Violin in nature

Violin in nature

We ended our last blog highlighting the need for issuers, investors and the concessional finance community to step out of their comfort zone to find new solutions for scaling up private climate finance.

This blog is part of a three-part series focused on financial instruments which, like their musical counterparts, need fine tuning to work in harmony with our sustainable development goals and builds on a series of other blogs ( see here and here) related to the potential for sustainable-linked financing at the sovereign level.

Chile and Uruguay's first sovereign Sustainability Linked Bond issuances (SLBs) in 2022 certainly broke new ground. Both bonds- met with strong investor interest- created a link between environmental performance indicators and the financial terms of the bonds. Despite some caveats, SLBs have grown rapidly in importance in private markets, and these experiences provide insight into how these instruments need to be recalibrated to work best at the sovereign level. Such instruments could be an important complement for sovereign green bonds- and also address the constraints of the standard green bond use of proceeds model at the sovereign level.

A key question for the World Bank, and the wider development community, is how to build on this momentum and mobilize capital at a scale for the large set of countries struggling with the debt-nature-climate challenge. One of the main challenges for the scalability of sustainability-linked financing is market access, as there is a significant mismatch in the risk-return appetite of issuers and investors. You might say all members of the orchestra are not yet playing the same tune.

Another challenge is how to wisely use the scarce 'concessional' capital of Development Finance Institutions (DFIs) to de-risk and mobilize private sector capital. A third is to how design structures that would be as simple and standardized as possible. Ideally, these would be close to or the same as plain vanilla investments – which would avoid fragmenting the debt portfolio, which reduces the liquidity of sovereign debt markets and could be a barrier to being included in the main bond market investment indices.

Sustainability-Linked Funds (SLFs) represent an innovative approach to mobilizing private capital towards achieving sustainable development goals. By leveraging concessional finance from donors, SLFs can enhance credit for issuers and offer a financial incentive for achieving pre-established Key Performance Indicators (KPIs). SLFs can invest in conventional debt instruments, avoiding fragmentation of the debt portfolio and supporting emerging market issuers' access to private capital.

A Sustainability-Linked Fund (SLF) is a way to finance sustainability projects. SLFs can be denominated in foreign or local currency and implemented at a global, regional, or national level, following the key objectives set by development partners. They could be flexibly applied for different asset classes – sovereign, other public or private sector debt.

It has four key features:

- A coordinating financial institution – playing the role of conductor in our story - sets high standards and agrees on ambitious goals with each issuer/country. This would bring significant harmonization and economies of scale in the agreement of robust KPIs with multiple issuers/countries, enhance the fund's credibility and minimize risks.

- Concessional funds from development partners are invested in the fund's junior tranches (first loss), which mobilizes investors to invest in senior tranches. This makes it easier for emerging markets to access private capital.

- Issuers who meet goals are rewarded financially. This gives issuers an incentive to achieve goals.

- The fund invests in conventional debt instruments, which are easier to price, attract more investors and are more liquid. This reduces the potential to fragment the debt market, which can reduce market liquidity.

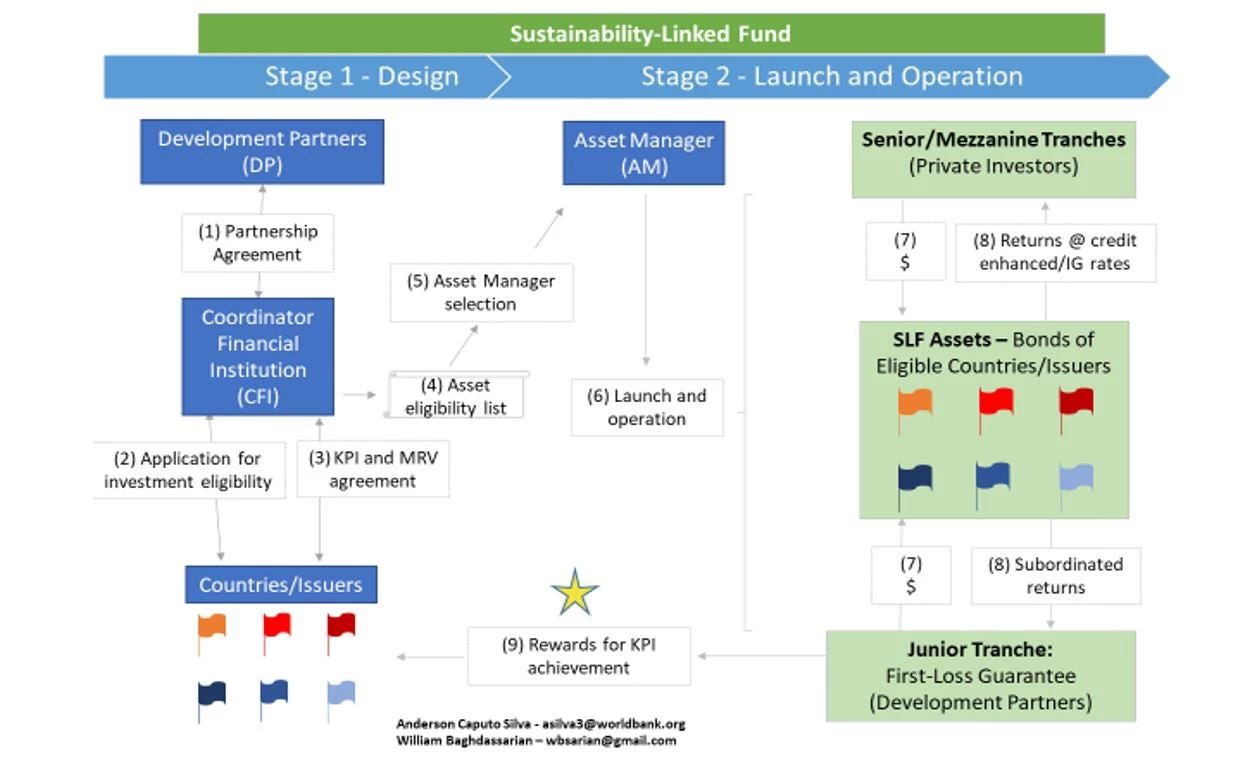

Figure 1 illustrates how the SLF would work.

Design Steps

The design stage involves three key types of stakeholders: development partners; coordinator financial institutions; and sovereigns or other public/private issuers.

In step 1, a financial institution, such as a multilateral bank, convenes a group of partners – including other development institutions and donors – to jointly agree on the overarching objectives of the SLF. The fund objectives, a description of the target asset class (sovereigns, other public/private sector issuers), and the types of KPIs (for example, linked to climate, nature, or other ESG aspects) form the basis for a Sustainability-Linked Framework to establish the investable universe for the SLF.

Steps 2 and 3 comprise the dialogue between the coordinating financial institution and countries/issuers that meet the criteria established in the SLF Framework. These involve the countries/issuers' formal application for investment eligibility and their KPIs and monitoring mechanisms agreement.

Steps 4 and 5 conclude the SLF design stage by publishing a list of eligible countries/issuers and selecting a qualified and reputable Asset Manager (AM).

Launch and Operation Steps

In coordination with the coordinating financial institution, the selected asset manager would take all necessary steps to launch and operate the fund.

Step 6 involves structuring the SLF, including drafting documentation, getting regulatory approvals, raising capital for junior and senior/mezzanine tranches, and investing in eligible assets. DPs are the main target investors for the junior tranche, while the lower risk (senior/mezzanine tranches) are primarily aimed at private investors.

Steps 7 and 8 represent the investments in conventional debt instruments of eligible countries/issuers and the returns received by the different types of investors during SLF operation.

Step 9 closes the operational loop with the distinctive feature of the SLF: the financial incentive, and reward, for eligible countries/issuers. The reward is payable against achieving KPIs, thus representing an opportunity cost for countries that fail to reach established targets.

SLF Design, Launch and Operation

Figure 1 presents the structure of SLFs, describing 9 key steps in their process of design, launch and operation.

Getting a pitch perfect performance from these players will require coordination, cooperation and commitment. If successful, these types of instruments can start to bring our financial sector and development objectives into much needed harmony.

Related blogs:

What’s next for sustainability-linked financing?

Linking sustainable policies with sovereign debt

Linking sovereign debt with national sustainability commitments

Join the Conversation