Women solely own 30 percent of all properties in Sao Paulo, Brazil, versus men solely owning 50 percent. Photo: Romel Simon/World Bank

Women solely own 30 percent of all properties in Sao Paulo, Brazil, versus men solely owning 50 percent. Photo: Romel Simon/World Bank

In vibrant cities with promises of economic prosperity, it's easy to assume progress has touched everyone equally. However, a closer look reveals that urban landscapes are not always inclusive, especially for women, who face numerous challenges in property ownership , stemming from persisting social, cultural, and legal factors. In this context, a recent EFI Note, supported by The World Bank’s Global Tax Program (GTP) as part of its dedicated work stream focusing on the intersection of taxation and gender, sheds light on property ownership and taxation patterns in São Paulo, Brazil.

As the largest city in the Americas with a population of 12 million, São Paulo serves as a fascinating case study. While Brazil has implemented substantial legal safeguards to protect women's rights in property ownership—ensuring equal ownership and administrative rights for both men and women within relationships, equal inheritance rights for sons and daughters, and equal rights for surviving spouses irrespective of gender—we document distinct patterns of property ownership and wealth accumulation. The study uses an administrative property registry—a rich data set containing detailed information on properties’ characteristics, location, and ownership—to tackle three broad questions that can help policy makers better understand the dynamics of gender and property taxation.

What is the share of property owned by women?

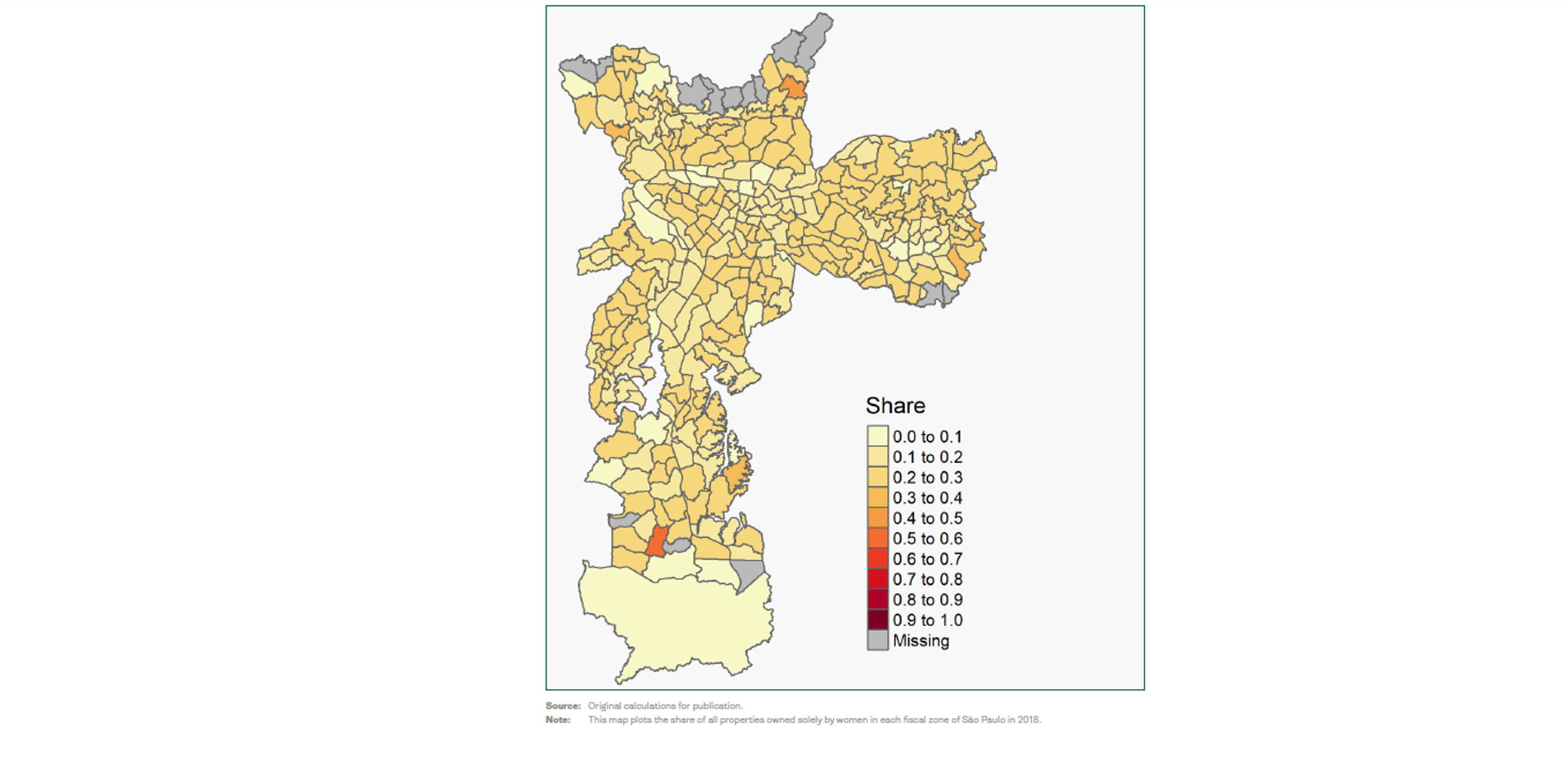

Women solely own 30 percent of all properties in the city versus men solely owning 50 percent. Approximately 9 percent of properties are jointly owned by two or more individuals from both genders, while the remaining properties are owned by firms. Gender gaps are even larger for commercial properties: while men solely own over 40 percent of commercial properties, women solely own only 16 percent; private firms own almost a third of all this type of property, and the rest are owned by public firms and jointly owned by women and men. Women's ownership share varies across the neighborhoods within the city (see Figure 1).

Figure 1: Women own approximately 30 percent of properties across the city

Source: Original calculation for publication.

Note: This map plots the share of all properties owned solely by women in each fiscal zone of São Paulo in 2018.

Do women and men own property wealth equally?

The average value of property solely owned by women versus men is very different. Properties owned by men are valued at R$270,000 on average, 20 percent higher than the average value of women-owned properties (for more on the methodology, see here ). Our findings show that in most of the property value distribution by district, the share of property values solely owned by women is around 30–35 percent. However, for properties in the top 20 percent of value, women ownership rapidly declines. For example, among the highest-valued properties (assessed above R$2.5 million), women ownership decreases to around 20 percent.

These patterns are seen throughout São Paulo, but the gaps are larger in zones with higher property values (see Figure 2). We observe significant gaps in the central zone and nearby areas, where the percentage of property wealth owned by women is often 10 to 30 percentage points lower than their share of property units. In the areas farther from the central zone and with lower property values, we often see smaller, or even positive, gaps favoring the share of property ownership for women.

Figure 2: Share of women ownership is particularly low for the highest-value properties

What are the implications of these findings for property taxation?

Since property taxes are calculated based on property values, women end up paying a smaller proportion of taxes. Despite a flat tax rate of 1 percent, the effective tax rate increases as the assessed property value rises due to exemptions and additional charges. The study shows that women are more likely to own fully exempt properties, with one-third of their properties being exempt, compared to 27 percent for men (see Figure 3). Additionally, properties owned solely by women contribute only 14 percent of the total property tax revenue, while those owned by men contribute 32 percent. Most of the remaining taxes are paid by properties owned by private firms.

Figure 3: Women-owned properties are more likely to be exempt of property taxes

Our findings provide valuable evidence of the persistent disparities that women face in owning property and property wealth in the biggest urban area in the Americas. On average, women own 20 percentage points less property than men, and this imbalance worsens in higher property value brackets. This has implications for property taxation, as women end up paying proportionally lower taxes since property taxation in São Paulo is increasing in property value. This analysis also serves as a motivating factor to pursue deeper research on the roots of these inequities and their implications for women’s welfare, to see more on this check other GTP funded work, as well as pinpointing effective policies that can foster and promote women’s property ownership, empowering women and fostering equality in the urban environment.

Join the Conversation