The Word "Economy" with businessman on blurred abstract background. | © Adobe Stock

The Word "Economy" with businessman on blurred abstract background. | © Adobe Stock

Governments play a pivotal role in shaping markets by setting the rules and incentives that govern them. They can also be active participants in the market through Businesses of the State (BOSs), which are companies with government ownership providing goods and services to consumers. While state ownership is often justified to address market failures, provide public goods, promote equity, or develop markets in sectors with high-risk, it can also have unintended consequences. The impact of state participation depends on the type of markets, regulatory environment, and how level the playing field is with privately-owned firms.

Traditionally, analyses of state participation have focused on centrally and majority owned firms in sectors like infrastructure, energy, and telecom. However, the World Bank's new Global Businesses of the State (BOS) database (Dall’Olio et al, 2022a) offers a more comprehensive view of state involvement in the economy and its multiple channels.

The database collects data on companies with direct or indirect government ownership of at least 10%, revealing the state's active role in competitive sectors like manufacturing or accommodation, which could be efficiently served by the private sector. This information spans over 90 countries and reveals the diversity in BOSs in terms of sectors, ownership levels, and corporate structures, both within and across countries.

What does the WB BOS database bring to the table?

- Unified definition: The WB BOS database provides a standardized definition of BOSs, allowing for international comparisons. This helps overcome issues related to variations in national legal forms and self-reporting. The database goes beyond majority and direct control by including entities where the state can influence markets through minority (10–49%) and indirect ownership.

- Ownership structures: Similar to a genealogical tree, the database illustrates how firms are linked to the state through direct and/or indirect connections, offering specific shareholding percentages and degrees of connection. These complex ownership structures shed light on government participation in domestic and international markets. For example, the largest firm in the database has 1,400 subsidiaries operating in 61 economic activities across 55 countries.

|

- Sector classification: The database covers BOSs that operate in a wide range of sectors, including agriculture, manufacturing, construction, wholesale and trade, and financial services, which are primarily comprised of private firms. By implementing a new sector taxonomy Dall’Olio et al. (2022b), the activities are classified into competitive, natural monopolies, or partially contestable based on their inherent technology and market failures. This taxonomy helps policymakers understanding the economic rationale for state participation in different activities and design sector-specific reforms to promote private sector-led growth.

Three Key Insights for Policymakers:

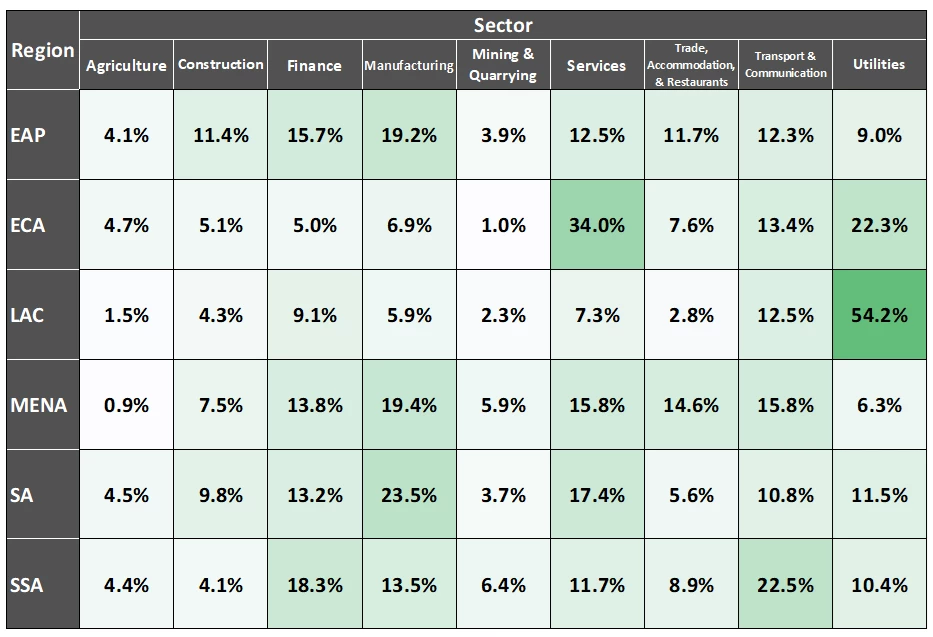

- Diverse State Participation: The state is active in competitive markets, where the private sector traditionally operates. Examples include manufacturing of food, apparel, construction, and accommodation services. About two-thirds of BOSs in over 90 countries operate in competitive markets. State participation in competitive markets can pose risks, especially when regulatory and institutional conditions don’t ensure a level playing field. The sector composition of BOSs also varies by regions (Figure 2).

Figure 2: BOSs are active in competitive markets in which private firms are likely to provide goods and services more efficiently although with variations across regions.

Source: Authors elaboration using the WB BOS Database for 91 countries as of February 2023. Note: This figure shows the share of BOSs in each main economic activity within a region. Summing shares across economic activities equals to 100% for each region.

Multiple Channels of Influence: The state influences markets through indirect shareholding and complex holding groups with connections across sectors. Understanding these relationships is crucial for assessing contingent liabilities, employment dynamics, competition risks, and value chain implications. It also helps in designing corporate ownership reforms and promoting transparency. For instance, state holding groups in manufacturing often span in construction, trade, and finance.

- Diversified investment strategy: Governments maintain a diversified investment strategy beyond majority ownership. Most BOSs in natural monopolies are fully owned, whereas in nearly 30% of the BOSs in competitive sectors the state holds minority participation ranging from 10-49%. This strategy is prevalent in mining, manufacturing, digital and financial services (Figure 4 , bottom panel).

Understanding these nuances and the extent of state participation in markets is vital for effective policymaking and reform. A "one-size-fits-all" policy approach won't suffice. This new evidence can guide policy makers around the globe in tailoring reforms for stronger private sector-led growth. Examples of such reforms are seen in countries like Kenya, The Gambia, Moldova, among others.

Join the Conversation