Geospatial image of forest in Brazil

Geospatial image of forest in Brazil

This blog is based on a case study which the World Bank contributed to the WWF report “Geospatial ESG” published earlier today. The report explores the question: What can currently be achieved with geospatial ESG driven techniques to better understand the environmental impact at the asset, company and sovereign level? The World Bank case study has benefited from discussions with Marek Hanusch, Gabriel Lara Ibarra and Claudia Mayara Tufani.

Droughts, wildfires or deforestation have easy-to-see effects on our environment and our economy – but what about financial markets? Is environmental degradation, accelerated and intensified by climate change, accurately accounted for in asset prices? Answering this question of financial materiality can be as daunting and confusing as piecing together a puzzle with missing pieces. The wealth of geospatial data provides a new box of promising puzzle pieces.

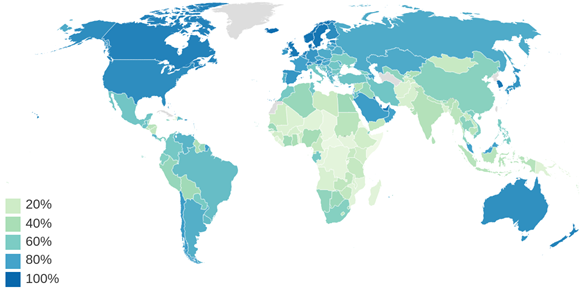

The rapidly growing availability of geospatial data paves the way for better evaluation of Environmental, Social and Governance (ESG) performance and ultimately, better informed ESG investing. Asset managers, pension funds and other institutional investors are already integrating ESG factors into their investment decisions. This raises an important question: How do financial markets account for ESG performance? Various methods exist, but the main inputs are sovereign ESG scores. These characterize a country’s sustainability profile and can be used to map out risks and opportunities. However, as two previous World Bank reports noted, sovereign ESG faces several structural challenges. One of which is the quality of environmental data.

Fortunately, geospatial data has become more accessible than ever, with an entire industry revolving around the data from space agencies and meteorological organizations. Its objective nature and wide coverage across time and space makes it an attractive choice to fill important gaps, especially for countries with low statistical capabilities. However, better data measurement alone is not enough. Geospatial data grants us invaluable insights into our changing environment. Yet, it leaves questions about the economic and financial materiality unanswered. Does environmental degradation drive unemployment? If so, does this in turn affect financial markets? In the following case study, we tackle the first question for Brazil.

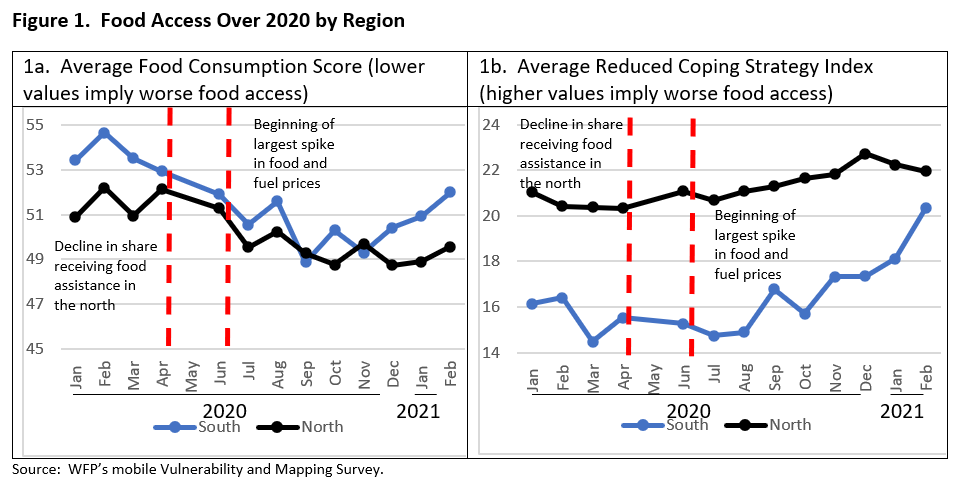

Figure 1 – Detecting rainfall anomalies from geospatial data

We use the SPI to detect the location and duration of rainfall anomalies, such as droughts. Values shown here are from December 2020. Each square represents 1 decimal degree (approx. 110km)

Case study: Brazil

The World Bank classifies Brazil as highly vulnerable to hydrological and meteorological disasters. Between 1900 and 2016, Brazil experienced economic losses of more than $US 6.1 billion due to flood damages, while heavy and prolonged droughts affected the livelihoods of almost 80 million people, causing $US 111.2 billion in total damage. These events are expected to increase both in frequency and severity in the future (see Brazil’s profile on the Climate Change Knowledge Portal).

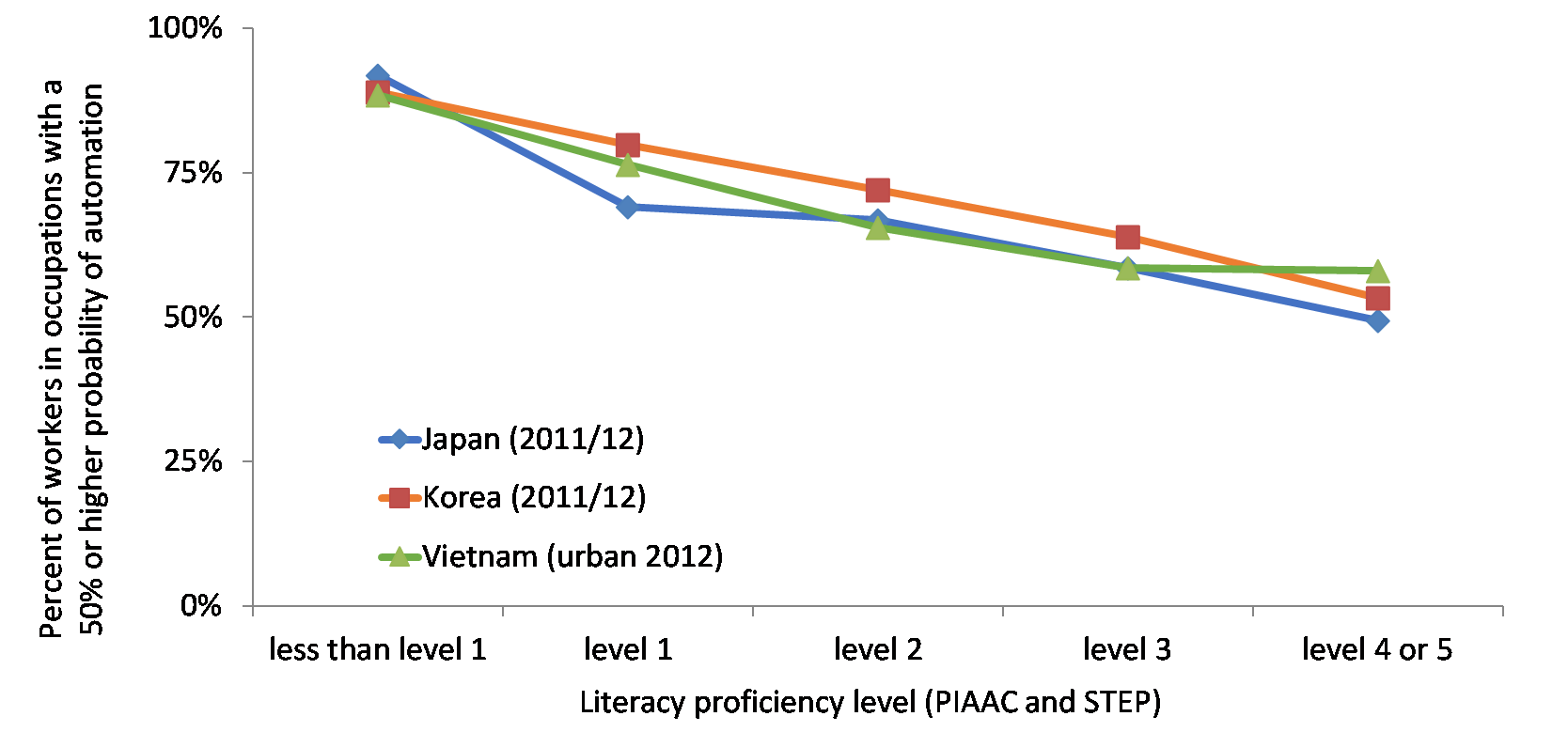

How strongly does formal employment respond to rainfall anomalies? That depends on the location, time and duration of the drought. Using local projection models, a statistical method that is often used to assess how an economy responds to a particular event (e.g. a policy change or a natural disaster), it is possible to draw response graphs as presented in Figure 2. Shorter droughts (1-3 months) affect employment much stronger than extended droughts (6-12 months). This may be because during longer droughts, the labor market has time to prepare and adjust. For shorter droughts, the effect is not immediate but unravels over the months, cumulating to a drop by -0.2% a year after.

Figure 2 – Shorter droughts affect formal employment more than extended droughts

Depending on the duration of a drought, employment can drop up to 0.2% a year later (1-month long drought) or have barely any effect at all (12-month long drought). This considers all 27 federal units.

This effect is admittedly not particularly large, but also not surprising since we considered droughts in all states and during all seasons. In comparison, Figure 3 only considers droughts during harvesting months and if they took place in states, where satellite images indicate that land is primarily used for agriculture. As a result, formal employment is affected earlier and the cumulative effect reaches around -0.35% after a year. To put this number into perspective, according to the Brazilian Institute of Geography and Statistics (IBGE), Brazil has about 41 million formally registered workers. The estimated decrease after a year would therefore translate into a drop in formal employment by about 143,000 workers.

Figure 3 – Droughts during harvest have more severe effects in farming-dependent regions

When we repeat the analysis of Figure 2 for droughts during harvest seasons and focus only on the 12 most agriculture-dependent federal units, the effects become more significant.

Still, even the results in Figure 3 are not overwhelming. This is likely due to several reasons. Despite Brazil being an agricultural powerhouse, leading the production of various crops, dairy products and meat, only 9% of the Brazilian work force is employed in agriculture. Also, since we only considered formal employment due to data limitations, we almost certainly underestimated the total effect, as informal workers are important in Brazilian agriculture and more vulnerable to adverse market conditions. These considerations leave plenty of room for future work.

The goal of the case study was to show how geospatial data can help piece together a large chunk of the puzzle. By estimating how employment reacts to droughts, we gained more understanding about the economic materiality of rainfall anomalies. Whether we instead look at employment, price levels or industrial output, the combination of high-resolution geospatial data with forward-looking statistical methods is a powerful blueprint for future work.

Finally, did this case study solve the puzzle of financial materiality? Certainly not. Connecting the dots with financial markets is challenging, especially since the concept of materiality is dynamic. Even if we were to identify a link with, say, bond prices, the relationship may only not always be present and can fluctuate with other economic variables, such as the commodity cycle or monetary policies. Much work remains to be done. The materiality question is a difficult puzzle and thanks to geospatial data, we have additional pieces to work with. But maybe as important as having enough puzzle pieces is knowing how they fit into the bigger picture.

Join the Conversation