The failure of SIFIs could set off a global financial disaster (Credit: istock photo, BrianAJackson)

The Global Financial System can’t stand another systemic shock. Even as efforts are rallying to accelerate the recuperation of global financial systems, regulators should remain vigilant for possible deterioration. Restoring financial stability through recovery plans and extended interventions using public funds mandates closer monitoring of the financial markets as well as additional measures to minimize the likelihood and severity of potential outcomes if systemically important financial institutions (SIFIs) were to fail.

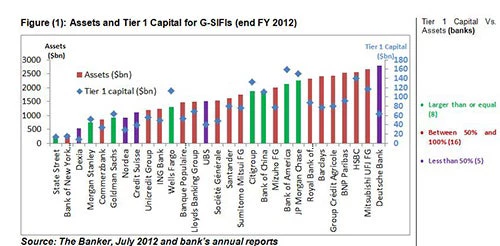

The Financial Stability Board, established by the G20, defines a SIFI as a financial institution whose distress or disorderly failure, because of its size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and global economic activity. In some cases where financial institutions (FIs) have become too big, their vulnerabilities could extend beyond the domestic financial system across borders. In November 2011, the FSB identified 29 such institutions and defined them as G-SIFIs (Globally Systemically Important Financial Institutions). Assets of G-SIFIs exceed USD$ 46 trillion, accounting for 22% of global financial assets and 66% of the World’s GDP--IMF WEO 2013 estimated global GDP to be around USD 70 trillion and global financial assets of around USD 209 trillion.

Addressing the vulnerabilities of SIFIs and the potential implications on the global financial system has been on the G20 leaders’ agenda since 2010. In an attempt to coordinate global efforts to mitigate these too-big-to-fail risks, G20 leaders have agreed to a multipronged and integrated set of policies that levied G-SIFIs with an additional loss absorption capacity tailored to the impact of their default, rising from 1% to 2.5% of risk-weighted assets (with an empty bucket of 3.5% to discourage further systemicness), to be met with common equity. The FSB will update this list annually and G-SIFIs are asked to report additional status and performance information and data that will be publicly available to keep markets updated. The initial time frame for adoption of the augmented provisioning should kick start by November 2014 and be fully adopted by January 2019.

The proposition of an additional absorptive capacity would require either raising new equity or reducing risk-weighted assets (RWAs), which means reducing trading activity and lending. The only way for banks to maintain business and avoid inflating their balance sheets is to lend off their balance sheets, either through helping companies to issue bonds, or through securitizations. This capital surcharge would not just hamper fundamental ratios of GSIFIs, but also could put pressure on global credit markets.

Figure (1): Assets and Tier 1 Capital for G-SIFIs (end FY 2012) Tier 1 Capital Vs. Assets (banks)

However, the main emphasis of this undertaking was on banks without a specific procedure to identify non-bank financial institutions that can be large enough to impose systemic risks.

SIFIs are not only banks but also non-bank financial services

From this point forward, we take stock of the US financial reform act and how it has attempted to mitigate potential vulnerabilities of SIFIs. The famous Dodd-Frank Act emphasized the need for a comprehensive financial sector reform program for the US which, among many measures, mandated financial regulators to identify systemically important financial institutions. The primary focus of the act is on banks, particularly commercial banks, designating all commercial banking groups with $50 billion or more in assets as SIFIs.

The complexity of the financial system also pushed financial watchdogs – members of the Financial Stability Oversight Council (FSOC) - to identify non-bank SIFIs in consultation with the Federal Reserve. This process will encompass finance companies, securities firms, life insurers, property insurers, hedge funds and mutual funds, etc.

Regulating SIFIs is not enough

The Fed’s recent designation of AIG, Prudential Financial and GE Capital as SIFIs raised the question again of how appropriately the Fed will be able to manage non-bank SIFIs with tailored regulation. Although more focused monitoring and enhanced regulation on special institutions, such as non-bank SIFIs, could properly prevent potential economic shocks and downturns, there are two sides to every coin. This designation of systemically important banks and FIs could be seen as a signal to market participants that these intuitions would never be allowed to fail and that government backup would be guaranteed due to their importance. In this respect, there is still much to consider and improve regarding best practices of regulation and supervision of SIFIs. Therefore, how appropriately the Fed applies the standard for banks to other non-bank FIs as well as insures is being closely watched. Chief Advisor of China Banking Regulatory Commission and President, Andrew Sheng also highlights the importance of an eclectic approach which offers more room for judgment and diversity of views not only for different countries, but also for the varied functions and features of special financial institutions.

Recent discussion by the World Bank on SIFIs:

In the same vein, the World Bank Group emphasizes that maintaining a robust and resilient financial system is fundamental for job creation and further poverty reduction. At the recent international seminar on Policy Changes for the Financial Sector, President Jim Kim underscored the importance of financial stability in achieving the institution’s mission of ending extreme poverty and boosting shared prosperity. Reducing the potential of future financial crises and shocks is a critical task to expanding financial inclusion and promoting sustainable economic growth, ultimately increasing economic opportunities for the poor. In this regard, the Financial Systems and Global Practice group is closely monitoring the global financial system, in which SIFIs play a significant role, and its development of practice.

Join the Conversation