Workers in a poultry processing plant in Senegal - Dominic Chavez IFC

Workers in a poultry processing plant in Senegal - Dominic Chavez IFC

This blog is the second in a series focused on the results of global pulse surveys of multinational enterprises during the pandemic.

Read about the results of the first round and the third in this blog series.

Multinational enterprises (MNEs) have experienced successive and cascading effects of the COVID-19 pandemic. Demand and supply shocks have triggered a global recession; global value chains (GVCs) have been severely disrupted; and, across the world, governments are considering new rules affecting foreign investors. The result has been a sharp decline in global flows of foreign direct investment (FDI), with an uncertain outlook over the coming months.

For many developing countries, FDI plays a key role as a source of finance, with the potential to bolster these countries’ economic resilience during the crisis and support employment growth and economic transformation through the recovery phase. Given the significance of FDI for development, the World Bank Group is conducting quarterly pulse surveys of foreign investors to gauge the effect of the pandemic on their operations, expectations, and investment plans.

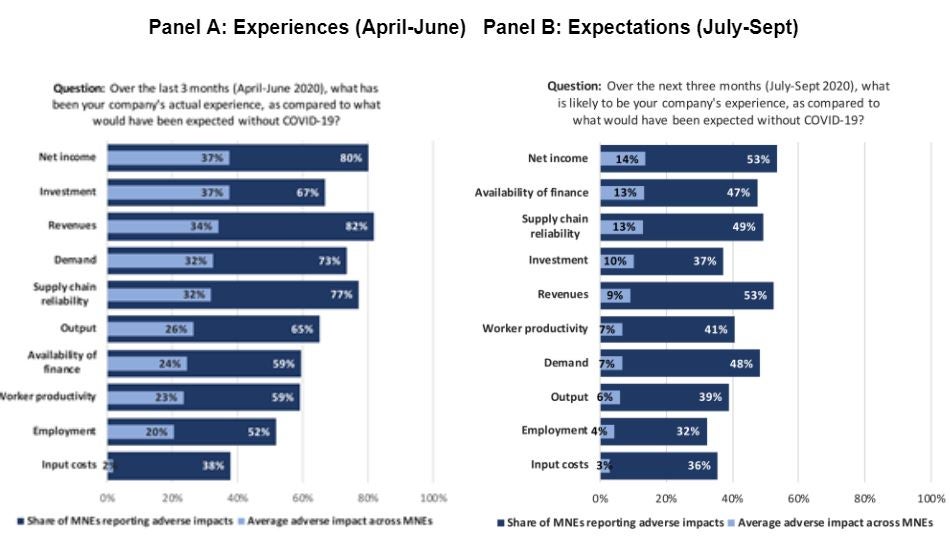

Results from second round of the pulse survey, released in September, show that the adverse effects of the pandemic became near-universal for MNE affiliates over the second quarter of 2020. Over 90 percent reported experiencing some adverse effects in the period—although many foresee a less severe impact in the third quarter. More than 80 percent of MNEs saw their net income decline from what they would have expected without COVID-19—by an average of 37 percent—while two-thirds decreased investment and over half reduced employment in developing-country affiliate operations.

The results draw on responses from around 80 MNE affiliates (companies with foreign owners) operating in developing countries, including low-income and middle-income economies. Differences in the sample mean that these results are not directly comparable to the results of the first round of the survey, released in April, which reported the experiences of MNEs in the first quarter of 2020, as the pandemic first took hold. But they both attest to the severe impact of COVID-19 on businesses.

Yet MNEs expect pandemic-induced shocks to ease over the third quarter (July to September) as economies gradually reopen and companies adjust to new market conditions. Over half of respondents still expect adverse effects on income, but the anticipated magnitude of effects will be less severe. MNEs reported an improved outlook for supply chain reliability, possibly signaling businesses’ adaptation and resilience.

Figure 1: Adverse effects of COVID-19 became near-universal in the second quarter, but MNEs expect shocks to ease over the third quarter.

Adjusting business strategies

The disruption of GVCs and international trade caused by the pandemic, along with longer-term effects such as changing patterns of industrialization, rising economic nationalism, and the importance of environmental sustainability, have challenged many MNEs’ business models and approaches.

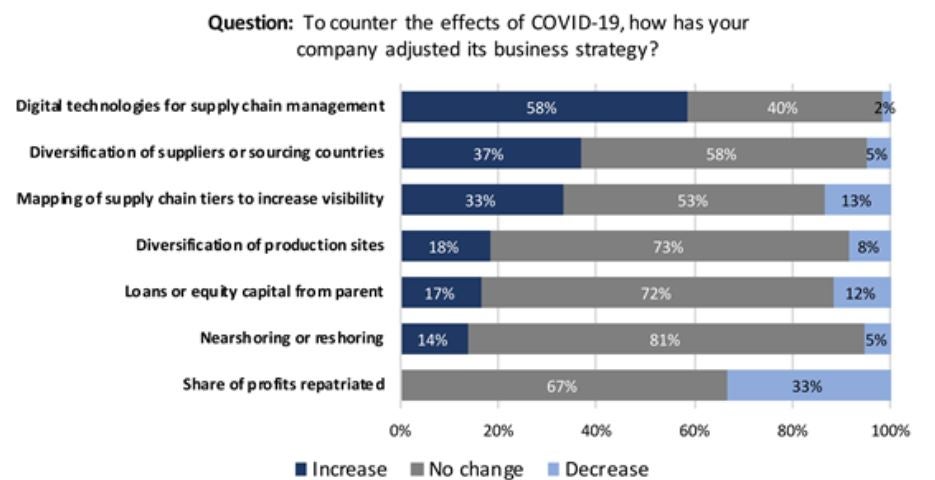

To help understand how firms are adapting to these pressures, the second round of the survey enquired about adjustments to firms’ business strategies. The results indicate that, in order to increase supply chain resilience, over half of MNEs (58 percent) have turned to digital technologies that can help firms optimize capacity and improve logistics, and a third report mapping the tiers of their supply chains to improve visibility of potential vulnerabilities. Some are diversifying suppliers (37 percent) and production sites (18 percent), and there are early signs that some firms are shifting production closer to consumers by nearshoring or reshoring (14 percent). Changes to GVCs identified in this survey, such as diversification of suppliers and geographic relocation of production, could have considerable implications for global trade and investment.

Figure 2: Firms have focused on supply chain optimization and resilience

Little support, fast-changing rules

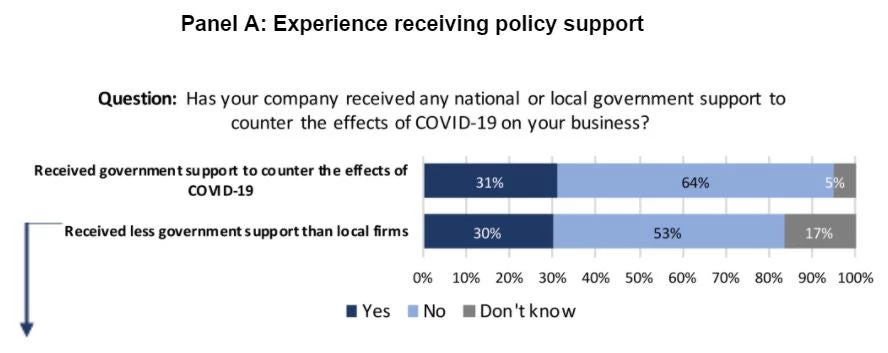

Policy will play a significant role in shaping both the course of the crisis and its impact on MNEs. The first round of the survey identified strong demand among investors for government to provide policy support to businesses. While many governments have introduced support measures, results from the second global pulse survey indicate that two-thirds of MNEs have not received any form of government assistance to counter the effects of the pandemic. A sizeable share of MNEs (30 percent) also report receiving less government support compared to local businesses (non-MNEs).

Responses suggest this could be due to ineligibility based on foreign ownership status, firm size, or other factors, or gaps in information and implementation. These results highlight the need for fair implementation and wide dissemination of information about support policies to ensure MNEs are fully able to access the support available.

Figure 3: Many firms report receiving no support, or less support than non-MNEs

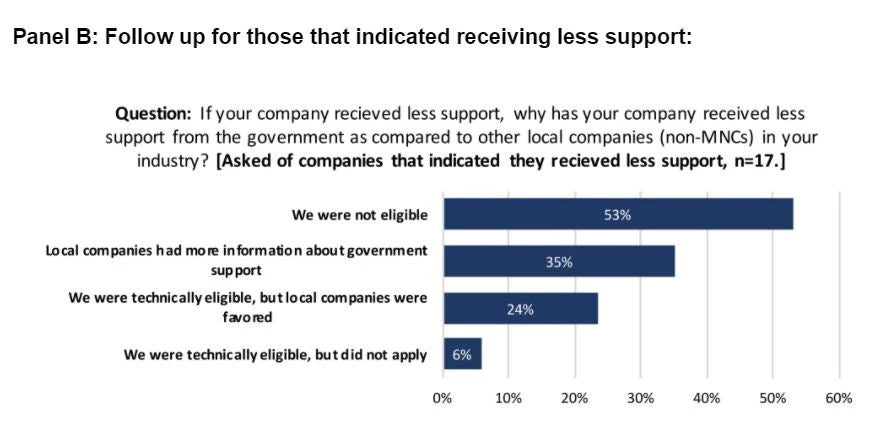

Support for businesses has not been the only policy response to the pandemic affecting MNEs, with some governments introducing changes to foreign investment rules over recent months. Among developed economies, the European Union introduced new guidance on FDI screening in March 2020 that emphasizes protecting strategic health-related industries. Countries including Australia, Canada, France, Germany, and the United Kingdom have all tightened their FDI screening regimes. China, India, and South Africa have made changes as well.

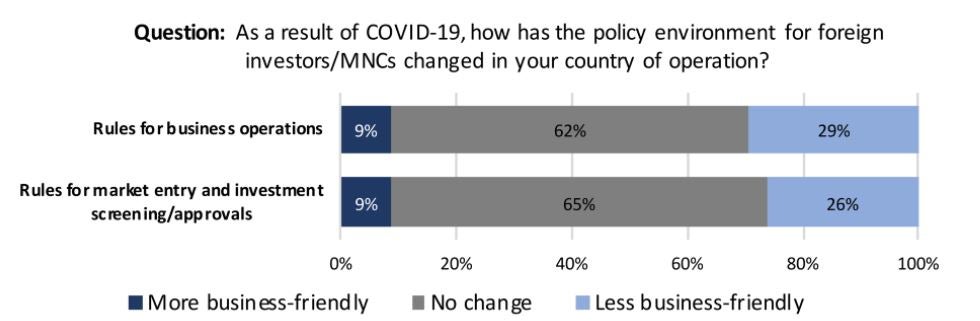

Survey data suggest that MNE affiliates are witnessing these changes to the business environment firsthand. Over a quarter of MNEs indicated that rules for business operations and market entry for foreign investors had become less business-friendly in their country of operation as a result of COVID-19.

Figure 4: Firms report FDI rules are becoming more restrictive

Overall, results from the second survey present a mixed picture. On one hand, MNEs expect future effects of the pandemic to be less adverse. On the other hand, firms have already experienced significant negative effects and are considering changes to their operations in response. This indicates that now more than ever, policymakers in developing countries should not make the environment for foreign investment any more restrictive. Supportive and predictable policy conditions for FDI can retain, expand, and attract investment—providing much-needed capital to support economic recovery.

Join the Conversation