In many countries, childcare costs are one of the most significant family expenses. Photo: Binyam Teshome / World Bank

In many countries, childcare costs are one of the most significant family expenses. Photo: Binyam Teshome / World Bank

Recent years have shown an increased public empathy for parents struggling to juggle childcare and work responsibilities. In many countries, childcare costs are one of the most significant family expenses. Indeed, high childcare costs can incentivize women, particularly low-income women, to reduce employment hours or even stop working to become stay-at-home parents and cover childcare needs .

How can governments support parents with affordable childcare?

The World Bank’s Women, Business and the Law 2022 added new pilot research on laws for childcare provision in 95 economies to its longstanding legal research affecting women’s economic opportunities. The pilot data helps to identify regulatory interventions on the availability, affordability, and quality of formal childcare for children below the preprimary school starting age (typically below three years, in private or public settings).

When zooming in on childcare affordability, the pilot study focuses on three policies that could prove effective: (1) free public provision; (2) financial incentives to parents and private providers, including employers; and (3) support through the tax system.

Public childcare is offered free of charge in only a few economies

In only 10% of economies where the law regulates public provision of childcare (58 out of 95), such provision is mandated to be free of charge. These economies are Angola, Brazil, Georgia, the Republic of Korea, Malta, Mexico, Moldova, Peru, Spain, and Ukraine. The actual level of "free" provision is often not specified and might range from free education (i.e., tuition and training fees, school supplies, and textbooks) to supervision and care of children (i.e., maintenance of facilities, utility bills, teacher salaries). Direct government provision at no cost highly depends on the countries’ financial and human resources, implementation capacity, and political commitment. Other less costly approaches may include meals, which are covered in nearly 40% of the economies.

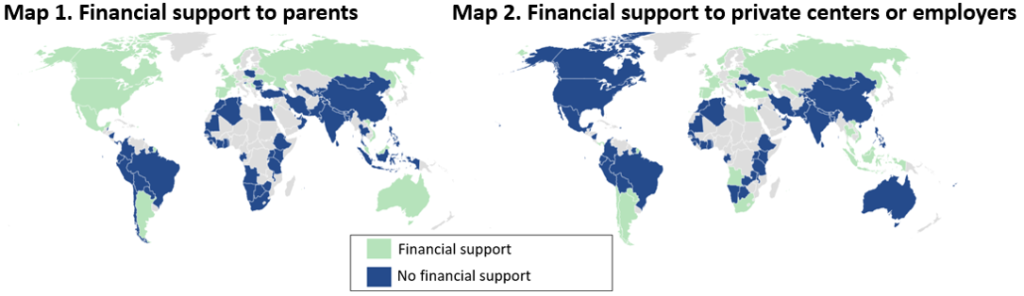

Financial support arrangements vary across regions

The pilot study reveals a variety of financial (non-tax) support arrangements for parents to reduce childcare costs and for private providers, including employers, to deliver high-quality services. Maps 1 and 2 illustrate that these arrangements differ widely across regions. Countries with constrained resources could prioritize low-income families to drive uptake by these families.

Source: Women, Business and the Law 2022.

Parents receive some form of financial support (e.g., subsidies, care vouchers, etc.) in nearly 30% of the studied economies for the use of childcare; none are located in Sub-Saharan Africa or South Asia . Financial support to parents is typically based on the family’s income and parents’ work status. A third of the economies covered provide support options for low-income families. Other support includes fee reductions (or exemptions) in Hong Kong SAR, China, and Croatia; grants and subsidies in Singapore and Mauritius; and state guarantee of access and priority enrollment in Brazil, the Philippines, and Chile.

Providers may receive financial support through direct payments to reduce their operating expenses and encourage the supply of services. Such financial support is vital for increasing the number of spots available in childcare facilities and enhancing service quality. Private childcare centers receive financial support in nearly 35% of the economies in the sample. Only five economies provide similar financial support to employers for establishing or supporting childcare services for their employees. Support can range from subsidies, allowances, and reimbursements to one-time grants.

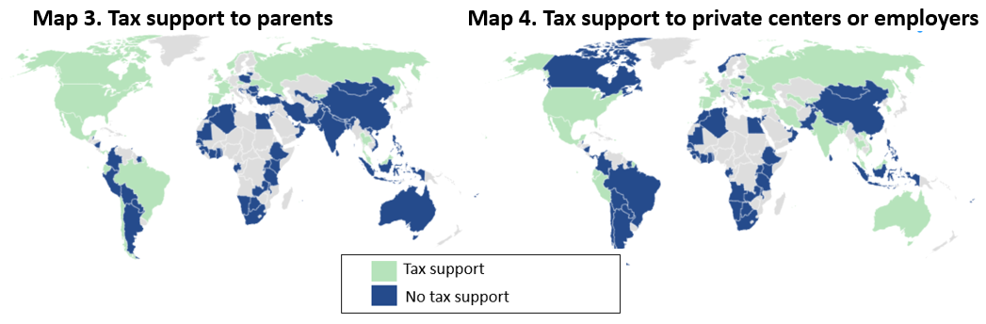

Preferential tax regimes are limited in most developing economies

Governments also grant preferential tax regimes to childcare providers or employers, as well as its uptake by parents (maps 3 and 4). These incentives can help families afford childcare by lowering the cost for parents and easing their participation in the labor force.

Source: Women, Business and the Law 2022.

OECD high-income economies provide tax benefits to support parents in using childcare services. None of the economies measured in South Asia or Sub-Saharan Africa offer tax benefits to parents. However, this tax approach may not be as effective, even if available. Many people in low- and middle-income economies are either below the income tax threshold or work in the informal sector. As such, they may not be able to take advantage of preferential tax treatment . Refundable childcare tax credits could assist low-income parents who are not required to pay taxes.

Tax support could incentivize providers to help set up childcare provision. Nearly one in four covered economies give tax benefits to private childcare centers. However, only one out of five economies grant employers tax benefits for providing or supporting childcare.

While tax systems might provide tax incentives to parents and providers directly, an even more important step is to increase revenues to finance high-quality childcare for a more gender-equal labor market. As such, taxation plays a crucial role in supporting women’s empowerment.

Moving the agenda forward to tackle childcare costs through public support

The lack of affordable childcare in many economies calls for new opportunities to build policy momentum. However, no quick fix or one-size-fits-all solution exists for public support . The necessary institutional and fiscal capacity needs to be put in place to cater effectively to make childcare more affordable.

The launch of the World Bank’s Childcare Incentive Fund in April 2022 raised childcare sharply up the global policy agenda. As childcare programs adapt, Women, Business and the Law will collect more robust data for 150 economies – to be further scaled up to 190 economies – to fill knowledge gaps around the design and effectiveness of childcare policies and to inform their successful implementation to increase women’s economic opportunity.

Why is it important to collect more data on the magnitude of public support mechanisms? Experiences from existing regulatory frameworks around public support present valuable, evidence-based lessons on how governments can improve affordable childcare for recipients and suppliers. More research is needed to identify best practices and core principles. Comparative learning data are essential to shifting traditional gender roles and bringing well-documented childcare benefits to the forefront as the catalyst for overall economic growth.

Join the Conversation