Small store in the village, Madagascar. Pierre Jean Durieu / Shutterstock

Small store in the village, Madagascar. Pierre Jean Durieu / Shutterstock

As public debt reaches the highest level since the early 2000s across Sub-Saharan Africa, governments are under serious pressure to mobilize revenues or face either default or austerity measures. Tax evasion and avoidance, often in the form of illicit financial flows, are often overlooked, despite accounting for 3.7% of GDP.

Taxation is one of the most important instruments a government has to reach economic, political, and social outcomes. It plays a primordial role in a country’s life, especially in implementing development objectives set by decision-makers. There is a need for African countries to implement targeted policies to maximize revenue mobilization and prevent tax revenue losses. But African countries need to work together.

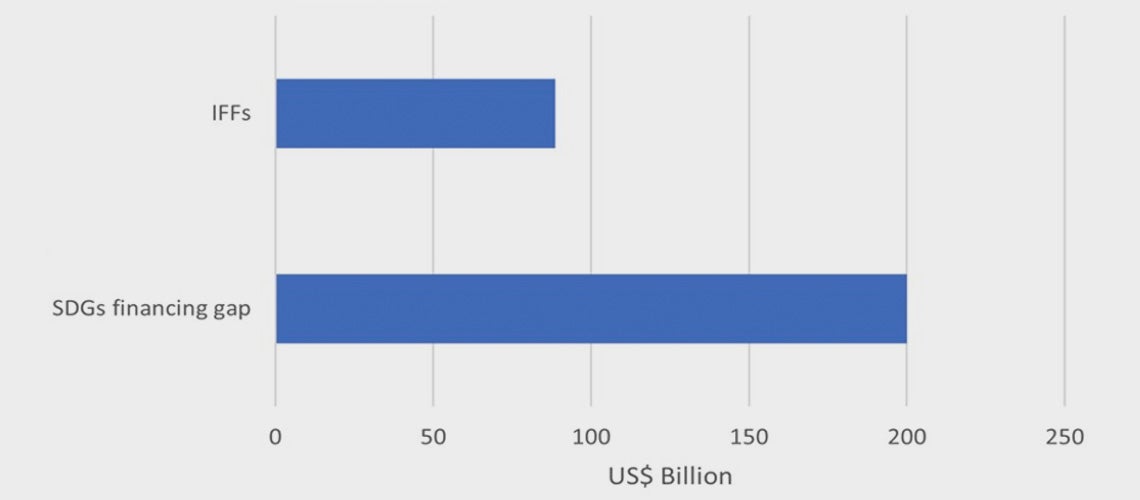

Studies suggest that Africa is a ‘net creditor’ to the rest of the world in the sense that the stock of capital flight exceeds the continent’s liabilities. In 2013, an African Development Bank and Global Financial Integrity Report titled “Illicit Financial Flows and the Problem of Net Resource Transfers from Africa: 1980 - 2009” revealed that over the period 1980-2009 Africa, on an inflation-adjusted basis, lost between $1.2-$1.4 trillion via illicit financial flows (IFFs) alone – a loss of approximately $1,146 per person. A recent UNCTAD report indicated that Africa loses $88.6 billion through IFFs each year, representing approximately 3.7% of the continent’s GDP. This is nearly half of the $200 billion financing gap needed to reach the SDGs by 2030 in Africa. These IFFs are almost equivalent to the Official Development Assistance (ODA) and Foreign Direct Investment (FDI) of all African countries combined and often take the form of corruption (including facilitation of payment such as bribes by companies), illegal exploitation, tax avoidance, and tax evasion.

Figure 1: Illicit Financial Flows vs Sustainable Development Goals financing gap in Africa

Source: Constructed by authors using data from UNCTAD 2020.

Addressing illegal exploitation, tax avoidance, and tax evasion requires a multifaceted approach, and regional cooperation can play a vital role in curbing losses. Our blog outlines three regional approaches that African countries could jointly adopt to reduce tax revenue leakages and enhance regional domestic revenue mobilization:

- strengthen regional tax bodies and cross-border cooperation;

- enhance digitalization of tax administration;

- promote universal adoption of automatic exchange of financial account information.

Strengthening regional tax bodies such as the African Tax Administration Forum (ATAF) and the West African Tax Administration Forum (WATAF) to share information and best practices to enhance tax compliance and combat tax evasion and avoidance.

The ATAF and the WATAF are regional tax organizations that promote cooperation and collaboration among African tax authorities by providing platforms for exchange of information, best practices, and experiences. Strengthening some key activities of both organizations, such as capacity building, research and analysis, advocacy and communication, cooperation, and collaboration would help countries take a step towards curtailing tax evasion and avoidance. Establishing a similar regional tax organization (such as WATAF in Central Africa and the Southern African Development Community (SADC)) could also assist. ATAF provides technical assistance and training to tax administrations in member countries to improve their capacity to administer taxes effectively, a key factor for this effort.

Enhance digitalization (technology) in tax administration

The adoption of technology in the taxation system can reduce tax evasion through the exchange of information across the different tax systems within and outside the continent. The low uptake of technology in tax mobilization is partly due to budgetary constraints. Furthermore, the restricted availability of internet connectivity has hindered technology adoption for tax payments, particularly in rural regions. Rwanda deployed Unstructured Supplementary Service Data (USSD) application to overcome the internet connectivity challenges, which has grossly improved the use of technology in tax payments.

Just as technological advancement has improved efficiency in different aspects of our lives, it can also assist tax authorities from different geographical areas to collaborate and strengthen the tax systems. Adoption of technology would lower tax evasion and enhance tax revenue mobilization via the use of standard tax software to collect and share companies’ financial records and electronic invoicing and automated reporting.

Without effective integration of technology into taxation administration, it is difficult to ascertain the true state of tax evasion and difficult to develop a roadmap for curtailing it.

Universal adoption of automatic exchange of financial account information

The idea of using technology is imperative to ensure transparency in tax payment and administration and this entails three things: availability of information, access to information, and exchange of information. Within the tax authorities, the exchange of information unit carries out these functions. However, only a few African countries have a functional exchange of information unit. This obviously slows down the pace of tax information sharing with countries within and outside Africa. African leaders need to collaborate and support each other in ensuring that all African countries have a functioning exchange of information unit.

The first step towards that would entail the effective implementation of the 2021 Automatic Exchange of Financial Account Information (AEOI) strategy. Four African countries – Mauritius, Nigeria, Seychelles, and South Africa exchange information on a reciprocal basis, while Ghana adopted a non-reciprocal. This shows that there is increasing room for African countries to participate in AEOI.

The 2022 Tax Transparency in Africa Report states that between 2014 and 2021, $244 million was identified and mobilized by nine African countries through the Exchange of Information Request (EOIR) initiative. However, two challenges remain – Exchange of Financial Account Information (EOI) infrastructure and tax administrator capacity. The African Union and development partners have strategic roles to play in assisting African countries to address the infrastructure shortage and the capacity gap, and the Africa Initiative of the Global Forum on Transparency and Exchange of Information for Tax Purposes could be leveraged to assist with this. For instance, the development partner could link their financial assistance to African countries to improve tax administration and adherence to Exchange of Information standards.

We hope countries can consider adopting these regional approaches. The effectiveness of policies curbing tax evasion and tax avoidance depends on the commitment and cooperation of African governments, regional bodies, and the support of development partners and civil societies.

Join the Conversation