A construction worker in Vietnam, Dominic Chavez/IFC

A construction worker in Vietnam, Dominic Chavez/IFC

This blog is the third in a series focused on the results of global pulse surveys of multinational enterprises during the COVID-19 pandemic. Read about the results of the first round and second round.

As the COVID-19 crisis extended into the second half of 2020, the outlook for both the pandemic and the global economy remained highly uncertain. How should a firm facing these uncertainties behave? The economic literature is very clear: They should wait. And this is exactly what they are doing. Smart policy makers can use the crisis as an opportunity for reform, making their economies more attractive when investors return.

Even when the net present value of an investment is positive, it often makes sense to wait when facing uncertainty. Delaying investment is optimal because most investments are irreversible, and firms do not want to make permanent mistakes. There is an “option value” of waiting to invest, especially when the uncertainty will be resolved in the future. For example, imagine you want to buy a car for $10,000, but there is a 50 percent chance that it goes on sale next month for $5,000. If you buy it now, you get to use it now, which has value. But if you buy the car now and it goes on sale next month, you will have lost the chance of saving $5,000. It will only be worthwhile to buy the car now if the value of driving it now is worth more than $2,500—the expected saving (50% chance of saving $5,000.) Hence many will wait when faced with uncertainty.

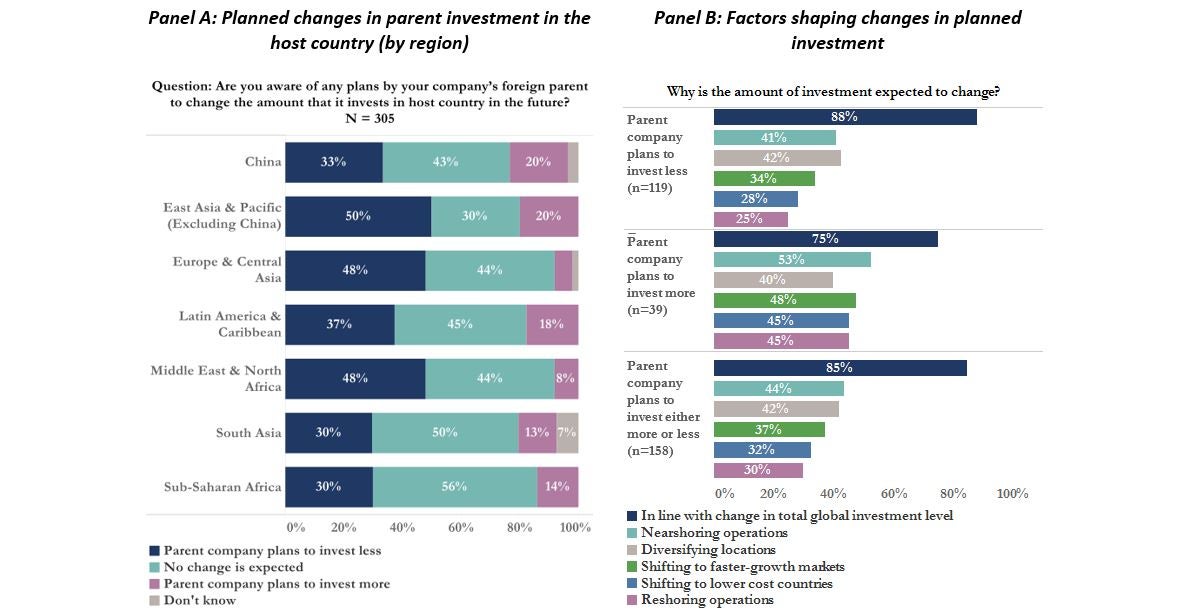

Given the current weak demand and the tremendous uncertainty in the global economy, most multinational enterprises (MNEs) are waiting. Foreign direct investment (FDI) is expected to drop 40 percent this year, and our recent MNE surveys show that 85 percent of firms are either not changing their investment plans or are investing less. Most firms have excess capacity so there is no need to make new investments. In addition, there is a value to waiting to find out which sectors and countries will grow most rapidly, which countries will remain open to trade and investment, and when COVID will be conquered before these companies make major irreversible investment decisions.

Smaller companies, bigger brunt

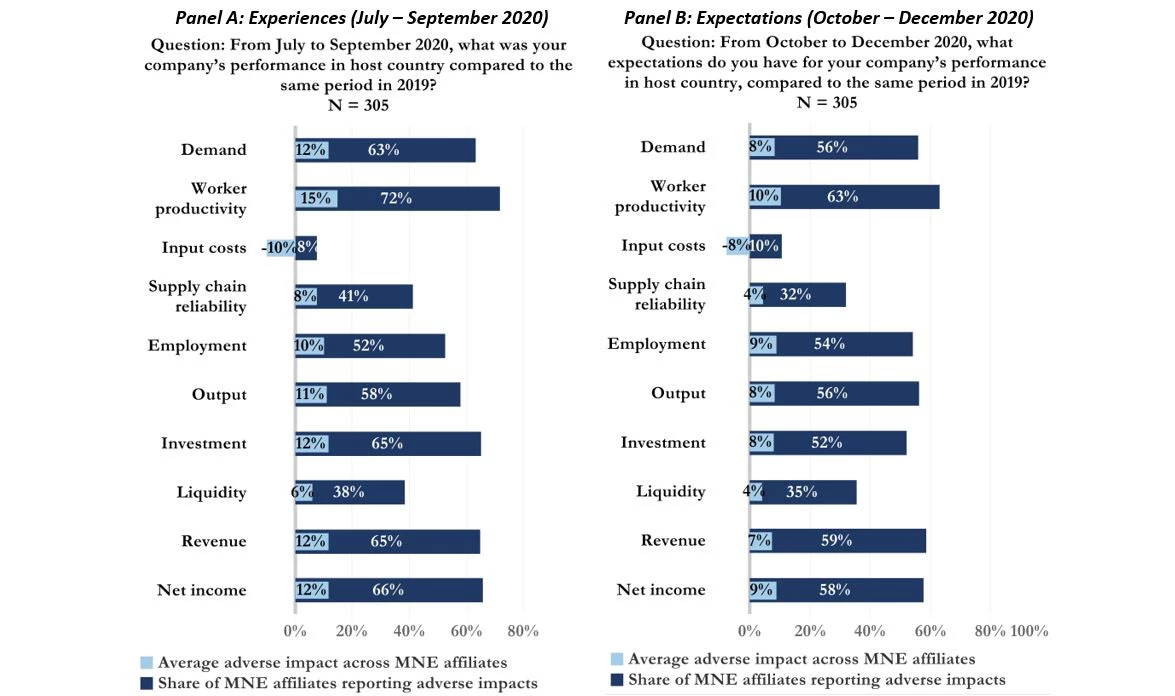

Overall, 97 percent of surveyed MNE affiliates (companies with foreign owners) experienced some adverse effects from the crisis in the third quarter of 2020. The most substantial impacts came through weak demand, reduced worker productivity, and reduced investment. The majority of firms did not experience supply-chain reliability problems or had issues with liquidity, and input costs remained in check. (Figure 1)

Smaller enterprises—those with fewer than 250 employees—were more severely affected, with 73 percent experiencing reduced profits (versus 61 percent of larger firms). Across regions, more MNE affiliates in the Middle East and North Africa experienced adverse impacts, possibly reflecting depressed commodity demand, while firms in East Asia and the Pacific generally experienced less severe impacts, consistent with broader economic trends and the course of the pandemic.

Looking ahead to the fourth quarter of 2020, firms expected some easing of demand and supply shocks, but nearly 60 percent of survey respondents still expected income and revenue to be down compared with the same period in 2019. In total, more than 90 percent of respondents expected adverse effects on at least one dimension in the fourth quarter, highlighting that the effects of the crisis are likely to remain widespread.

The results draw on responses from 305 MNE affiliates operating in 34 developing countries. The survey was administered by telephone and online in October and November.

Figure 1: Adverse effects of COVID-19 was near-universal in Q3 2020, with limited easing expected in Q4 2020

A challenging prospect for foreign investment

The outlook for FDI in developing countries is tied to the broader prospects for a global recovery. Across regions, sectors, and business sizes, affiliates cited changes in their parent company’s global level of investment as a key factor driving changes to investment plans in their local host country.

Survey results also indicate that among firms changing investment plans, some decisions could be driven by supply-chain realignments aimed at nearshoring or diversifying production locations. (Figure 2) These expectations, however, may be driven more by rhetoric than reality, as China records a high number of firms planning to expand investment, while multinationals in Europe and Central Asia—an often-cited nearshoring region—are less likely to expand. With many firms likely to be in the early stages of updating investment plans, future survey rounds will probably shed more light on regional trends.

Figure 2: Developing countries face a challenging outlook for FDI: 85 percent of MNEs expect investment to remain the same or decline

Reforming for recovery

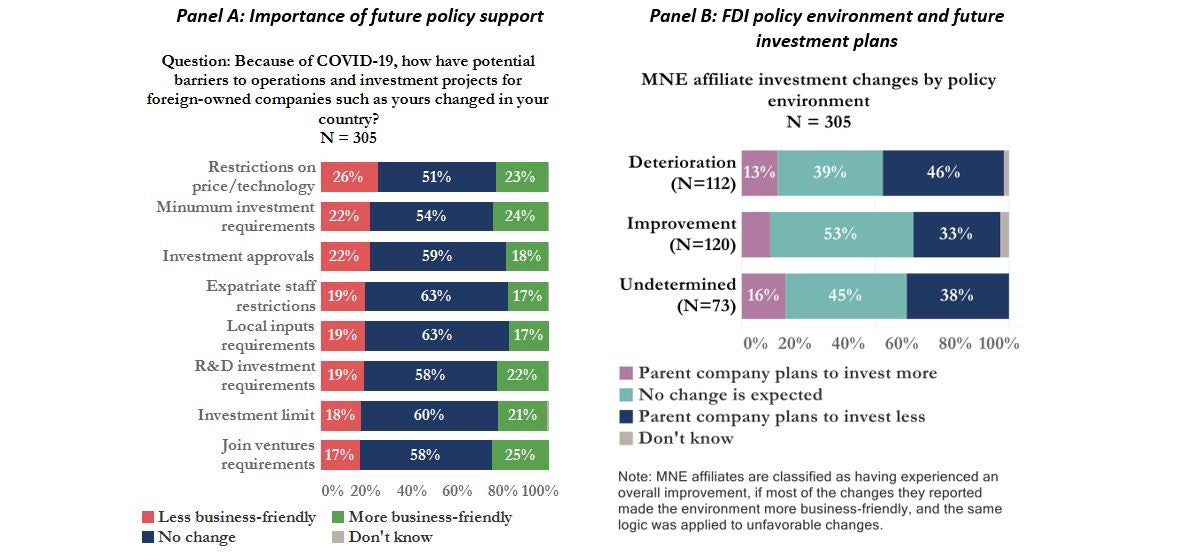

While firms are waiting to see what the future brings, countries can act to retain and attract investment for a stronger recovery. The entry and operational rules for foreign investors are an important factor that will shape the attractiveness of countries as investment locations and FDI’s role in economic recovery. Survey results present a mixed picture of MNE affiliates’ assessment of FDI-related policy changes (Figure 3, Panel A). Since the onset of the pandemic, 39 percent of firms have experienced an overall improvement in the policy environment for FDI in their host country, while 37 percent have experienced a general deterioration.

Relatedly, the survey provides suggestive evidence that host countries’ policy environments remain important determinants of MNEs’ investment plans. (Figure 3, Panel B) A greater share (46 percent) of MNE affiliates that experienced an overall deterioration in the policy environment reported plans to invest less in the future, compared to just 33 percent of affiliates that reported experiencing an overall improvement in the policy environment. With an adverse outlook for foreign investment in developing countries, these results suggest that it is vital for governments to maintain an open and supportive environment for FDI in order to retain and attract foreign investors.

Figure 3: Policy support continues to be important for MNE affiliates and restrictive measure can worsen investment prospects

This blog is the third in a series focused on the results of global pulse surveys of multinational enterprises during the COVID-19 pandemic. Read about the results of the first round and second round.

Analytical report 2020 Q3 MNE Pulse Survey.

Explore the 2020 Q3 MNE Pulse Survey data online.

Join the Conversation