This blog is the first in a series focused on the results of global pulse surveys of multinational enterprises during the pandemic.

Read about the results of the second round and the third in this blog series.

The coronavirus (COVID-19) pandemic has severely impacted multinational enterprises (MNEs) and foreign direct investment (FDI) in developing countries, jeopardizing these firms’ contributions to crucial development outcomes. In addition to bringing capital to developing countries, MNEs are key drivers of global trade, accounting for about 80 percent of total exports. FDI can drive economic transformation by introducing new technologies and best practices in developing countries.

The pre-COVID-19 global environment for FDI was already characterized by eroding investor confidence due to trade and investment policy uncertainty, flagging global growth, falling commodity prices, and rising protectionism. Against this backdrop, the COVID-19 crisis represents a new, unprecedented threat to MNEs: The pandemic has disrupted existing global value chains (GVCs) on which many MNEs rely, and a series of supply and demand shocks threaten the viability of many businesses.

To better understand the impacts of the pandemic on MNEs and FDI, the World Bank Group conducted in March a pulse survey of foreign investors in developing countries. Survey results shed light on three main areas: The actual effect of the pandemic on MNEs in the first quarter of 2020, the likely effect of the pandemic in the second quarter, and areas for policy support.

The survey’s findings support earlier predictions that the pandemic would adversely impact FDI through:

- Supply shocks, resulting from restrictions on company operations and labor shortages. The pandemic has also disrupted access to inputs, as suppliers reduce production and competitors engage in stockpiling amid uncertainty, and

- Demand shocks, as consumer confidence declines and government responses, such as travel restrictions, reduce the consumption of certain goods and services.

The survey also suggests that the impact is expected to worsen over the second quarter of 2020.

Immediate challenges, prolonged impact

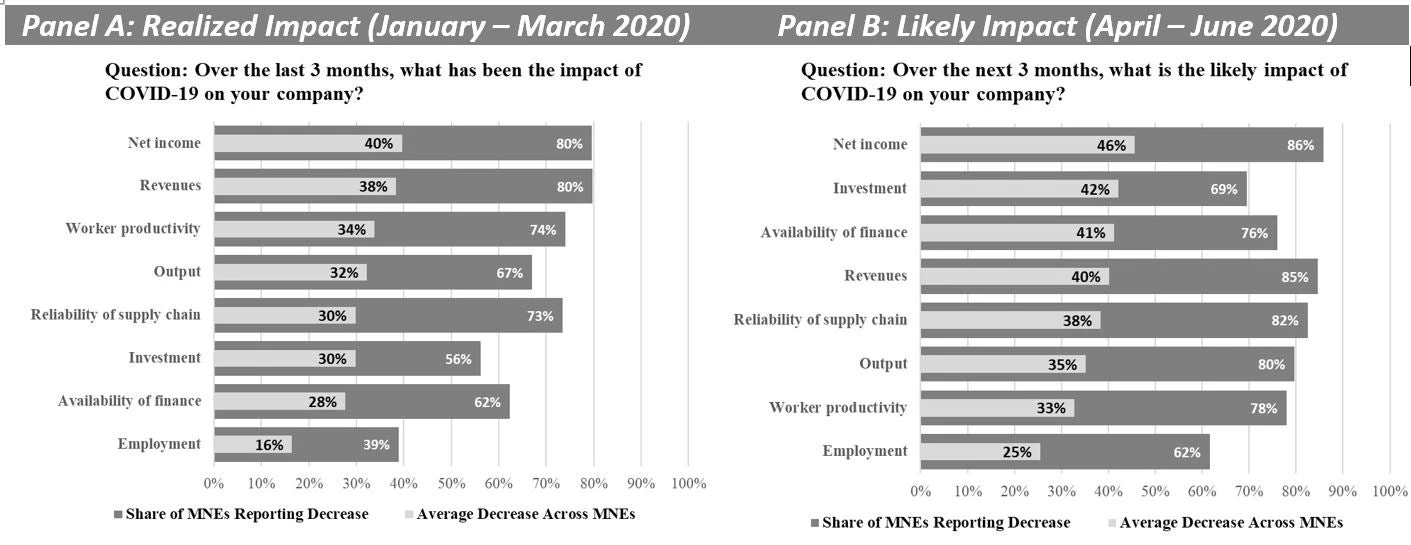

Ninety-three percent of respondents experienced negative impacts due to COVID-19 in the first quarter of 2020. On the supply side, roughly three in four MNEs reported declines in supply-chain reliability and worker productivity (Figure 1, panel A) compared to expectations for the period that they had before the crisis. Despite MNEs’ often superior access to capital, about two-thirds reported reductions in output and the availability of finance and liquidity.

On the demand side, the impacts were even more severe: 80 percent of respondents reported decreases in revenues and net incomes compared to expectations before the pandemic. As a result of worsening performance and pandemic-related uncertainty, COVID-19 caused more than half of respondents to reduce investment (by an average of 30 percent) and nearly 40 percent to shrink employment (by an average of 16 percent) in the first quarter of 2020.

1. COVID-19 has adversely impacted MNEs across a wide range of factors, with impacts expected to worsen over time

Across all categories, respondents expected impacts to worsen in the second quarter of 2020 (Figure 1, panel B). Particularly sharp declines were expected in investment (42 percent average decline in Q2 versus 30 percent in Q1) and employment (25 percent versus 16 percent). Negative impacts in investment and employment are especially worrisome because they signal how the pandemic has created enough medium- and long-term uncertainty to cause MNEs to scale back or even cancel plans.

The importance of policy support

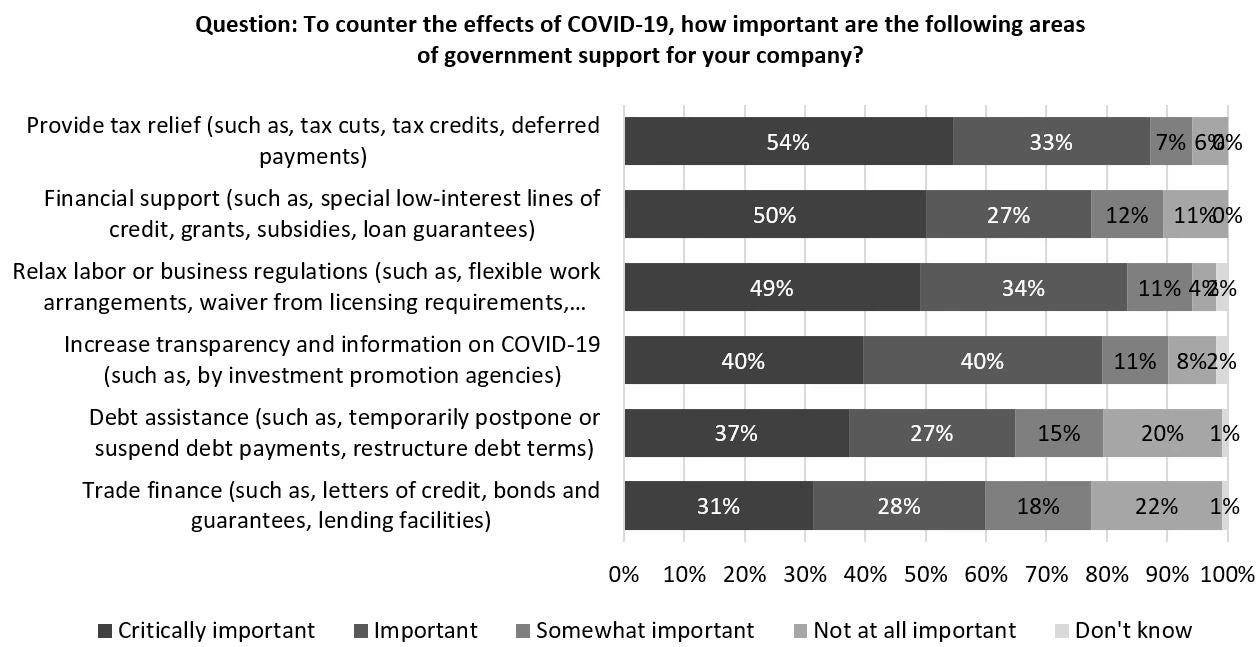

Although support to households and local small and medium-sized enterprises remains critical, survey results suggest that governments need to ensure that MNEs also receive policy attention. More than half of respondents consider government support to be “important” or “critically important” (Figure 2), and three areas were identified as high priority for policy support:

- Providing tax relief (including tax cuts, tax credits, deferred payments) was important or critically important for nearly 9 in 10 businesses. Support to “keep the lights on” such as providing tax credits, waivers, or deferrals; VAT exemptions; and reductions in social security contributions can go a long way in stabilizing MNE operations.

- Mobilizing financial support to counter the liquidity crunch caused by falling cash flows and access to financing was viewed as important or critically important by more than 75 percent of the surveyed MNEs. Such support programs could include special low-interest lines of credit, grants, subsidies, or loan guarantees.

- Relaxing labor or business regulations was considered important or critically important by more than 80 percent of the surveyed MNEs. Regulatory flexibility to reduce costs and support recovery could include fee waivers and reductions for standard business permits and licenses, extension of deadlines for regulatory filings (e.g. tax filings), and new regulations to facilitate the transition to new ways of working (e.g. flexible and remote working arrangements.)

Figure 2. MNEs’ demand for policy support is high

As the COVID-19 pandemic spreads and its economic impact deepens, governments must act resolutely and effectively in order to maintain private sector vitality and restore investor confidence. Immediate support should be timely, time-bound, targeted, and transparent. Governments will also have to begin planning for the next phase of economic policies to guide their economies’ transitions to a post-pandemic world. Along the way, governments should ensure that policies adequately address the needs of MNEs in order to safeguard FDI’s crucial role in driving the long-term economic growth of developing countries.

The World Bank wants to hear from foreign investors and multinational companies on the impact of COVID-19 and business strategies. Take the short pulse survey!

Join the Conversation