warehouse interior with shelves, pallets and boxes

warehouse interior with shelves, pallets and boxes

As the COVID-19 pandemic enters its second year, some parts of the world have seen economies reopen, consumer demand pick up, and economic conditions improve. However, vaccine availability and distribution remain uneven across the globe and the first months of 2021 have seen significant virus waves in various parts across the world.

These mixed signs are weighing on the outlook for foreign direct investment and economic recovery, according to the World Bank’s most recent quarterly Global Pulse Survey of multinational enterprises (MNEs) in developing countries. Global FDI flows fell by 35 percent in 2020, but survey results have shown a steady improvement in indicators such as demand and revenue since the onset of the crisis, with average impacts on affiliates in developing countries greatly reduced by Q1 2021.

Nonetheless, most MNEs are still operating below pre-pandemic capacity, indicating a prolonged and uncertain recovery as the world moves out of the pandemic and toward a “new normal”. This uncertainty has led MNEs to pause major investments and instead rely on available capacity to expand output as economic activity picks up.

A drawn-out recovery

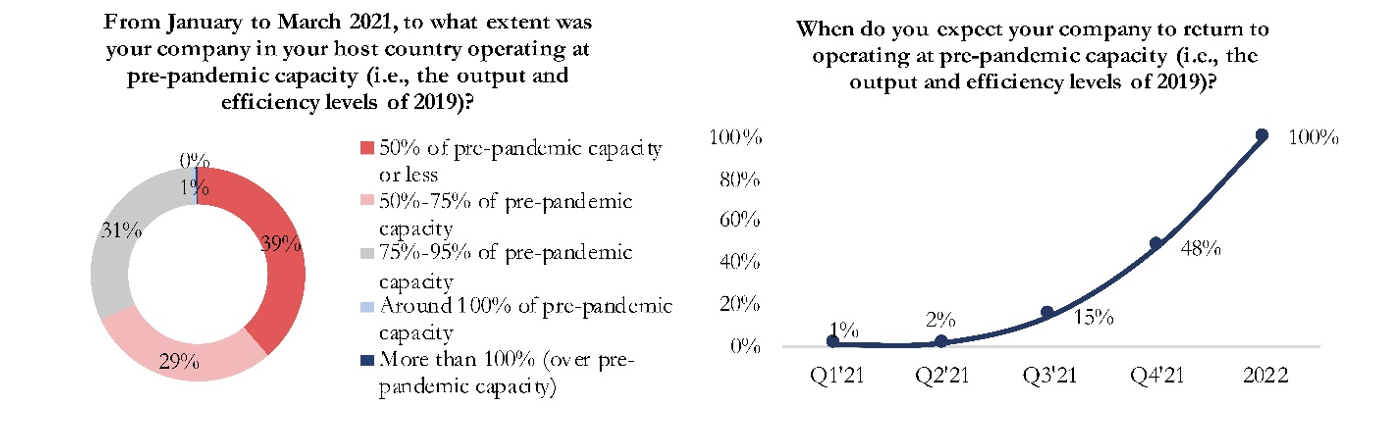

In Q1 2021, fewer firms reported negative effects on worker productivity, output, demand, and net income compared with Q4 2020, and the average magnitude of these negative effects has also fallen to pandemic-period lows. Despite these signs of recovery, 93 percent of MNEs in developing countries still report facing at least one adverse effect from the pandemic in Q1 of 2021 and more than two thirds of MNEs (68 percent) are still operating below 75 percent of their pre-pandemic output levels (Figure 1). Only 2 percent of MNEs expect operations to return to pre-pandemic levels in the first half of 2021 and 52 percent expect operations will not return to full capacity until some point in 2022 (figure 1).

Figure 1: Firms are still well below pre-pandemic capacity and do not expect a recovery until 2022 (N=300)

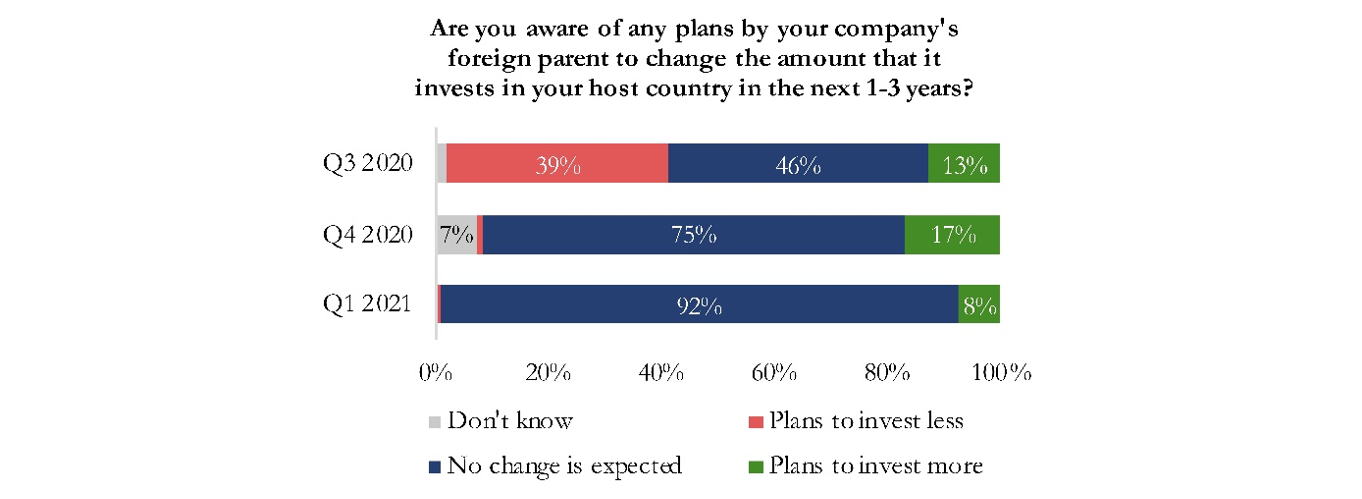

Considerable uncertainty has led most MNEs to adopt a “wait and see” approach to further investments in 2021. Survey data show that a 92 percent of respondents have no plans to change their level of investment in the next three years. Nonetheless, the outlook for investment has stabilized from earlier periods of the pandemic. The share of firms expecting to reduce investments has fallen from 39 percent in Q3 2020 to almost none in Q1 2021 (Figure 2). On the other hand, only eight percent of the MNEs expect investment to increase compared to 17 percent in Q4 2020.

Figure 2: Most firms do not expect their parent company to change its level of investment in the next 1-3 years (Q3 N=305; Q4 N=329; Q1 N=300)

Among respondents that expect no change in investment levels, 74 percent cited uncertainty about future demand. Almost half (48 percent) cited policy and regulatory restrictions as a contributing factor discouraging investment expansion. This creates an opportunity for governments to incentivize investment through strategic adjustments to investment policies, reduced operational restrictions, and increased support for MNEs.

Increasing focus on sustainability and green initiative

Despite the negative shocks brought on by the pandemic, there has been an amplified push for MNEs to take greater responsibility in their environmental performance. As companies start to gear up for the post-pandemic recovery, our survey results suggest an increased focus on sustainability and green initiatives. Nearly half of the surveyed MNE affiliates (48 percent) in developing countries indicate that they increased efforts to decarbonize their operations and improve sustainability since the onset of the pandemic.

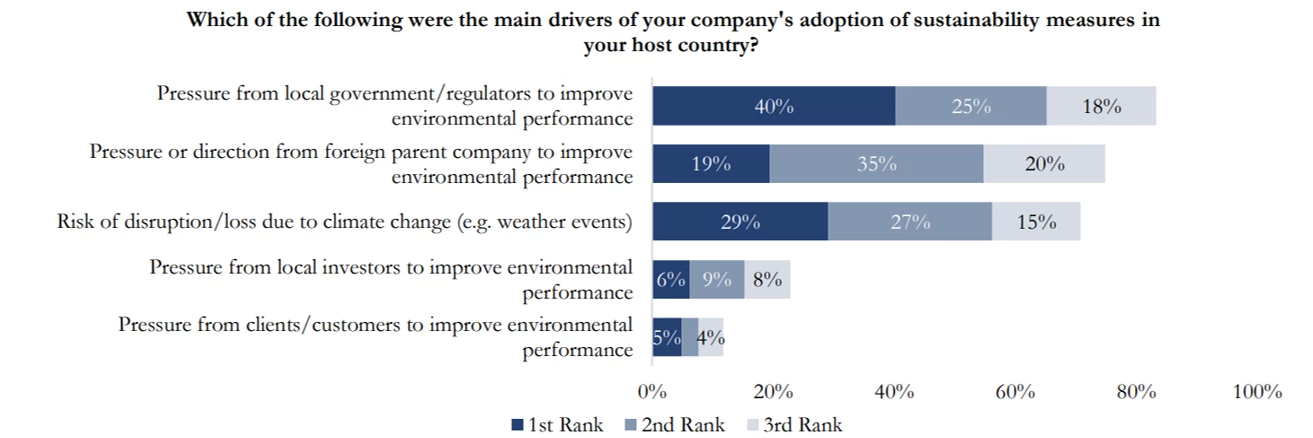

The trend toward sustainability has been driven by pressure from local governments as well as direction from parent companies. Eighty-three percent of MNEs that adopted sustainability measures ranked pressure from local government in the top three drivers of the change and 74 percent ranked pressure from parent companies in the top three. These drivers indicate the effectiveness of robust environmental government policies to drive change in private sector behavior, as well as a potential positive spillover of FDI in developing countries through the linkages between MNE parents and their affiliates. It also appears that companies are internalizing the risks of climate change, with 71 percent ranking direct threats to production in their top three reasons for adopting sustainability measures.

Figure 3: Pressure from local governments and parent companies is driving adoption of sustainability measures (N=300)

The largest risk to the global economy remains COVID-19 infections and the most important policy action is to vaccinate the population as quickly as possible. Countries should also use this time as an opportunity to implement policies that lower restrictions and boost competitiveness to better retain and attract FDI.

This blog is the fifth in a series focused on the results of global MNE pulse surveys during the COVID-19 pandemic. Read about the results of the surveys for the first quarter, second quarter, third quarter, fourth quarter of 2020 and the first quarter of 2021.

Join the Conversation