Light at the end of the tunnel? Update on the impact of COVID-19 on the private sector in Somalia

Light at the end of the tunnel? Update on the impact of COVID-19 on the private sector in Somalia

As documented in our previous blogpost summarizing the findings from round 1 of the Somalia COVID-19 (coronavirus) Follow-Up Enterprise, the pandemic and necessitated public health measures to slow down its spread have resulted in deep and wide-ranging disruptions to Somali’s private sector. How has the situation evolved since July 2020? To gauge this, a second round of the ES Follow-up Survey—conducted by the World Bank Group, the UN Industrial Development Organization with overall leadership and guidance from the Somali Ministry of Commerce and Industry, and the national Somali Chamber of Commerce and Industry—was conducted in Somalia in December 2020/January 2021, interviewing 498 (of 550 interviewed in round 1) formal businesses in five cities: Baidoa, Beledweyne, Bosaso, Kismayo and Mogadishu.

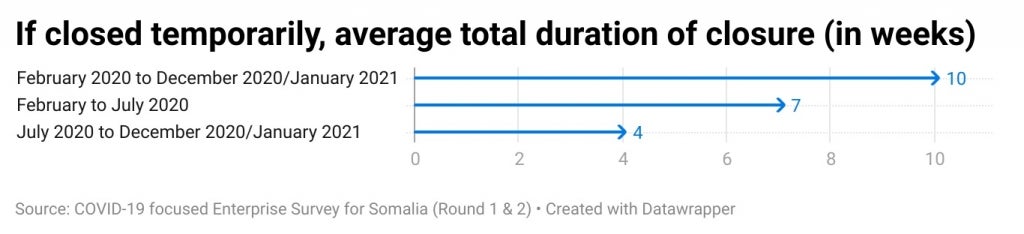

While the impact of the disruption on key performance measures eased since July 2020, it is too early to call it a recovery. Fewer businesses report suspending operations since July 2020 compared to the pre-July 2020 level, and the average duration of such suspensions is half of the pre-July 2020 level. In December 2020/January 2021, about 44% of the businesses faced disruptions to supply of inputs, raw materials or finished goods purchased for resale, down from 71% in June/July 2020. Sales in November/December 2020 were on average 10% lower than their levels in the same months in 2019. This is an improvement from the first round of the surveys where sales in May/June were 32% below their level a year ago.

Firms are increasingly relying on adjustments to their products and services and/or ways of delivering them as a coping mechanism. This is a change from the early periods of the crisis, where employment related cuts were the most reported adjustments. Almost three-fourths of Somali firms have adjusted their products or services since June/July, while 70% of the firms have adjusted means of delivering goods and services. While this could be a sign of return to pre-COVID-19 normality, it could also be because firms have utilized workforce related adjustments extensively in the early stages of the pandemic and therefore there is limited room for further cuts in employment. It could also be that firms have by now learned better how to adapt their operations to wither the impact of the shock.

Adjustment to workforce is not insignificant, however. Forty-seven percent of the firms reduced working hours in November/December 2020 compared to the same month in 2019; this is down from about 70% observed in June/July 2020. About 45 % of the firms note reducing the number of temporary workers (and 46% of them reduced permanent workers) compared to the pre-COVID level. By November/December 2020, Somali firms have shed 37% of their full-time permanent employees compared to the level in February 2020.

There is also a growing importance and demand for external finance since the initial periods of the crisis. Bank loans was the most common means of bridging liquidity and cash flow shortages in December 2020/January 2021 (reported by 46% of the firms), up from just 14% in June/July 2020; in June/July 2020, delaying payment which was the most frequently cited mechanism reported. Access to credit is also the second most desired policy support cited by firms to help them navigate the impact of the pandemic, the first being deferral of payments to lenders, suppliers, and other service providers. While this could be a sign of a start of a recovery process, access to credit still remains a big challenge in Somalia, with 68% of the firms in five cities considered as credit constrained, either discouraged to apply for a loan or their applications rejected since the COVID-19 outbreak.

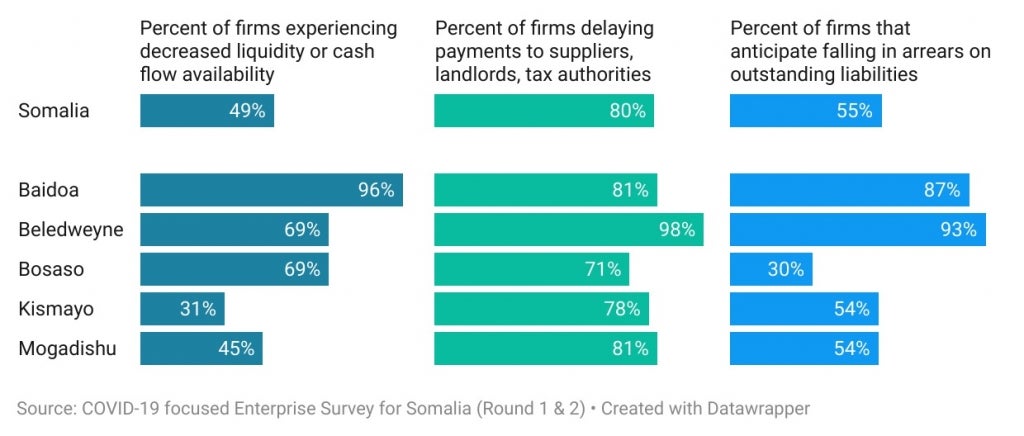

While firms are optimistic about the future, uncertainties remain. Almost all interviewed firms expect their sales and workforce to return to their normal levels, roughly in about three to four months from the time of the interview. Asked what their sales would look like six months into the future from the time of the interview, reinforcing this general optimism, 62% of firms note that their sales in June/July 2021 would be higher compared to the same months in 2020. Similarly, 57% of firms note that their workforce would be higher its level in June/July 2020. While this optimism is a good sign since it plays a pivotal role in firm’s decisions on investments and hiring, significant challenges remain. Almost half of the firms report facing liquidity and cash flow shortages, while about 80% of the firms note delaying payment to suppliers, landlord and tax authorities. Close to 55% of the firms expect to fall in arrears in any of their outstanding liabilities in the next six months from the time of interview. Coupled with existing structural issues, including limited access to credit, and limited government support so far, these call for close monitoring as business navigate the recovery. This is particularly so given the recent uptick in COVID-19 cases in Somalia right after the round 2 survey was completed.

This survey continues to be an excellent example of collaboration between the World Bank and the International Finance Corporation (IFC) and with Somali government and other development partners, helping deepen understanding of COVID-19’s effects on fragile economies. The survey has informed the design of the World Bank COVID-19 response operations, including additional financing for the Somalia Capacity Advancement, Livelihoods and Entrepreneurship through Digital Uplift Project, which was approved by the World Bank Executive Board of Directors on June 9, 2021. The project will expand access to finance to support the recovery of viable but vulnerable micro, small and medium enterprises (MSME) in targeted productive sectors, with special focus on women-owned and -managed businesses. The survey also helped fast-track the pilot launch of Somalia’s Business Registration and Licensing System by the Ministry of Commerce and Industry and jointly supported by World Bank and IFC. The new system facilitated online registration of businesses with lesser visits to government offices in times of COVID-19. In addition, the survey informed IFC’s support to the small traders who have been adversely impacted by COVID-19 through ongoing implementation of the Somalia Trade Information Portal as a tool to provide greater transparency of accessing trade related laws, regulations and measures.

A third round of survey is planned for August 2021 to monitor the lingering impacts of the shock and the recovery process. Anonymized micro-data for round 1 and 2 surveys can be downloaded freely from Enterprise Survey website.

Join the Conversation