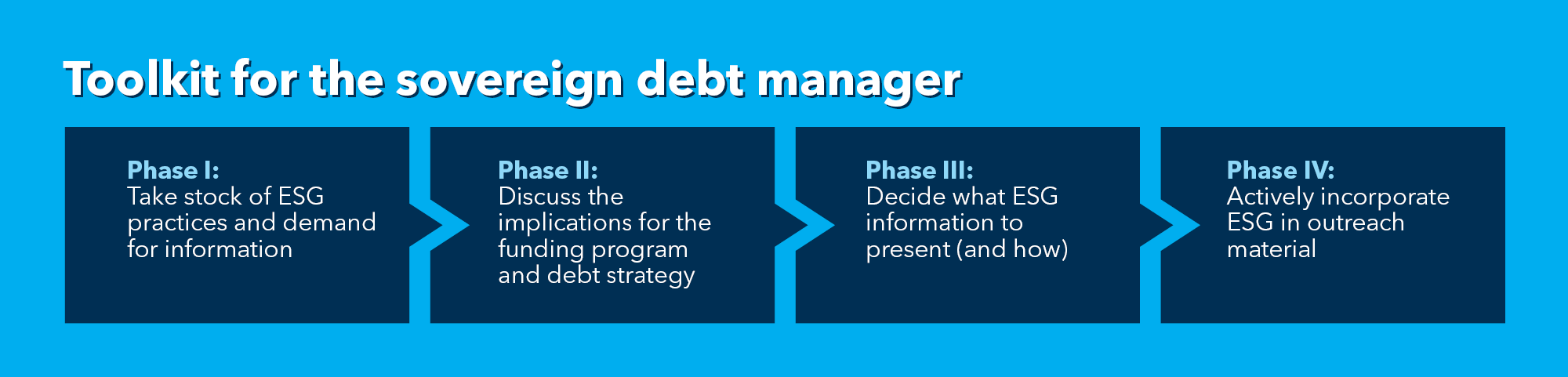

The new World Bank guide outlines the process for issuing thematic bonds, presents a toolkit of key actions that can help debt managers improve communication with investors and credit rating agencies and shows how countries like Colombia, Egypt, Indonesia, Mexico, and Uruguay are approaching this work.

Figure 3: ESG Engagement Toolkit for Sovereign Debt Managers

This guide complements another recently published World Bank report “Riding the Wave: Navigating the ESG Landscape for Sovereign Debt Managers,” which defines a framework that debt managers can use to design an appropriate strategy for undertaking ESG activities.

The World Bank plays a leadership role in promoting and financing sustainable development. Its triple-A–rated bond issuance program, including green bonds and Sustainable Development Bonds, has catalyzed sustainable capital markets across the world. The World Bank Treasury leverages its experience in the capital markets to serve as advisor to governments on developing sustainable financial systems, providing technical assistance to facilitate the issuance of green, blue, social, and sustainable bonds.

Join the Conversation