Composition of external PPG debt

Composition of external PPG debt

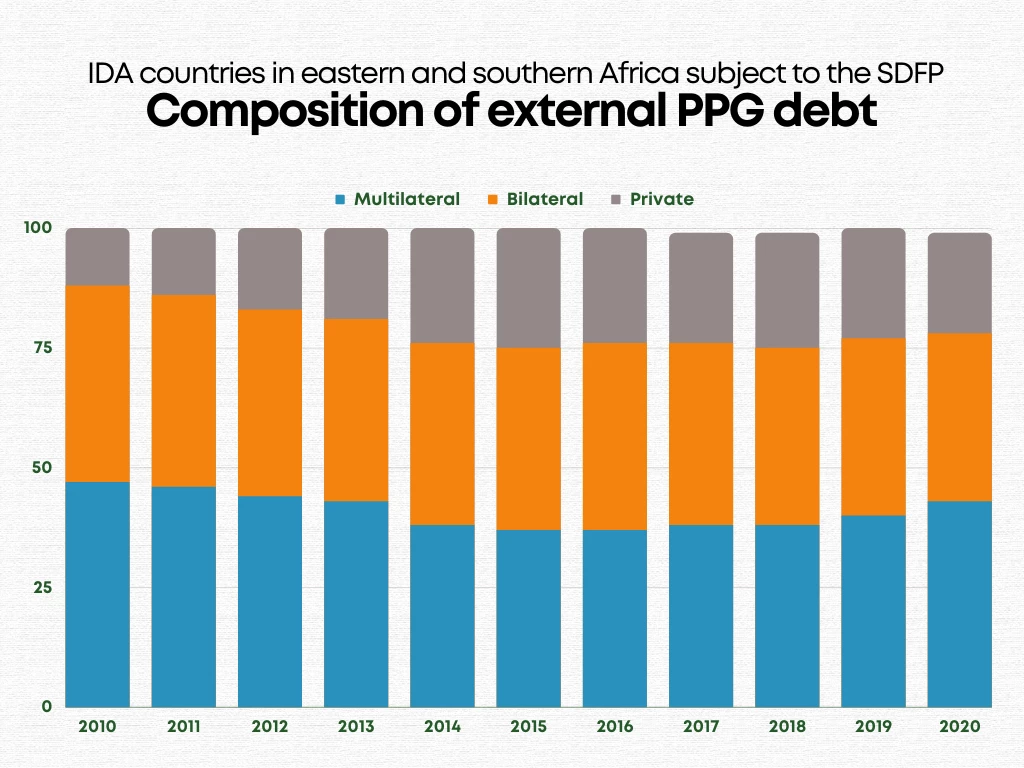

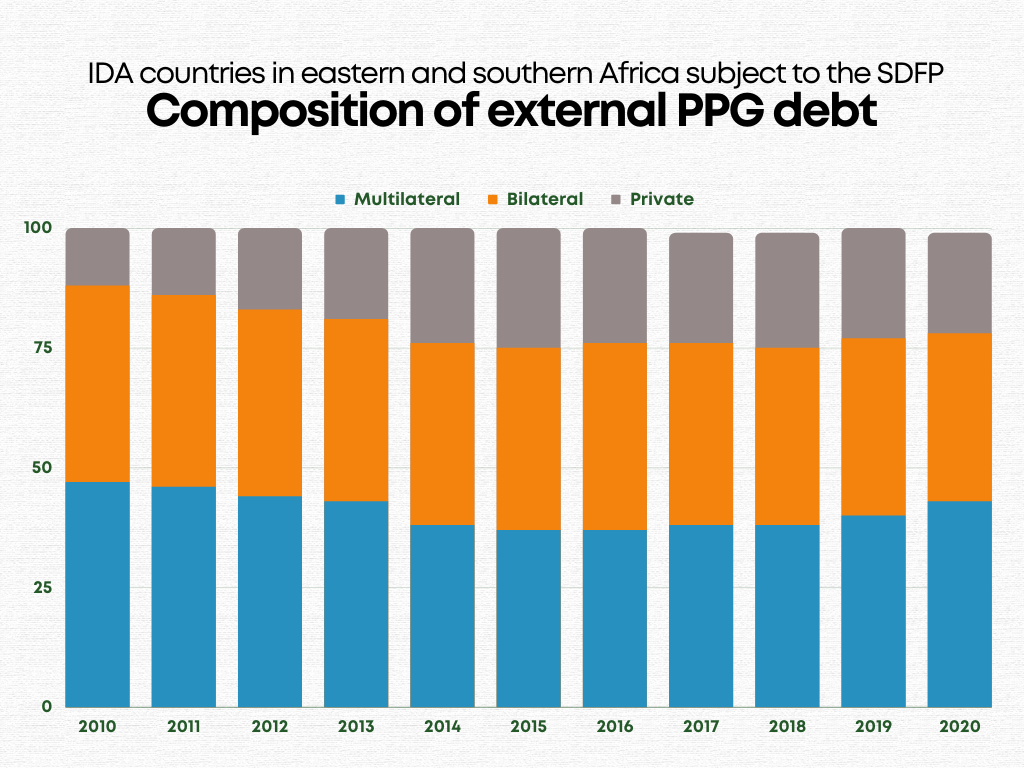

Levels of public debt across eastern and southern Africa’s low-income countries have doubled over the last decade. The region’s debt portfolio still predominantly contains multilateral loans (47%) and bilateral loans (35%). However, the share of highly concessional multilateral financing has been continuously declining over the past decade. This gap has been filled with private sector financing, which has increased by a significant 12 percentage points. Today, private sector financing accounts for about 19% of total debt in the eastern and southern African region. This happens as countries in the region shift to tapping the international markets and issuing large bonds (as was the case with Kenya and Rwanda last year).

These developments are a hard pill to swallow—especially in a region already battling other challenges like fragility, food insecurity, climate change, the socioeconomic impacts of COVID-19 (coronavirus), and the fallout from the Ukraine crisis. It’s also a region brimming with potential: With nearly half the population under the age of 18, people are the greatest resource. High levels of debt thus threaten programs that protect and build precious human capital.

|

|

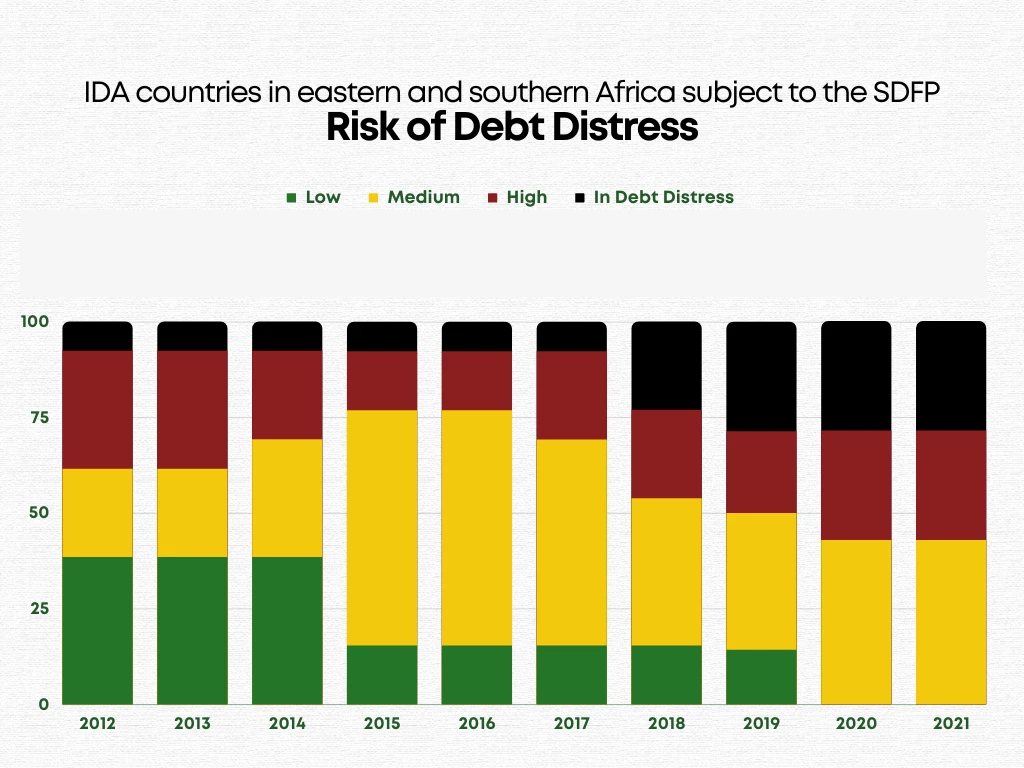

Charts showing the composition of external debt and risk of debt distress for eastern and southern African countries under the SDFP, as of December 31, 2021. Source: World Bank, International Debt Statistics Database. |

|

It’s important to underscore that debt per se is not the concern if used for high-yielding investment, along with strong growth and fiscal prudence. But debt quickly becomes problematic when it is costly, unnecessarily risky, or not transparently communicated. There are, however, ways to ensure that debt is sustainable, aligned with a country’s fiscal consolidation strategy, and supports growth. In fact, several important lessons have come out of the International Development Association’s (IDA) work in helping countries improve debt sustainability and transparency and strengthen debt management.

The World Bank’s IDA works with the world’s poorest countries. And through this experience, we have learnt that tangible outcomes require concerted action to borrow smart; a commitment to sustainability and transparency from borrower countries; and close coordination between creditors and borrowers. It is a change that will not happen overnight but with steps in the right direction, careful incentivizing and close coordination between a range of players, it is possible.

First, let’s understand the magnitude of the challenge

Over a dozen countries in eastern and southern Africa have benefitted from the Heavily Indebted Poor Countries (HIPC) initiative since the early 2000s, bringing much needed fiscal and financial respite. However, the region has seen a rapid increase in debt levels over the last decade, with a stark shift in the composition towards non-traditional financing flows. The pandemic has aggravated this increase, and further with rising fuel and food prices, including from the Ukraine war, debt is edging dangerously close to unsustainable levels in several countries in the region. Some 20 years later, 11 of the region’s 17 active IDA-eligible countries are at high risk of, or already in, debt distress. This is a stark reminder of how quickly countries can backslide into unsustainable debt positions without strong institutionalized reforms.

Incentivizing transparency, coordinating dues: The path forward needs commitment from all players

Such unsustainable and alarming trends call for countries to take action to borrow without sorrow.

Debt reforms have been high on the international agenda for some time, and while some reforms have taken place, the challenge remains in ensuring that these are accompanied by sustainable fiscal policy and economic growth.

By complementing other ongoing initiatives, IDA’s Sustainable Development Finance Policy (SDFP) seeks to incentivize countries to borrow sustainably while promoting coordination among creditors in support of countries' efforts. The first important action is commitment to reform, and actioning this. Since the SDFP’s inception in July 2020, 14 countries with elevated debt vulnerabilities in the region have committed to implement performance and policy actions (PPAs) to tackle fiscal and debt challenges head on. In the second year of implementation, PPAs are increasingly focused on enhancing fiscal sustainability--a longstanding challenge for the region--through managing fiscal risks from state-owned enterprises, improving domestic revenue mobilization, and prioritizing public investments. In some cases, these may build on countries’ earlier efforts to target such challenges, while taking a more holistic approach.

In the spirit of borrowing smart, this fiscal year, nine out of the 14 countries preparing PPAs have committed to only borrowing concessionally. This has three positive implications:

- It is helping to alleviate the unsustainable buildup of costly financing in many countries across the region.

- It is fostering a careful analysis of use of funds, thereby ensuring that costly financing is only directed to high priority- and high-return investments.

- It is helping convene creditors to the table on the discussion of ensuring countries have access to sustainable financing.

In fact, securing support from the international community is at the core of this kind of reform. Through its Program for Creditor Outreach, the SDFP leverages the World Bank’s role as a convener to promote stronger collective action, greater debt transparency and closer coordination among borrowers and creditors to mitigate debt-related risks.

At this month’s World Bank-IMF Spring Meetings, these critical conversations will continue. A range of stakeholders in the debt sphere—borrowers, creditors, civil society, academics, international financial institutions—will convene to engage in frank dialogue, while examining past lessons. Such platforms are essential to discuss, support, and advocate for debt sustainability, transparency and eventually—debt effectiveness, wherein the benefits of borrowing outweigh the risks. We invite you to stay tuned in to these important conversations about how countries can borrow without sorrow.

Join the Conversation