Strengthening the Financial Resilience of Pastoralists to Drought in Mali

Strengthening the Financial Resilience of Pastoralists to Drought in Mali

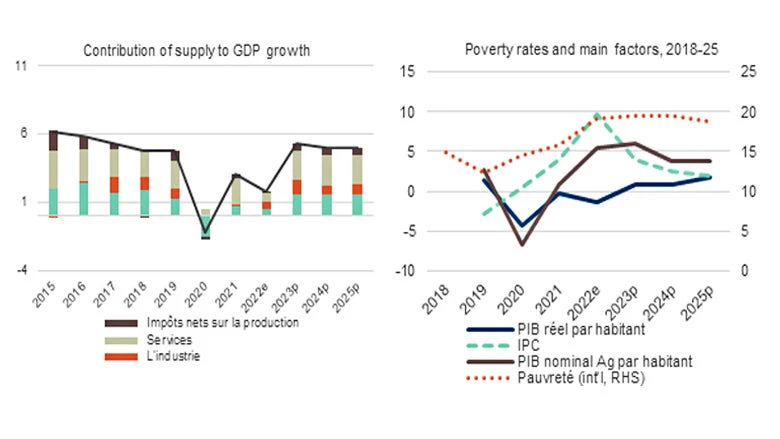

According to the 2023 World Bank Economic Update for Mali, entitled “Strengthening Financial Resilience of Pastoralists to Drought,” Mali’s economy showed signs of resilience despite ECOWAS sanctions, high food inflation, and parasite infestations affecting cotton production. GDP growth is estimated at 1.8% driven by the recovery of food agriculture and the resilience of the gold and telecommunications sectors.

Economic growth still not strong enough to move the needle on poverty

According to the estimates, there was a sharp increase in Mali’s poverty rate, which rose from 15.9% in 2021 to 19.1% in 2022, owing to negative GDP per-capita growth (-0.9% per capita) and high food inflation (13.9% in 2022) , disproportionately affecting the poorest households that spend a higher share of their budget on food. The report highlights the correlation between the government’s policy response to cushion families from the impacts of food and energy inflation and the rescheduling of its fiscal consolidation exercise.

The forecast for 2023 is fraught with risks surrounding the timing of elections and tightening of financial conditions

Further delays in the electoral process could trigger a fresh round of ECOWAS sanctions. The higher cost of securing financing in the regional market, given Mali’s high gross domestic financing needs, is the other major risk that has emerged in the last 12 months. Tighter monetary policy drove higher yields for 6-12-month Treasury bills and 5-year Treasury bonds for WAEMU countries. Liquidity and rollover risks coupled with ensuing public finance constraints could produce a drag on the wider economy and on society, when social spending and investment are cut and the risk of accumulating arrears grows.

Figure 1: GDP growth, supply side contribution, and poverty rate

Heavy economic losses, growth volatility and a sharp increase in poverty are expected to follow in the wake of climate change-related shocks in Mali

Mali was already severely exposed to recurrent droughts, floods, and locust invasions, which had major economic and social repercussions. Between 1970 and 2020, the country suffered at least 40 major shocks. Drought, for example, is estimated to have affected about 400,000 persons each year and led to $9.5 million in lost earnings from crops annually.

According to the World Bank’s 2022 Climate Change Development Report (CCDR), the Sahel region is one of the most vulnerable to climate change. Most climate scenarios forecast higher temperatures for the region, while rainfall is likely to become more irregular. The CCDR estimates that Mali’s annual GDP could contract by 10.7% by 2050 as a result of climate change if no adaptation measures are implemented. Livestock farming (15% of GDP in Mali) is highly vulnerable to climate shocks.

Disaster risk financing and insurance (DRFI) provide mechanisms that can be used to alleviate the negative socioeconomic impacts of climate shocks, such as droughts

DRFI mechanisms are geared toward building the financial resilience of countries, households, and farmers to climate shocks by providing them with targeted and timely financing in response to shocks or imminent shocks. The DRFI toolkit includes market-based instruments (for example, insurance schemes, catastrophe bonds and swaps), contingency financing (credit, for example) and budgetary tools (e.g., a dedicated reserve fund or a contingency budget). Against a backdrop of increasing climate-related risks in the agricultural sector, a feasibility study was conducted in Sahel countries to assess the feasibility of regional index-based disaster risk financing insurance (IBDRFI).

The IBDRFI uses satellite observation to anticipate the availability of fodder for livestock and provide timely support to pastoralists in case of major drought. The report indicates that approximately 15% of Mali’s territory could deliver IBDRFI solutions for pastoralists and, following an in-depth analysis, a further 10% could be added, corresponding to over 60% of Mali’s livestock.

Join the Conversation