A new jobs diagnostics tool helps identify constraints to better jobs outcomes that could inform policy or regulatory choices. Copyright: Arne Hoel

A new jobs diagnostics tool helps identify constraints to better jobs outcomes that could inform policy or regulatory choices. Copyright: Arne Hoel

There are not enough good jobs in developing countries. As the World Bank’s upcoming Flagship report, “Jobs for Development,” emphasizes, the formation and growth of private firms and organizations is a key driver of more productive and better-paying jobs.

When workers are organized by firms, they become more productive because firms facilitate the allocation of skills and talent, enhance the adoption of technology and innovation, and improve access to large markets and global value chains. For this reason, understanding firm performance and potential constraints to firm formation and growth is the first step to guiding policies for creating more productive and better-paying jobs.

Tool for understanding constraints to labor demand

However, many developing countries do not have quality data on private sector firms, but need to ask multiple diagnostic questions to understand the most binding constraints to better job outcomes. For example, do firms spend a lot to train workers? Or are labor costs per unit of output high? To find answers, we need comparable data for different countries and examine relevant indicators across space and time.

To facilitate such analyses, the World Bank’s Jobs Group has developed a new jobs diagnostics tool using data from the World Bank Enterprise Survey (WBES) database with a focus on formal, registered companies with five or more employees in the manufacturing and services sectors. This tool covers 154 countries and surveys from 2006 to the latest year in the WBES dataset.

What can the tool do?

This new tool provides more than 150 indicators to help identify constraints to better jobs outcomes that could inform policy or regulatory choices. Indicators include characteristics and performance of registered firms and constraints to labor demand, such as operational costs, size of the workforce, access to finance, regulations, and infrastructure among others.

The tool provides charts and tables to benchmark firm performance in a country against a group of other countries. Some of the indicators are part of the WBES standard indicators, and other indicators are newly developed based on WBES microdata. You can supplement the tool’s indicators with other data to find key constraints to better jobs outcomes.

What questions can the tool answer?

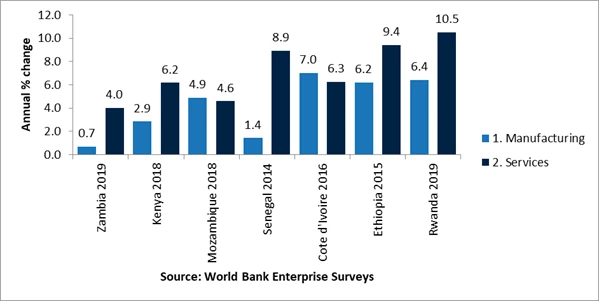

For example, let’s first examine an essential question to understand firm performance, such as, “Are firms expanding their employment levels?” (Figure 1).

Figure 1: Annual employment growth (%) by sector, selected Sub-Saharan African countries

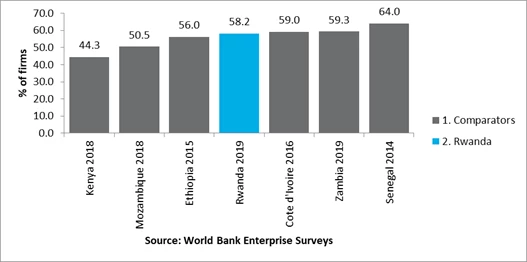

Or often we want to know specific constraints to firm operation in a country. We know that access to finance is a major constraint to firm growth, especially in Sub-Saharan Africa. However, this constraint does not affect firms equally across regions, so we can look at a group of countries to ask, “Are firms constrained in access to finance?”

Figure 2: Percent of firms that have difficulties obtaining loans or lines of credit, selected Sub-Saharan African countries

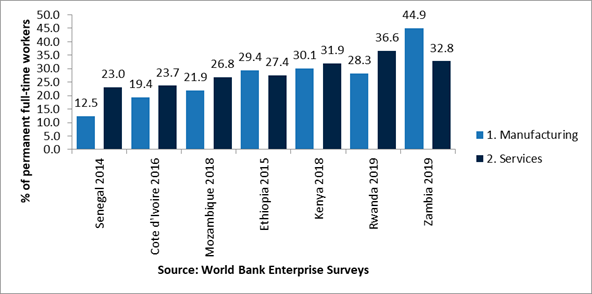

The tools also allow you to ask gender-specific questions, for example, by assessing women’s representation in formal firms (Figure 3). The tool’s outputs help identify gender gaps in employment to guide more granular analysis.

Figure 3: Percentage of full-time workers that are female by sector, selected Sub-Saharan African countries

How do you use it?

The tool is easy to navigate. First, select the country of your interest and a set of up to nine comparator countries. Then, by clicking the “generate charts” button, the tool will automatically create bar charts for all indicators, which you can copy and paste. To help analysts to navigate the tool, the Jobs Group has also created a video tutorial that explains the tool’s main functions. The tool is quick and easy to understand, but interpreting the results and thinking about constraints to better jobs outcomes may take more time.

One of many jobs tools

In addition to the new WBES tool, the Jobs Diagnostic Tools page contains a range of useful tools. These resources can help you conduct jobs diagnostics and include tools drawing on World Development Indicators (WDI), Global Jobs Indicators Database (JOIN), Penn World Table, UN Population data, Global Labor Database, and harmonized household survey data such as the WB Global Monitoring Data and International Income Distribution Database (I2D2). For further gender-specific analysis, the Gender Data Portal offers statistics and indicators. Together with these existing resources, the new tool can facilitate more comprehensive job diagnostics to identify the main jobs challenges faced by a country.

To receive weekly articles, sign-up here

Join the Conversation