A man at his business, in front of a computer.

A man at his business, in front of a computer.

This blog post is also available in Spanish.

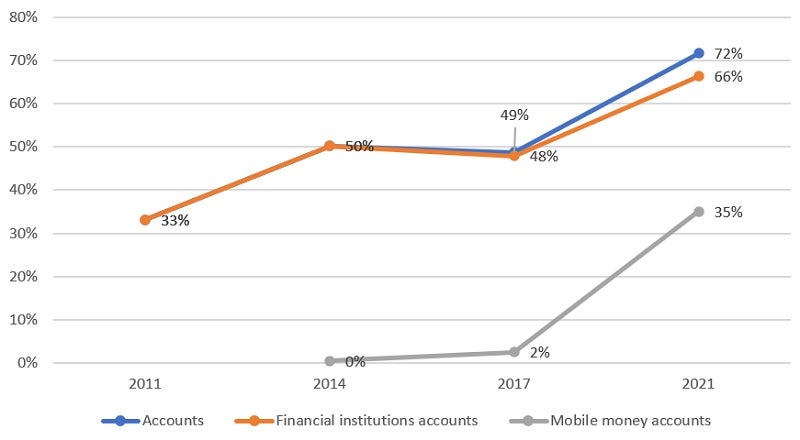

Argentina is one of the 25 countries worldwide with the greatest growth in financial inclusion in the last decade. According to the World Bank's Global Findex database, between 2011 and 2021, account ownership in Argentina has grown more than 100%, and the gender gap has been reversed. The difference in account holding between men and women is 4 percentage points in favor of women (2021). The COVID-19 crisis boosted financial inclusion with the opening of new accounts and the expansion of digital payments. In fact, almost 40% of account holders opened an account at a financial institution for the first time during the pandemic to receive their salaries or monetary transfers from the government.

Adults with an account in Latin American and Caribbean countries – 2021 (%)

Digital account usage and payments grew by more than 60 percent over the past three years. In addition, Argentina registers the lowest levels of account inactivity compared to other economies in the region.

Factors that influenced the increase in accounts in Argentina and future challenges

Argentina is actively encouraging financial inclusion. In the country, there are diverse financial service providers. Argentina has the largest number of Fintech companies in the region, after Brazil, Mexico and Colombia, and has created an immediate payment scheme called Transferencias 3.0, which facilitates interoperability, and is aimed at payments in shops. Immediate payments facilitate a better experience for users and allow the use of innovative channels and new technologies for the delivery of financial products, which contributes significantly to increasing financial inclusion.

Additionally, Argentina has high levels of connectivity, with 93.5 percent of the adult population having access to an Internet connection. It also has a solid national digital identification and registration system, which covers 98 percent of the population, allowing people's identity to be validated through an extensive database with biometric information.

Added to this are flexible regulations - such as the identity accreditation of financial users using the identity document that is downloaded to the cell phone - that make it possible to remotely open accounts for new clients. This regulatory framework also includes initiatives aimed at specific segments of the population, such as simplified accounts, which promote access to accounts for the low-income population. Additionally, measures such as the digitization of government payments and the promotion of the use of QR for payments in businesses have favored access and use of deposit accounts and electronic means of payment.

Still, the Global Findex data suggests that Argentina has not yet deployed its full potential for financial inclusion. It needs more initiatives around digital payments and to provide greater focus on generating resilience—the ability of individuals and companies to face their financial risks without deteriorating their well-being.

For example, only 45 percent of adults who work in the private sector receive their salaries through accounts at financial institutions, compared to 82 percent of public sector workers. Likewise, only 26 percent of adults in Argentina make payments for basic services through an account and 45 percent make digital payments in stores (for example, with the use of QR codes) or through the internet.

On the other hand, 33 percent of adults say that it would be very difficult to raise the necessary funds in emergency situations, while a very low proportion of the population resorts to financial products: 13 percent would request a loan and 10 percent would use their savings.

The future of financial inclusion in Argentina

In recent years, with the support of the World Bank, the government worked on the creation of an action plan and a monitoring and evaluation system for the National Financial Inclusion Strategy 2020-2023 (ENIF). These tools were key to ensuring the effectiveness and coordination of government efforts and must be incorporated and strengthened within the framework of a new financial inclusion strategy, which provides continuity to the achievements achieved and identifies opportunities for improvement.

Currently, the government is working to identify, based on evidence, the needs and challenges of the population in the access and use of financial services. This should contribute to better decision making for the design of this new policy instrument. At the World Bank, we are convinced that continuing to deepen financial inclusion is key to supporting the country's inclusive economic recovery, as well as providing tools to mitigate unexpected events and take advantage of growth opportunities for vulnerable populations.

Join the Conversation