This blog post is part of a special series based on the 2023 Commodity Market Outlook, a flagship report published by the World Bank. This series features concise summaries of commodity-specific sections extracted from the report. Explore the full report here.

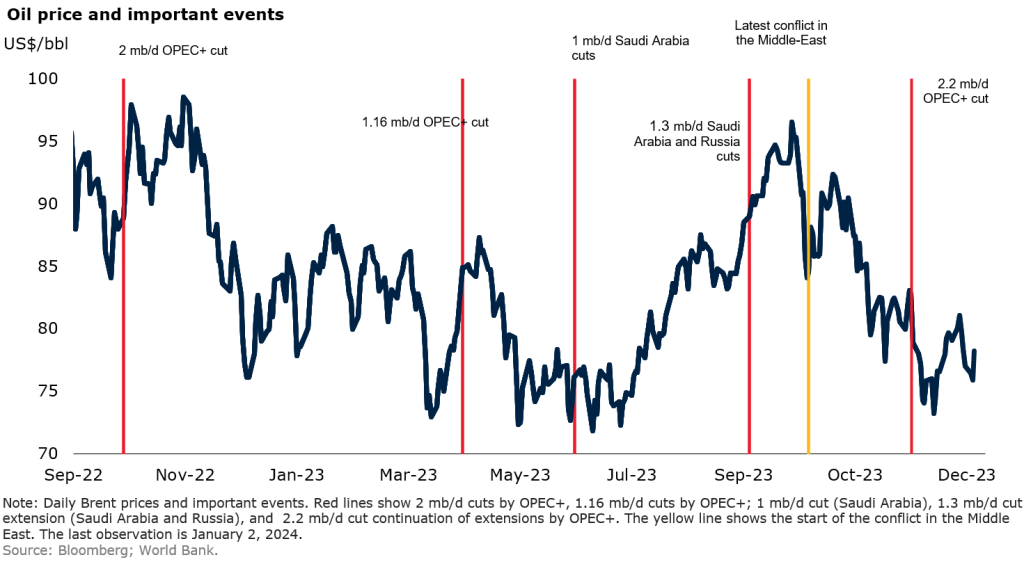

Oil prices averaged US$78/bbl in December, down from US$94/bbl in September, reversing all the gains accrued in 2023Q3. Oil prices have been under downward pressure amid weak global economic activity, record output from the United States, and steady production and exports by Russia. The price weakness unfolded despite supply disruption concerns in the aftermath of the Middle East conflict, the extension and deepening of production cuts by OPEC+, as well as the announcement of oil purchases by the U.S. government to replenish its Strategic Petroleum Reserve. Since the beginning of the latest conflict in the Middle East, Brent prices have been volatile amid potential geopolitical impact on supply and concerns of slowing global growth. Global oil consumption in 2023 is estimated to reach an all-time high, supported by resilient demand in China. Oil prices are expected to decline to US$81/bbl in 2024 and moderate further in 2025, down from US$83/bbl in 2023. The outlook is subject to upside risks, including the extension of OPEC+ cuts beyond 2024Q1 along with potential supply disruptions in the Middle East. Slower-than-expected growth, particularly in China, presents a key downside risk.

Russia oil export revenues reached a 12-month high in September. Russian oil production averaged 9.6 million barrels per day (mb/d) in 2023, a slight decrease of 0.2 mb/d compared to 2022. Russian exports remained resilient through a redirection of trade. The share of Russian oil exports to China, India, and Türkiye has increased by 40 percent between 2021 and 2023, partially offsetting the 53 percent decline in exports to the EU, the United Kingdom, the United States, and OECD Asia. In September, Russian crude export revenues spiked to a 12-month high amid increasing uncertainty regarding the discount at which Russian oil trades. Russia appears to be trading above the official cap, surpassing $80 per barrel since July 2023, possibly using a "shadow fleet" to circumvent Western restrictions. However, following the recent decrease in Brent crude oil prices, Urals prices were pushed below the $60/bbl price cap in the first week of December.

OPEC+ extends supply cuts. On November 30, several OPEC+ countries announced a continuation and expansion of their voluntary cuts, totaling 2.2 mb/d. This included the ongoing 1 mb/d cut by Saudi Arabia and an increased cut by Russia to 0.5 mb/d. As of November 2023, the OPEC+ alliance held 5.1 million barrels per day (mb/d) of spare capacity, about 5 percent of global demand. In June 2023, OPEC + announced continuation of the voluntary supply cuts, initially due to expire in December 2023, through December 2024. This extension involved additional cuts of 1 mb/d by Saudi Arabia from July, and 0.3 mb/d by Russia beginning in October. The November announcement further confirmed the extension of these cuts into the first quarter of 2024.

Non-OPEC producers led global supply growth in 2023. Production in non-OPEC+ countries in 2023 has been robust, as reductions in output by OPEC+ have been roughly offset by production increases led by the United States, Brazil, Guyana, and the Islamic Republic of Iran. During 2023Q1-Q3, the increase in the U.S. supply varied across shale gas producers but overall increased by 5 percent (y/y). The third quarter of 2023 marked the highest quarterly production, breaking the record from 2019Q4, before the outbreak of the pandemic. Looking forward, global supply is expected to increase in 2024, driven primarily by the United States and followed by Brazil, Guyana, and Canada.

All-time high in global demand in 2023, primarily driven by China. Oil demand increased by 2.3 mb/d in EMDEs during the first nine months of the year, while it remained relatively stable in advanced economies. Demand in China has been surprisingly resilient, driven by a wide range of factors, including transportation activity, which has continued to recover. China is estimated to account for around 75 percent of the increase in oil demand in 2023. Global oil consumption is expected to rise by 2 percent in 2023 to an all-time high of 101.7 mb/d, and slow down to less than 1 percent in 2024, reflecting the delayed impact of tighter monetary policy in advanced economies.

Risks to the oil market outlook. The latest conflict in the Middle East has raised geopolitical risks for commodity markets, as the region accounts for one-third of the world’s seaborne oil trade. Although a receding scenario, an escalation of the conflict, depending on the duration and scale, could trigger sharp oil supply disruptions (see the October 2023 Commodities Market Outlook, Special Focus). In addition, there are several potential upside risks to the oil market outlook, including the possibility of Saudi Arabia and Russia extending or increasing production cuts. Despite the recent oil production surge, there is also a risk that the U.S. shale oil industry may not be able to meet the production increases assumed in the forecast, especially by 2025. Downside risks to oil prices are primarily associated with a worse-than-expected performance of the global economy, particularly stemming from China. These factors collectively contribute to the complex dynamics of the oil market in the face of geopolitical uncertainties.

Join the Conversation