Can encouraging women who own informal firms to register their businesses help them increase their use of financial services? Yes, but only if you combine registration support with an information session at a commercial bank.

That’s according to a recent World Bank study, which included more than 3,000 informal firms in Malawi, of which 40% were women-owned.

While governments may wish to encourage firms to formalize, many firms choose to remain informal, as taxes impose additional costs on businesses, and they may not benefit from some of the potential advantages of formalizing, such as bidding for government contracts.

However, informality can come at a cost. As only registered businesses can open business bank accounts, remaining informal can translate into lesser access to formal financial services such as business loans, which can impact firm growth. In Sub-Saharan Africa, only 27% of women have an account at a financial institution, according to the World Bank’s Gender Data Portal. Among informal entrepreneurs in Malawi, the majority of whom have a personal bank account (60% of women and 55% for men). However, only 2% of the firms have a business bank account.

We tested three alternatives to bring firms into the formal sector and understand its impacts on financial inclusion and business performance:

- One group of was provided support to obtain a business registration certificate that offers access to formal markets but imposes no tax obligations.

- The second group received assistance for both business registration and tax registration.

- For the third group, the assistance to obtain business registration was supplemented with an information session at a bank.

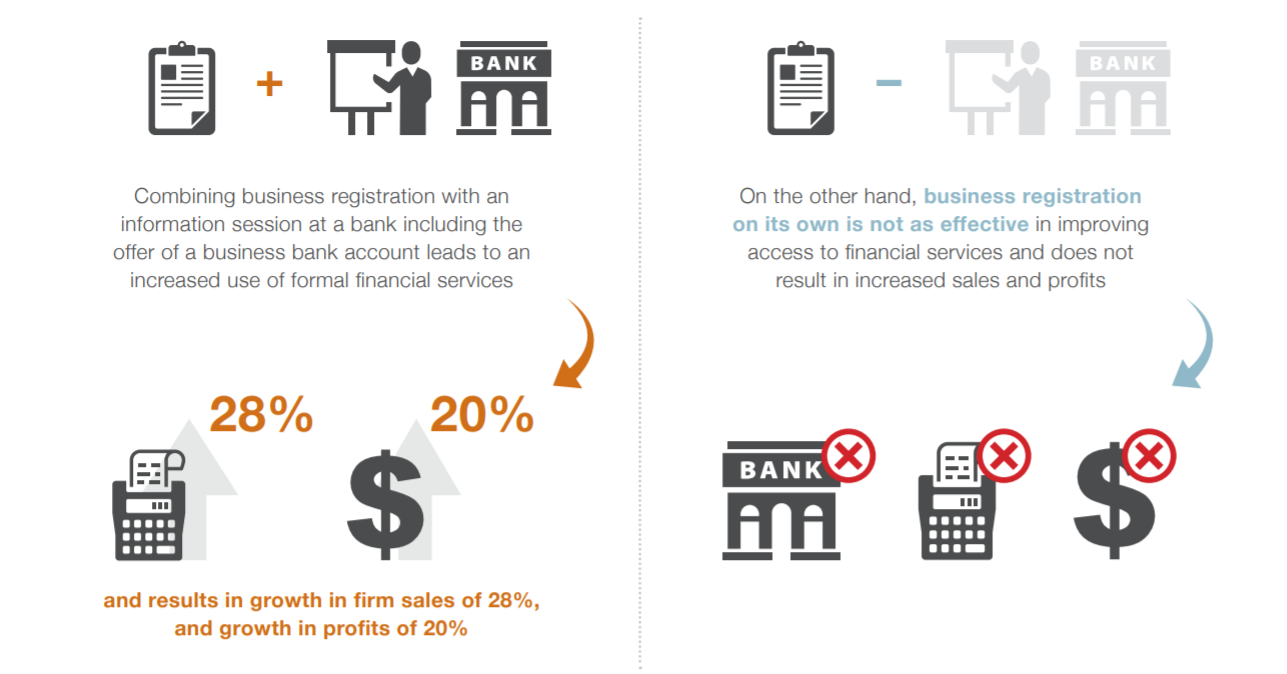

Business registration on its own did not lead to improving access to financial services or enhanced sales and profits, when compared with a control group of similar firms.

More interestingly, female-owned firms that received both the business registration assistance and an information session at a bank, not only had higher levels of formalization (83%), but also increased use of formal financial services.

Participants had higher rates of bank account ownership (whether personal or business) and were more likely to have above the median savings levels. Their savings were more likely to take place in a bank account rather than at home or in informal mechanisms and their business finance hygiene improved – there was an increase in financial record keeping, and participants were less likely to use business funds for household needs. Ultimately, this resulted in increases in sales and profits of 28% and 20% respectively in participating women-owned firms.

What are the key takeaways?

- When we make registration virtually costless, an overwhelming number of firms choose to register.

- Registration on its own delivers no measurable benefits to firms. There seems to be another, compounding, issue at hand: imperfect information. When we couple business registration with an information session at a commercial bank, benefits to the firm are prevalent.

- The combination of registration assistance and bank information session have the same (large and positive) effects on levels of business performance for women as it does for men. This is in contrast to small business grants and training interventions which have often struggled to be effective in growing women-owned firms.

- At a one-time cost of $27 per firm registered, this is an effective and replicable design to offer informal firms support to formalize, in a cheaper way than many other government business support programs.

For governments seeking to increase economic growth and achieve gender equality, reducing the costs of registration and coupling it with interventions that increase direct contact with formal financial institutions provide one compelling option.

Visit our Gender Data Portal to find interesting national data on men and women’s access to different types of financial institutions.

Join the Conversation