"Approved" stamp on loan application | © shutterstock.com

"Approved" stamp on loan application | © shutterstock.com

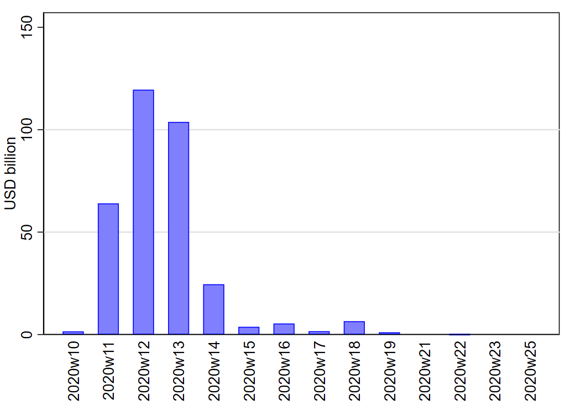

In spring 2020, stay-at-home policies aimed at containing the spread of the coronavirus led to a sharp decline in the revenues of nonfinancial firms. To shore up cash positions and ride out the crisis, firms approached their banks and drew down on pre-committed lines of credit. As a result, between early March and the end of April, the banking system was hit by a tidal wave of credit line drawdowns (figure 1), estimated at about half a trillion USD (Li et al. 2020). Banks were able to withstand the unprecedented credit demand, successfully providing liquidity to the real sector during a time of stress. However, they also curtailed new loan originations and tightened lending standards by an extent not seen since the 2008 financial crisis (figure 2).

Figure 1. Credit Line Drawdowns by Listed Firms during the COVID-19 Crisis

Notes: The figure depicts weekly credit line drawdowns between March 2, 2020 and June 30, 2020 for public and private firms with public debt that file 8-K regulatory filings with the Securities and Exchange Commission (in USD, billions). The figures only refer to a subset of firms that accessed their credit lines during this period.

Source: Authors’ calculations using S&P Global Market Intelligence, Leveraged Commentary and Data (LCD).

The decline in credit and the tightening of lending standards suggest that credit line drawdowns may have affected banks’ attitudes toward risk-taking during the crisis, prompting them to be more cautious in lending decisions. The pullback from lending may also have been caused by the immediate or expected effects of drawdowns on bank balance sheets (Acharya et al. 2021), despite banks entering the crisis with strong financial positions (Li et al. 2020).

In a recent paper (Kapan and Minoiu 2021), we empirically examine the link between credit line drawdowns and the supply of bank credit, using data from several segments of the bank loan market. The paper sheds light on the tension that can arise during crises between banks’ provision of liquidity insurance on the one hand, and sustaining the supply of credit on the other hand.

Did Credit Line Drawdowns Affect Bank Lending?

To answer this question, we employ data sets at the loan and bank levels to establish a link between bank exposure to credit line drawdowns and lending decisions. Our measure of bank exposure to credit line drawdown risk is given by total outstanding credit commitments (made through the syndicated loan market), in percent of total assets, measured just before the onset of the pandemic. While credit line drawdowns are a phenomenon affecting primarily large banks and large firms, our data sets cover lending outcomes for both large and small borrowers, which enables us to document the crowding out effects of drawdowns on other borrowers. This is particularly important given that the pandemic has had a significant impact on smaller firms (Bloom et al. 2021; Bartik et al. 2020).

Figure 2. Change in Lending Standards, 1990-2020

Notes: The figure depicts the net percent of domestic banks that reportedly tightened standards for commercial and industrial loans (positive values indicate an overall tightening, on net—more respondents said that they tightened than that they eased). The chart shows that lending standards tightened significantly at the onset of the pandemic—in the 2020:Q1 and especially the 2020:Q2 survey—when the net shares of banks that reported tightening rivaled those during the 2008 financial crisis, and continued to tighten in 2020:Q3, albeit at a slower pace. The survey addresses changes in the standards and terms on bank loans over the quarter.

Source: Senior Loan Officer Opinion Survey of the U.S. Federal Reserve Board, public release.

We have two main findings. First, we show that the largest global banks, including U.S. banks, with higher exposures to drawdown risk reduced the supply of new syndicated loans in 2020:Q2 more than other banks. On the intensive margin of loan adjustment to the drawdown shock, more exposed banks supplied smaller loans, on average, to the same borrower in 2020:Q2 compared to anytime during 2019. On the extensive margin, more exposed banks were less likely to renew loans maturing in 2020:Q2, including credit lines, and were less likely to establish new lending relationships.

Second, we turn to bank-level data from the 2020 Senior Loan Officer Opinion Surveys (SLOOS) conducted by the Federal Reserve, which allow us to examine lending outcomes for small firms as well (defined as having annual sales below $50 million). Tabulations of the raw data show that banks with high exposure to credit line drawdown risk were more likely to tighten standards on new commercial and industrial loans and credit lines during 2020:Q1-Q3 than banks with low exposure (figure 3). In a regression framework that controls for banks’ self-reported changes in credit demand and balance sheet characteristics, we show that more exposed banks indeed were relatively more likely to tighten the standards and terms of new loans in 2020. These effects are quantitatively stronger and more persistent for loans to small firms, echoing the findings of Chodorow-Reich et al. (2020), who document tighter access to credit for small firms during the pandemic. We show that small firms face a relatively stronger tightening of loan terms from more exposed banks, on dimensions such as collateral requirements, maximum maturity, and maximum size of new credit lines.

Figure 3. Change in Standards for Commercial and Industrial Loans during 2020

Notes: This figure shows the fraction of banks reporting that they tightened lending standards on commercial and industrial loans to large or small firms during 2020 by size of exposure to credit line drawdown risk (denoted CLE; high CLE is above-mean drawdown risk and low CLE is below-mean drawdown risk).

Source: Senior Loan Officer Opinion Survey of the U.S. Federal Reserve Board, Refinitiv Dealscan, Call Report.

What Is the Mechanism That Ties Credit Line Drawdowns to Bank Lending?

We look for evidence on the friction behind our results by examining banks’ survey responses on their motivations to tighten lending standards from the 2020 SLOOS. This evidence highlights an important role for changes in risk tolerance at banks during the pandemic. A key result and unique contribution of our paper is to show that banks with larger exposures to drawdown risk were more likely to cite “lower risk tolerance” as an important reason for tightening lending standards, controlling for balance sheet characteristics and shifts in loan demand. By contrast, concerns over the banks’ own liquidity and capital positions were only weakly related to their ability to grant loans in 2020, suggesting that balance sheet constraints are not the key friction driving our results. Instead, the key mechanism appears to be the rise in risk aversion associated with the unexpected surge in drawdowns, which brought to the fore banks’ dormant off-balance sheet risks.

Policy Implications

Our results highlight the tension that can arise during crises between banks’ role as “lenders of first resort” (Li et al. 2020) and their fundamental function of supplying credit, with implications for monetary policy and financial stability. First, banks’ exposure to pre-committed credit restrains financial intermediation after unexpected surges in drawdowns, even when balance sheets are strong, which can hamper monetary policy transmission. Second, a prudential metric of the Basel 3 regulatory framework—the liquidity coverage ratio (LCR)—needs to be revisited. In particular, given the high credit line utilization rates in spring 2020—especially in sectors severely hit by the pandemic—the assumption regarding the “stressed scenario” drawdown rate used in the LCR may need to be raised from the current 10% to a more realistic 20%–30%.

The views expressed in this article are ours and do not reflect those of the staff, management, or policies of the International Monetary Fund or the Federal Reserve System.

References

Acharya, Viral V., Robert F. Engle, and Sascha Steffen. (2021). “Why did bank stocks crash during COVID-19?” NBER Working Paper No. 28559. National Bureau of Economic Research.

Bartik, Alexander W., Marianne Bertrand, Zoë B. Cullen, Edward L. Glaeser, Michael Luca, and Christopher T. Stanton. (2020) “How are small businesses adjusting to COVID-19? Early evidence from a survey.” NBER Working Paper No. w26989. National Bureau of Economic Research.

Bloom, Nicholas, Robert S. Fletcher, and Ethan Yeh. (2021) “The impact of COVID-19 on US firms.” NBER Working Paper No. w28314. National Bureau of Economic Research.

Chodorow-Reich, Gabriel, Olivier Darmouni, Stephan Luck, and Matthew C. Plosser. (2020). “Bank Liquidity Provision across the Firm Size Distribution.” NBER Working Paper No. w27945. National Bureau of Economic Research.

Kapan, Tumer, and Camelia Minoiu (2021). “Liquidity Insurance vs. Credit Provision: Evidence from the Covid-19 Crisis.”

Li, Lei, Philip E. Strahan, and Song Zhang. (2020). “Banks as lenders of first resort: Evidence from the COVID-19 crisis.” The Review of Corporate Finance Studies 9.3, pp. 472-500.

Join the Conversation