ESG concept of environmental, social, and governance in sustainable business| © shutterstock.com

ESG concept of environmental, social, and governance in sustainable business| © shutterstock.com

In 2019, 90% of S&P 500 firms published sustainability reports, up from only 20% in 2011.1 Pressure is mounting for companies worldwide to disclose Environmental, Social, and Governance (ESG) information. Investors like BlackRock are voting against companies such as the US oil giant ExxonMobil because of their insufficient progress on integrating climate risks into their business models and disclosures.2 More and more countries are mandating institutions to disclose ESG-related risks, including China and South Africa. In the European Union (EU), listed companies, banks, and insurance companies with more than 500 employees must include a non-financial statement as part of their annual public reporting obligations under Directive 2014/95/EU, also called the Non-Financial Reporting Directive. Whether the United States will mandate ESG disclosures is still being discussed, but large US corporations operating in the EU are expected to comply with EU rules.3

A key concern with mandating ESG reporting is whether it can have effects on firms’ financial policies and performance. Opponents of mandated ESG disclosure argue that it may generate negative externalities. For example, firms that already disclose ESG information may be penalized if they need to differentiate themselves from their competitors, resulting in higher costs and potential losses of shareholder value. On the other hand, more and better disclosure can lead to tangible capital market benefits such as improved liquidity, lower cost of capital, higher asset prices (or firm value), and better corporate decisions.4

One key potential benefit is improvement in investment efficiency. Financial reporting has been shown to affect firms’ investment behaviors by reducing information asymmetries and agency costs, improving external monitoring, and reducing inefficiency in managerial decisions, or by learning from peer reporting. Although ESG and financial disclosure differ in terms of the set of stakeholders that rely on each type of information as well as their use, ESG reporting has the potential to improve information dissemination and reduce information asymmetries between managers and investors. This reduction of agency costs may in turn improve investment efficiency, as investors may be willing to provide capital and enable financially constrained firms to access new investment opportunities.

In a recent paper, we use the EU Directive as a shock to examine whether US firms exposed to mandatory ESG disclosure (“treatment” firms) improve their investment efficiency relative to firms not affected by these reporting requirements (“control” firms). Firms impacted by the EU regulation are those that have significant operations in EU countries and meet the criteria specified in the Directive. To proxy for investment efficiency, we follow the prior literature on financial reporting and investment efficiency and distinguish between firms prone to underinvestment because of adverse selection problems, and firms likely to overinvest due to managerial empire building. Firms that are likely to underinvest are those with relatively lower cash and higher leverage, whereas firms that are likely to overinvest are those with higher cash levels and lower leverage thresholds. We construct a panel of 1,240 US firms between 2012 and 2017 and employ a differences-in-differences approach to conduct our analysis, followed by robustness tests, including a placebo test, propensity-score matching, and entropy balancing, to address endogeneity concerns.

We start our analysis by showing that treatment firms increased their Bloomberg ESG disclosure score by 1.78 after the publication of the Directive in 2014, equivalent to a 10% increase of average disclosure scores, and were more likely to adopt reporting frameworks that are compliant with the Directive, such as the Global Reporting Initiative (GRI). Two firms that declare operations in the EU are Guess and Philip Morris (figure 1). Guess saw a sharp increase in the quality of ESG disclosure in 2014, after adopting the GRI framework. Philip Morris joined the United Nations Global Compact in 2015 and steadily improved its disclosure quality in the following years. On the other hand, both Costco and Chevron, which have no presence in the EU, have kept their sustainability reporting behavior unchanged.

Figure 1: Annual ESG disclosure scores of four US companies

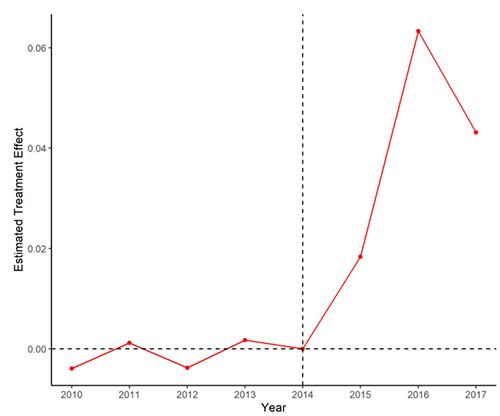

We then examine corporate investment behavioral responses and find that treatment firms that are likely to underinvest increased their investment levels by 6.3% of total assets after 2014, relative to the control firms, representing a 45% increase in the average investment levels for the sample firms (figure 2). In addition, we find no evidence that firms that are prone to overinvestment significantly modify their investment behavior. We then assess whether better ESG disclosure has affected external financing on debt and equity markets. We find that firms that are prone to underinvestment can raise an additional 8.7% of debt relative to total assets after the adoption of the Directive, consistent with the increased transparency brought by the disclosure of ESG information, mitigating adverse selection issues. Furthermore, we find no evidence that increased ESG disclosure affects the issuance of equity.

Figure 2: Estimated treatment effect on investment for firms likely to underinvest

Finally, we examine the cross-section of firms to investigate the channel of transmission from ESG disclosure to investment behavior. Investment efficiency gains are strongest for firms with lower quality of disclosure before the regulatory shock, which are more financially constrained, and which are more likely to suffer from managerial entrenchment. Taken together, these results suggest that enhanced ESG disclosure plays a role in reducing information asymmetries, especially adverse selection costs that reside in the corporate debt market, leading to investment efficiency gains.

Our findings have important policy implications for regulators considering the potential impacts of ESG disclosure, as well as for firms considering how to disclose ESG-related information. Our findings suggest that non-financial reporting plays a key role in improving investment efficiency, which can in turn have significant consequences on the real economy, an added benefit to providing more transparency on firms’ corporate and social responsibility.

Join the Conversation