Nobody cares about open data. And they shouldn’t. What people care about are jobs, clean air, safety and security, education, health, and the like. And for open data to be relevant and meaningful, it must contribute to what people care about and need.

We wrote a few weeks ago that the private sector is increasingly using open data in ways that are not only commercially viable but also produce measurable social impact. What is missing is financing that can help catalyze the growth of data fueled businesses in emerging economies. We are developing a fund that will address this precise need.

The context

Companies such as Climate Corporation, Opower, Brightscope, Panjiva, Zillow, Digital Data Divide and many others have shown that it’s possible to be disruptive (in established sectors such as agriculture, health and education), innovative (across the data spectrum - from collection to storage to analytics to dissemination), profitable, and socially impactful at the same time (see Climate Corporation’s Ines Kapphan, Metabiota’s Ash Casselman, and the GovLabs@NYU’s Joel Gurin talk about how how open data based companies are tackling complex, sophisticated development problems in high-impact business sectors – their path breaking work is clear evidence of the growing maturity of the industry).

The question however remains whether open data driven business is just a rich-world phenomenon or can entrepreneurs in emerging economies build great companies atop open data (a la examples above)?

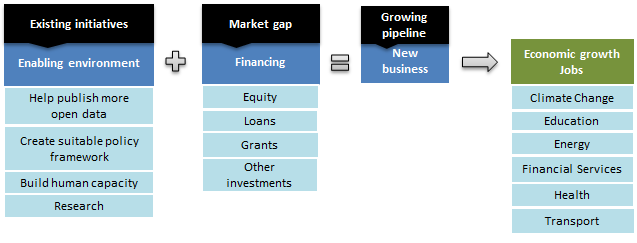

In our recent blog we identified four broad issues hindering the growth of data fueled businesses in emerging countries -

- Data - the raw material; sketchily available in most countries

- Policy - an enabler; not an area of focus in many economies

- People - the movers; very high-level skills required – often unavailable

- Financing - the catalyst; investors too risk-averse in a nascent market with unconventional needs

The Fund

In our opinion, this is a crucial gap and it may be very difficult to sustain open data initiatives without showing measurable development/economic impact (however much we might like to believe that open government data is a fundamental right that citizens have already paid for). In some ways, commercial success is one of the most tangible ways of measuring the impact of open data initiatives; commercial success can also help create the right sort of feedback loop that encourages governments to further open data and improve the associated policy environment. Data-based businesses also seem to occupy an interesting niche - profits plus social good (not universally but frequently enough). As the examples cited earlier demonstrate, the work of many data-oriented firms - based often on public, development-oriented data - has positive social consequences (Zillow helps create a more transparent real estate market, Opower helps reduce greenhouse emissions, Digital Divide Data helps create white collar jobs in underserved communities). The private sector is no panacea for development but for development agencies with an interest in open data, there is a compelling economic and development opportunity here.

We are thus working to establish a new fund (working title - POD Fund) that will invest in firms in emerging economies that have demonstrable market potential and that also focus on social outcomes. As governments open new data (followed perhaps by the private sector), the Fund will support firms that build new products and services that make money but also help resolve longstanding development challenges.

The Fund is still a concept but here’s a look at some questions we have heard repeatedly about it.

Who will establish the Fund (will it be a World Bank fund)?

All options remain on the table but we currently envisage the Fund to be an independent investment instrument managed by an external investment manager (whose investment choices will be bounded by parameters established by major shareholders). The investment manager should ideally have a global footprint and a track record managing similar funds. Watch this space for news about potential partners.

What will be the purpose of the Fund?

We are thinking of it as a market making fund, designed to address a specific market failure that makes it hard for entrepreneurs/firms to find financing for open data businesses in emerging markets. The idea is to get in early when pioneering data-driven companies are still struggling to establish a toehold - give them a leg up and create a powerful demonstration effect for more traditional investors to follow.

What will the fund invest in?

Companies in emerging economies that use data for social impact. The investments will be in the form of equity or loans and could even include investments in other funds. Much will depend on the nature of the markets the Fund begins to work in (countries such as Brazil, India, Indonesia, Mexico, and Russia are potential starting points but this isn’t an exhaustive list given that almost 60 countries now have ‘open government’ programs). Sectors of interest include transportation, energy, health and climate change.

What will be the structure of the Fund (who will invest in the Fund)?

We propose to set up the Fund with different layers of risk tranches bearing different risk/return profiles. The initial investors will likely have a keen interest in data for development, a long-term horizon, a strong risk-appetite, and a well-defined interest in social impact. The initial investors will also ideally have strong connections with either the government or the private sector in the early target countries/regions and possibly an established interest in one or more development sectors that might be the preliminary focus areas for the Fund.

Does a sufficient pipeline exist?

Yes. We’re in the middle of a pipeline evaluation in multiple regions/countries - India, Russia, Africa, Latin America, South East Asia among them - and the early findings are promising.

If there are such promising opportunities out there, why isn’t the private sector investing in these already?

The private sector is inherently risk averse and this is an extremely nascent market. Nowhere is this truer than in most emerging market economies. Therefore the World Bank Group can play a huge role by investing in companies with good potential to demonstrate to the private sector that good risk-adjusted returns can be achieved which, in turn, will catalyze more private sector investment and help grow the market.

Are investment sizes going to be too small to be profitable?

Perhaps. While we do see the potential of large investments, it’s likely that many investments will be relatively small. The Fund will thus require an investment manager that has experience structuring (perhaps standardizing) smaller deals. We are also hoping that the initial pipeline research will show that the portfolio can include loans to firms with an inherently good track record - albeit short - seeking to expand their current open data business or to expand their business to include open data.

Is lack of financing a critical problem precluding the growth of the open data economy?

Yes it is. Initial research shows many firms don’t have access to finance to either expand their current business or capitalize on good ideas and excellent people. However financing alone will not solve the problem. The environmental issues we identified earlier are fundamentally important - without data you can’t build data-oriented firms; without the right policies, it’s very easy to squelch innovation; and of course you can’t build companies without people with the right skills. It’s thus going to be crucial to ensure that the Fund works in close coordination with enabling initiatives on the ground. But financing is key - it adds accountability and results to the framework. If you are able to back open data-based companies that succeed, you are doing something right (and the results are typically black and white). Other open data goals - transparency, engagement, government accountability - remain valid but the commercial angle provides measurable benefits that are often missing from open data evaluation frameworks.

Will it be a purely commercial fund (what about development impact)?

Perhaps the most frequently asked question. And the answer is yes - we want the Fund to generate commercial returns. However, the World Bank Group (WBG) wouldn’t be involved if that were all. It is very important that the Fund generates a social return. We are very lucky that in the current environment more and more investors are looking for a double/triple bottom line. What is termed ’sustainable impact’ investing is a growth area – especially in emerging markets - as investors seek to diversify their return. Therefore, while it will be important that the Fund’s investment managers make sound commercial decisions – so the Fund can act as a catalyst for more money entering the system -- we will also ensure the investment guidelines stress development goals (we are in fact currently working to develop a framework to measure the development impact of the private sector use of open data).

What will it take to get the Fund off the ground?

A founding partner to start. We are reaching out to potential partners that can make the initial investment (The WBG’s private sector arm, IFC, has a track record in investing in funds such as these and we are currently working together to try and make this happen).

These are just some of the questions we have heard so far. It finally boils down to this - yes, it’s going to be a bet; the perfect information to make investment decisions isn’t available yet but the evidence of the potential grows every day and we believe the Fund can provide a large commercial return as well as make a significant development impact. However, given the nascent market, this is one area where we need both the main IBRD to work with governments to enable the environment as well as its private sector arm, IFC, to work with private sector companies to demonstrate the huge commercial potential. However, this isn’t even a play yet for most traditional investors - it requires one of more institutions that recognize the transformative potential of open data, care about the social impact, and that are willing to take the risks to create a new market. It requires leadership as well as the efforts of both governments and the private sector, through both arms of the World Bank Group - and its network of partners - to make this happen.

-----------------------------

World Bank Group Finances is the online access point for IBRD, IDA, and IFC open financial data. The website features datasets that cover loans, contracts, trust funds, investments, and financial statements. A relatedmobile app, which allows you to “talk” to us more easily about operational and financial data in nine languages, is available for download for Android and iOS smartphone and tablet users at the Google Storeand the iTunes Store, respectively. Follow us on Twitter to join and remain engaged in the conversation about the Bank’s open financial data.

Join the Conversation