The COVID-19 (coronavirus) pandemic and the associated health measures taken to contain its spread have jolted the global economy, forcing many businesses to close and retrench employees. But what about businesses in fragile economies that were already facing serious operating challenges even before the pandemic?

To better understand the effect of the crisis on Somalia’s private sector, the World Bank Group (WBG) and United Nations Industrial Development Organization, with support from the Somali Ministry of Commerce and Industry and the Somali Chamber of Commerce, undertook a survey of businesses in the country in June and July 2020. The survey covered 550 formal businesses, including micro-enterprises, across five cities in the country: Baioda, Beledweyne, Bosaso, Kismayo and Mogadishu.

Unsurprisingly, the survey found that COVID-19 has inflicted deep and widespread impacts on Somalia’s private sector, contracting sales and employment by about 30% and leaving most firms with liquidity challenges. A more surprising and heartening result was that Somali firms by-and-large were optimistic for the future and for recovery. This might be because they have already built resilience and patience having struggled through multiple shocks in a country that has long suffered from instability.

Meanwhile, microenterprises, the dominant type of formal firms in Somalia, appear to have been less affected in terms of disruptions to their operations, sales, and employment compared to larger firms, although they did report facing pervasive liquidity and cash flow challenges.

The findings, outlined below in more detail, are already informing ongoing and planned WBG operations to help Somalia mitigate the impact of the pandemic and carve a path to recovery and growth. For example, the survey is informing the design of a World Bank project to expand micro, small and medium enterprise financing under the newly established Gargaara Financing Facility. The survey’s findings are also informing the International Finance Corporation’s efforts to deepen engagement with Somali traders through the Federal Chamber of Commerce and streamline import and export license processes.

Impact

The shock has widespread and immediate impacts on the private sector. Since the start of the pandemic, about 45% of firms surveyed had to suspend operations, on average for about seven weeks. Firms in Mogadishu, exporters, and those in manufacturing sector were more likely to close. Two-thirds of firms experienced weakened demand while 70% sustained disruptions to their supplies of inputs and raw materials. Sales and employment in June/July dropped roughly by 30% compared to 2019.

The loss of sales has negatively impacted the financial health of businesses, with 90 percent of firms facing liquidity and cash flow challenges. Almost 90 of the firms had already delayed payments on outstanding commitments to suppliers, lenders and tax authorities. About 75% of firms indicated that they would be unable to honor payments due over six months to come. Failure to honor commitments could weaken trust, which is so crucial in an environment like Somalia’s that lacks or has only weak formal institutions.

Coping Mechanisms

Businesses implemented several adjustments to minimize the impact of the shock. Changes to working hours and the workforce were the most common adjustments, which included a reduction in working hours (68%), wage reduction (59%), and laying off temporary (64%) and permanent (57%) employees. Half of the firms surveyed started online business activity, while 36% increased delivery and carryout services. About 15% of the firms adapted their products or services to cater to changing demand.

Expectations

In June-July, Somali firms were optimistic about future recovery, despite the challenges – perhaps an indication of their resilience gained having lived through other shocks. Almost all interviewed firms expected their sales and workforce to return to normal levels, roughly in about three to four months’ time following the survey.

While optimistic, firms faced immediate challenges and remained vulnerable to closure if the situation worsened. Somali firms don’t appear to have required resources to buffer potential extended effects of the pandemic. Asked how long they would be able to remain in business if sales stopped, they said on average for about 3.5 months. In Baidoa and Bosaso, the reported average was just two months.

Support

Four months into the crisis, only 1% of the firms surveyed said they had received some relief support, with another 1.5% expecting to receive relief over the next six months. Given the size of the shock, adjustments by firms alone might be insufficient to navigate the crisis: interventions to support businesses may be needed. Regarding specific support, about 54% of the firms cited deferring payments to service providers and tax authorities as their most desired type of support. Access to new credit was second, cited by 14% of the businesses.

Microenterprises

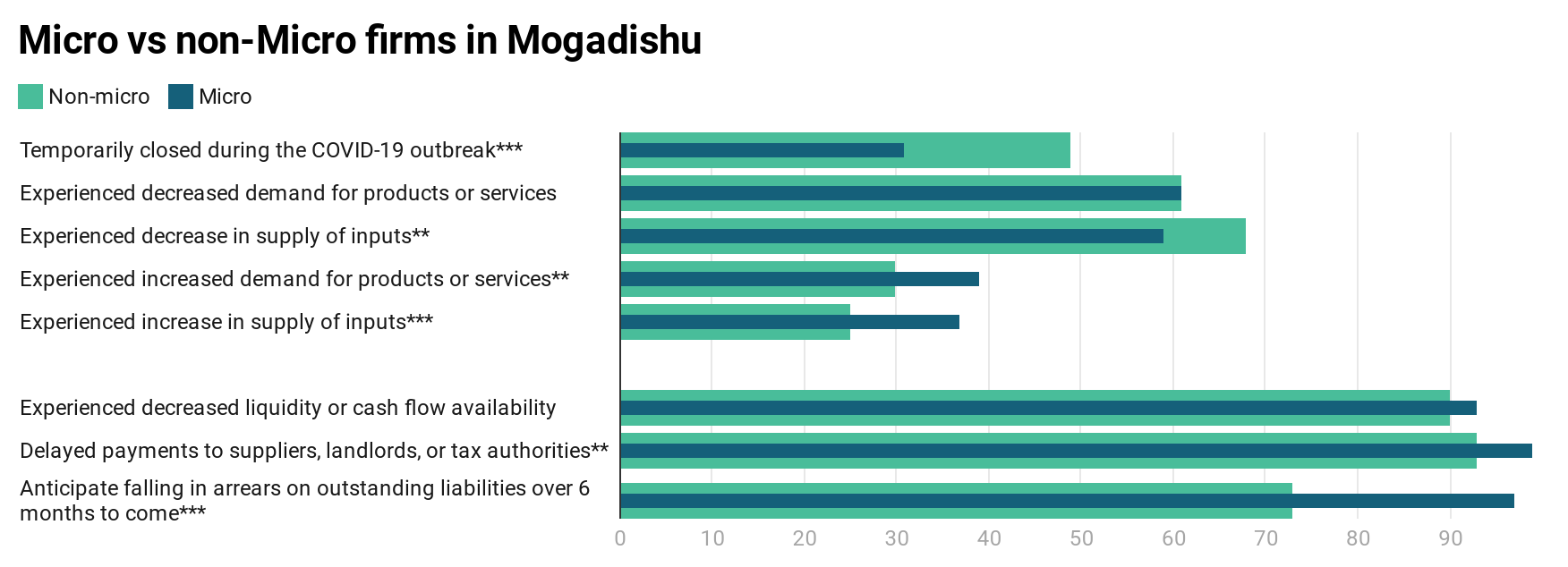

Microenterprises (formal firms employing fewer than five people) reported to be less affected in terms of disruptions to their operations, sales, and employment compared to larger firms, though they faced pervasive liquidity and cash flow challenges. About 31% of microenterprises in Mogadishu suspended operations because of COVID-19, compared to almost half of non-microenterprises (those with five or more employees). Relatively, a larger share of microenterprises compared to larger firms said they enjoyed a boost in demand for their goods and/or services. However, perhaps because of their limited resources to buffer shocks, more than 90% of microenterprises reported liquidity shortages, and almost all have had (or expect) delay payments to suppliers and tax authorities.

This survey is an excellent example of collaboration between the World Bank and IFC and with Somali government and other development partners, helping deepen understanding of COVID-19’s effects on fragile economies. And there’s more to come. A second survey is underway to monitor the impact of the shock and the recovery process. Data for both rounds of the survey will be posted on the Enterprise Survey website. A third survey, potentially covering more cities and informal businesses, is planned for 2021.

Join the Conversation