Photo: Arne Hoel/World Bank

Photo: Arne Hoel/World Bank

If you are reading this blog, you are probably an average formal sector wage earner; like Marina, a human resources specialist in a small country that we’ll call Frictionlesslandia. Marina works for a small firm that, like all firms in her country, reports its activity to the authorities and complies with all regulations regarding its employees. Marina and her employer pay into contributory social protection systems like unemployment insurance and public pensions. She’s also automatically enrolled in her company’s long-term savings program, which deducts a small amount of money from each paycheck to be put into a secure account she can access in the future. Marina is on cruise control, global pandemic notwithstanding, to build a strong safety “cushion.”

The thing is, Marina might be real, but (surprise!) Frictionlesslandia is not. Her situation is the exception, not the norm, in most low- and middle-income countries. While many workers are formally employed, others are employed in the informal sector, are self-employed, or have other types of informal economic activity (ILO estimates that before the COVID-19 pandemic, around 2 billion workers were in informal employment worldwide). In Africa, it is estimated that 86% of employment is informal. These workers are not as protected as Marina. Their work is unregulated by labor laws and highly unlikely to have access to the type of instruments that prepare the Marinas of the world for expected and unexpected shocks to income and employment. Their ability to save regularly and consistently using formal, reliable instruments linked to employment income is limited by a multitude of structural barriers; they may face liquidity constraints, low financial literacy, transaction costs, a lack of information, bureaucratic hassles, time costs, and more. They live in Frictionlandia.

Governments should address these structural challenges, but it can’t stop there. Providing access to and information about beneficial savings schemes does not guarantee uptake or use as policymakers intended. Saving for future economic shocks requires individuals to make a series of decisions and actions, each with its own set of challenges. Behavioral science — the study of how people make decisions and behave — provides a complementary lens to help policymakers uncover those additional bottlenecks and design effective policies that address them, so saving schemes to strengthen resilience (i.e., preparation and protection from economic shocks) can better respond to the needs and realities of their intended users. In a region like Africa, with high informality and limited fiscal capacity to support unprotected workers, low-cost solutions informed by behavioral science are invaluable.

A journey-based approach to improving saving among informal economy workers

Achieving resilience to financial shocks is a journey with many roadblocks for anyone, more so for informal sector workers who cannot benefit from schemes built for formal sector workers like Marina, leaving them more vulnerable than they already are.

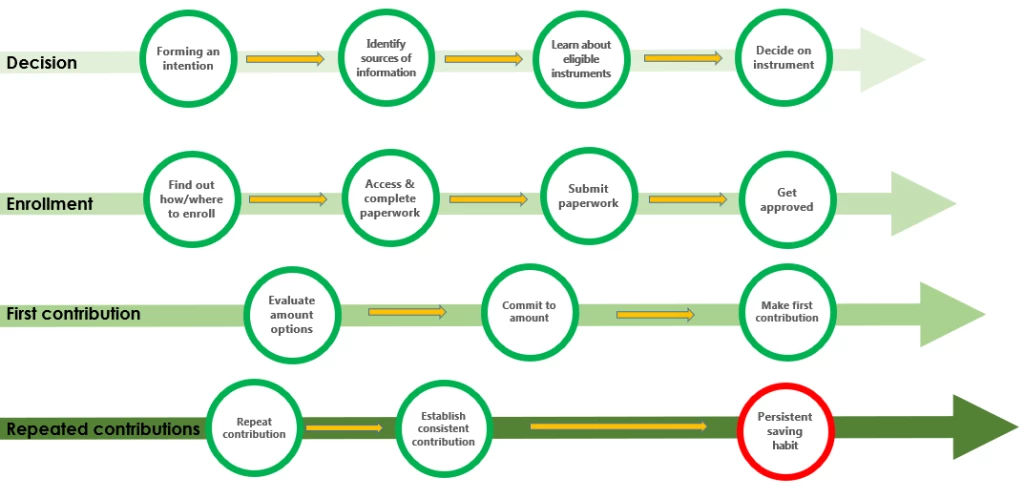

The long journey to resilience (shown above) begins with a decision to save, which requires forming an intention, identifying and absorbing information about (multiple) savings instruments and ultimately deciding on one (or more); followed by enrollment in an instrument, which requires identifying how and where to enroll, accessing, completing and submitting paperwork, and ultimately getting approved. Only then can contributory saving occur, requiring first an evaluation of the contribution amount options, committing to an amount, and making an initial contribution. The journey continues even after saving has started; individuals must repeat their contributions until ultimately forming a persistent saving habit. Exhausted yet?

Applying a behavioral science lens can help us see the many potential bottlenecks in the journey to resilience that individuals might experience at each stage. And in particular, to zoom-in on less visible barriers that might impact whether a person saves or not: From the mental burden of handling complex information, especially amid a very demanding “today” that makes hard to think about tomorrow (scarcity), to the lack of a social norm around saving (e.g. “nobody around me does it, everyone distrusts banks”) and preferences for smaller, immediate rewards over larger ones in the future (present bias) during the decision stage; the tendency to delay actions that feel difficult (procrastination), being deterred by seemingly small hassles (for us) and a lack of trust in key actors during the enrollment stage; and the difficulty in starting and sticking to new habits during contribution stages, whether due to status quo or aversion to losing liquidity in the short term.

Studies have demonstrated that innovative tools and strategies informed by the behavioral sciences — many of which harness digital platforms that are expanding rapidly in the COVID-19 world — can be used by policymakers to address these barriers:

- Alter the way information is presented (framed) to make relevant elements more salient, reduce over-information, and simplify it. This includes when and how information is given to people and how it is distributed. When and how choices are given needs to help individuals weigh the costs and benefits of the available options;

- Remove friction in the enrollment process by eliminating unnecessary steps, simplifying paperwork, or automating steps when possible, and adjusting where and how to enroll;

- Redesign the product to strengthen intentions to contribute and facilitate follow-through via tools like visualizing one's future self, behaviorally informed gamification (showing promise in South Africa), smart contribution defaults, and commitments now to gradual increases in contributions during higher cash flow periods; and

- Keep savings goals top of mind with strategies such as timely reminders (proven effective in Kenya) or partitioning accounts to align with personal goals.

These solutions can be tested with small populations, refined, and scaled. If we want governments to give their citizens more opportunities to live as securely as Marina does, programs and policies must adapt and respond to the realities and diversity of workers in the informal sector, even if this means keeping the myth of Frictionlesslandia alive.

Join the Conversation